ETFGI reports ETFs and ETPs listed in Canada reach a new record of 159.58 billion US dollars at the end of June 2020

LONDON —July 17, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs listed in Canada saw net inflows of US$2.37 billion during June, bringing year-to-date net inflows to US$16.81 billion which are significantly higher than the US$7.57 billon gathered at this point in 2019. At the end of the month, Canadian ETF assets increased by 4.1%, from US$153.29 billion at the end of May to US$159.58 billion a new record high at the end of June. At the end of June 2020, the Canadian ETF industry had 809 ETFs, with 979 listings, assets of US$160 Bn, from 36 providers on 2 exchanges according to ETFGI's June 2020 Canadian ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFS/ETPs in Canada reach a new record high of $159.58 billion at the end of June.

- YTD net inflows of $16.81 billion are much higher than $7.58 billion had gathered at this point last year.

- Equity ETFs listed in Canada were attractive during June with net inflows of $1.19 billion.

“The S&P 500 gained 1.99% during June. In Q2, U.S. equities staged a recovery from the Q1’s decline. Although Covid cases in the U.S. are still increasing the stimulus from the Fed and Congress, aided the market rebound. During June developed markets outside the U.S. were up 3.44% and up 16.8% in Q2. In June Hong Kong (up 11.35%), New Zealand (up 10.09%) Netherlands (up 8%) and Germany (up 6.08%) as the top performers. Emerging markets gained 7.6% in June and are up 19.3% in Q2.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

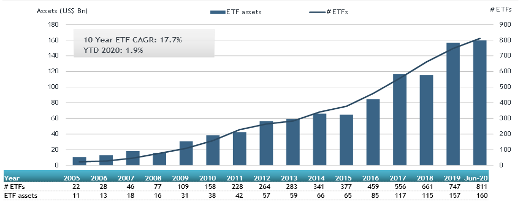

Growth in Canadian ETF and ETP assets as of the end of June 2020

Equity ETFs/ETPs gathered net inflows of $1.19 billion over June, bringing net inflows for the year to June 2020 to $9.58 billion, much higher than the $1.29 billion in net inflows Equity products had attracted for the year to June 2019. Active ETFs/ETPs attracted net inflows of $686 million over the month, gathering net inflows for the year in Canada of $4.72 billion, greater than the $4.09 billion in net inflows Active products had reported for the year to June 2019. Fixed Income ETFs/ETPs had net inflows of $449 million during June, bringing net inflows for the year to June 2020 to $1.90 billion, slightly lower than the $2.00 billion in net inflows Fixed Income products had attracted by the end of June 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $1.98 billion during June. The iShares S&P 500 Index ETF gathered $238.15 million alone.

Top 20 ETFs by net new assets June 2020: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

XUS CN |

1,752.05 |

245.06 |

238.15 |

|

|

iShares S&P/TSX Capped Financials Index Fund |

XFN CN |

882.52 |

210.23 |

212.84 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

4,747.51 |

499.38 |

199.95 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

469.72 |

(17.34) |

159.28 |

|

BMO S&P/TSX Capped Composite Index ETF |

ZCN CN |

2,855.04 |

117.52 |

156.84 |

|

iShares MSCI World Index Fund |

XWD CN |

707.12 |

214.06 |

146.69 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

1,429.02 |

111.40 |

96.96 |

|

Horizons S&P/TSX Capped Composite Index ETF - Acc |

HXCN CN |

796.14 |

932.04 |

87.69 |

|

iShares Core Canadian Universe Bond Index ETF |

XBB CN |

3,402.83 |

326.92 |

80.98 |

|

BMO Government Bond Index ETF - CAD Hdg |

ZGB CN |

133.34 |

91.94 |

74.95 |

|

Mackenzie Canadian Short-Term Bond Index ETF |

QSB CN |

155.64 |

152.08 |

70.35 |

|

Mackenzie Canadian Equity Index ETF |

QCN CN |

95.69 |

70.01 |

61.14 |

|

CI High Interest Savings Fund |

CSAV CN |

1,781.25 |

726.71 |

60.82 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

3,589.68 |

(448.78) |

58.82 |

|

BMO Nasdaq 100 Equity Hedged To CAD Index ETF |

ZQQ CN |

753.15 |

164.09 |

54.06 |

|

Mackenzie US TIPS Index ETF CAD-Hedged |

QTIP CN |

568.27 |

195.94 |

47.85 |

|

Horizons Cash Maximizer ETF - Acc |

HSAV CN |

292.24 |

290.83 |

46.46 |

|

PIMCO Monthly Income Fund - CAD Hdg |

PMIF CN |

1,117.12 |

37.72 |

42.14 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC CN |

1,237.05 |

93.49 |

41.75 |

|

iShares S&P/TSX Global Gold Index ETF |

XGD CN |

1,040.30 |

194.88 |

38.61 |

Investors have tended to invest in Equity ETFs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETFGI Global ETFs Insights Summit, New York has moved to a virtual event on July 28-30!

After watching the status of Covid-19 in New York it does not look likely in-person events will be realistic before the end of this year. Therefore, we have decided to move our Global ETFs Insights Summit, New York which was planned for April 2 in New York City at the Metropolitan Club to a virtual event on the afternoons of July 28, 29 and 30 from 2:00 pm – 5:30 pm EDT.

Register now to join us! Free registration and CPD educational credits are offered to

Featured fireside chats will include:

- Alex Matturri, Retired CEO, S&P Dow Jones Indices

- Anna Paglia, Global Head of ETFs and Indexed Strategies, Invesco

- Rick Redding, CEO, Index Industry Association

- Jim Ross,

Non Executive Chairman at Fusion Acquisition Corp. & Former Executive Vice President, Chairman, Global SPDR Business, State Street

Click here to see the full list of confirmed speakers

Panel discussions and fireside chats offer an opportunity for substantive and in-depth discussions on topics including:

- An Appraisal of Regulatory Issues impacting Market Structure and ETF Trading

- An Investigation of Semi- Non-transparent Active ETFs

- ETF Trading – Creating Better Trading Systems and Trading Tools

- Impact of Regulations on Investor Choice

- Portfolio Construction – How are Institutions and Financial Advisors Using ETFs?

- ESG and Sustainable Finance

- What are the Future Trends that Will Impact Investor and ETFs?

Click here to see the full agenda

The platform we’ve selected opens the door to a virtual experience that is as similar as possible to an in-person event. Attendees will see and hear from expert speakers, be able to ask questions, receive CPD educational credits, enjoy networking opportunities, visit our sponsor exhibit booths, attend virtual happy hours, and the first 100 registered attendees that attend the event will receive branded promotional items from our sponsors.

Register now and we look forward to seeing you at the event! Stay tuned for details on future events planned for London, Toronto and Hong Kong/Asia later this year.

###

New Episode 32 of ETF TV - Deborah Fuhr, ETFGI discusses global ETF flows in June and H1 2020

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.  ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com