ETFGI reports assets invested in ETFs listed in Canada reached a new record of US$203.04 billion at the end of January 2021

LONDON — February 25, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reports assets invested in ETFs listed in Canada reached a new record of US$203.04 billion at the end of January. ETFs listed in Canada gathered net inflows of US$2.77 billion during January which is less than the US$3.17 billion gathered in January 2020. ETF assets in Canada have increased by 0.5% from US$202.07 billion in December 2020 to US$20.04 billion, according to ETFGI's January 2021 Canadian ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs listed in Canada reach a record $203.04 billion at the end of January.

- ETFs listed in Canada gathered net inflows of $2.77 billion in January.

- March 9th will mark the 31st anniversary of listing of the first ETF.

“The S&P 500 posted a loss of 1% for January due to the sell-off during the last week of the month. Small and mid-cap stocks outperformed in January, with the S&P Mid-Cap 400® and the S&P SmallCap 600® up 2% and 6%, respectively. Slower-than-expected COVID-19 vaccine distribution affected global impacted equities globally. The Developed markets ex- the U.S. ended the month down 1% while Emerging markets were up 3% for the month. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

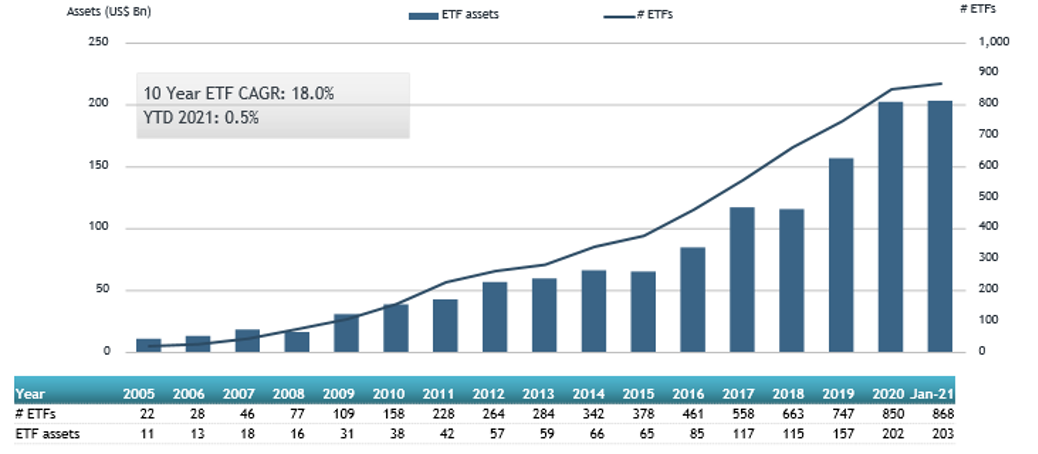

Growth in Canadian ETF and ETP assets as of the end of January 2021

The Canadian ETF/ETP industry had 868 ETFs/ETPs, with 1,059 listings, assets of $203Bn, from 39 providers listed on 2 exchanges at the end of January.

Equity ETFs/ETPs gathered net inflows of $1.12 Bn during January, which is higher than the $800 Mn in net inflows equity products attracted in January 2020. Fixed income ETFs/ETPs had net inflows of $839 Mn during January, which is lower than the $1.11Bn in net inflows fixed income products attracted in January 2020. Commodity ETFs/ETPs saw net outflows of $30 Mn in January which is less than the net inflows of $31 Mn over the same period in 2020. Active ETFs/ETPs attracted net inflows of $740 Mn over the month, which is lower than the $1.16 Bn in net inflows active products reported in January 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.25 Bn during January. Horizon S&P/TSX 60 Index ETF - Acc (HXT CN) gathered $361.55 Mn.

Top 20 ETFs by net new assets January 2021: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

HXT CN |

2126.34 |

361.55 |

361.55 |

|

|

BMO Aggregate Bond Index ETF |

ZAG CN |

4482.33 |

274.49 |

274.49 |

|

BMO S&P 500 Index ETF |

ZSP CN |

7496.91 |

150.92 |

150.92 |

|

iShares S&P/TSX Capped Financials Index Fund |

XFN CN |

879.66 |

127.76 |

127.76 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

2962.21 |

111.94 |

111.94 |

|

Mackenzie US Large Cap Equity Index ETF |

QUU CN |

767.79 |

110.59 |

110.59 |

|

Vanguard U.S. Total Market Index ETF |

VUN CN |

2478.54 |

105.19 |

105.19 |

|

Vanguard Growth ETF Portfolio |

VGRO CN |

1503.92 |

104.99 |

104.99 |

|

TD International Equity Index ETF |

TPE CN |

785.57 |

102.59 |

102.59 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

3436.58 |

99.68 |

99.68 |

|

Franklin Ftse Japan Index ETF |

FLJA CN |

136.18 |

81.44 |

81.44 |

|

BMO Long Federal Bond Index ETF |

ZFL CN |

1770.55 |

74.35 |

74.35 |

|

Vanguard FTSE Emerging Markets All Cap Index ETF |

VEE CN |

1101.45 |

74.21 |

74.21 |

|

iShares Core S&P US Total Market Index ETF |

XUU CN |

1198.55 |

73.95 |

73.95 |

|

TD S&P/TSX Capped Composite Index ETF |

TTP CN |

766.28 |

70.16 |

70.16 |

|

Vanguard All-Equity ETF Portfolio |

VEQT CN |

511.29 |

67.33 |

67.33 |

|

Vanguard FTSE Developed All Cap EX North America Index ETF |

VIU CN |

1457.16 |

66.05 |

66.05 |

|

Vanguard Balanced Etf Portfolio |

VBAL CN |

1120.93 |

65.86 |

65.86 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

2307.10 |

65.41 |

65.41 |

|

Fidelity International High Quality Index ETF |

FCIQ CN |

376.63 |

60.05 |

60.05 |

Investors have tended to invest in Equity ETFs during January.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register now for the ETFGI Global ETFs Global Summit on ESG and Active ETFs Trends, March 24th & 25th Register Here

Register now for the ETFGI Global ETFs Global Summit on ESG and Active ETFs Trends, March 24th & 25th Register Here

ESG ETFs Trends

The covid pandemic, social movements and regulatory changes elevated the awareness of ESG. ESG investing is a way for investors to mitigate risks and generate returns. The positive performance of ESG strategies during 2020 volatility gave investors a renewed interest and conviction. There is a lot to navigate – taxonomy, finding comparable data, understanding benchmarks, changing regulations, reporting standards, public policy, and investor interests. ESG investing is here to stay and investors need to understand how to apply ESG to their equity, fixed income and other investment mandates and how to implement exposure to ESG and transition from current allocations.

This event will provide an overview of the regulatory environment, public policy, investor initiatives and fiduciary obligations to help institutional investors and financial advisors understand how ESG strategies are being implemented across portfolios.

Topics Include:

- Overview of ESG trends in the ETF industry

- ESG practical implications for asset managers, investors and index providers

- Understanding EU Benchmark and Sustainable Finance Disclosure Regulations

- ESG trends for equity, fixed income and multi asset portfolios

- Investment performance of ESG integrated products

- A case study on managing an ESG fund

- The outlook for the future of ESG investing

- Trading and transitioning into ESG ETFs

- How investors – institutional, financial advisors and retail investors are integrating ESG into their equity, fixed income and multi asset portfolios.

Active ETFs Trends

Examining Active ETF landscape – Transparent Active ETFs have been available in the US since 2008, in April 2019 the SEC granted preliminary approval to the first non-transparent active ETF structure. The Central Bank of Ireland (CBI), which oversees Europe’s largest ETF market – over half the region’s ETFs are domiciled in Ireland – has up to now taken a pro-transparency stance. In Canada Active ETFs account for about 23% of overall assets due to ETFs being regulated like mutual funds. Mega-trends and thematic ETFs have proved to be a popular trend over the past few years. Meet and learn from ETF experts, lawyers, institutional investors as they talk about the new face of alpha.

Topics Include:

- How regulatory changes are impacting the Active ETF landscape

- Product design: Transparent, Semi-transparent and Non-transparent

- Assessing opportunities and white-label platforms

- Converting mutual funds into ETFs

- The potential for active management

- A case study of an Active ETF which uses AI and deep learning

- Trading and liquidity: The role of authorised participants and market makers

- Industry Outlook and Projections

Speakers Include:

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Bill Davis, Founder & Managing Director, Stance Capital

- Linda French, Assistant Chief Counsel, ICI

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- Howie Li, Head of ETFs, Legal & General Investment Management

- Alex Matturri, Member Board of Directors CBOE Global Markets, Retired CEO S&P Dow Jones Indices

- Ciara O’Leary, Partner, Dechert LLP

- Geeseok Oh, CAIA, Managing Director, Qraft Technologies Asia Pacific Limited

- Mark Raes CFA, MBA. Head of Product ETFs and Mutual Funds, BMO Financial Group

- Rick Redding, CEO, Index Industry Association

- Zohaib Saeed, Passive Product Specialist, DWS Group

- Olga De Tapia, Global Head of ETFs Sales, HSBC Global Asset Management

- Diana van Maasdijk, Co-Founder & Executive Director, Equileap

The ETFGI Global ETFs Insights Summits are designed to facilitate substantive and in-depth discussions around the impact that market structure and regulations have on ETF product development, due diligence, suitability, the use and trading, and technological developments have on ETFs and mutual funds in the respective jurisdictions.

Free registration and CE credits are offered to buyside investors and financial advisors. There are speaker and sponsorship opportunities available. Register Here If you cannot attend on the day register you should register so you receive the links to the session recordings.

Registrations are open for all of the ETFGI Global ETFs Insight Summits for 2021. The virtual events schedule is:

ESG and Active ETFs Trends, March 24th & 25th Register Here

2nd Annual Latin America, April 14th & 15th Register Here

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter. Contact Deborah.fuhr@etfgi.com if you are interested in sponsoring ETF tv.

ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter. Contact Deborah.fuhr@etfgi.com if you are interested in sponsoring ETF tv. ETF TV News #62 - Som Seif, Founder & CEO, Purpose Financial joins Dan Barnes and Deborah Fuhr ETFGI on ETF TV to discuss the first Bitcoin ETF listing in Canada, where demand is coming from and if a U.S. listing is likely to follow #PressPlay

ETF TV News #62 - Som Seif, Founder & CEO, Purpose Financial joins Dan Barnes and Deborah Fuhr ETFGI on ETF TV to discuss the first Bitcoin ETF listing in Canada, where demand is coming from and if a U.S. listing is likely to follow #PressPlay

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()