ETFGI Press Release July 2015: Hedge fund vs ETF

Assets in the global ETF/ETP industry surpassed assets in global hedge funds at the end of Q2 2015

LONDON — July 21, 2015 — Assets invested in the global ETF/ETP industry have surpassed the assets invested in the hedge fund industry at the end of Q2 as we had forecasted.

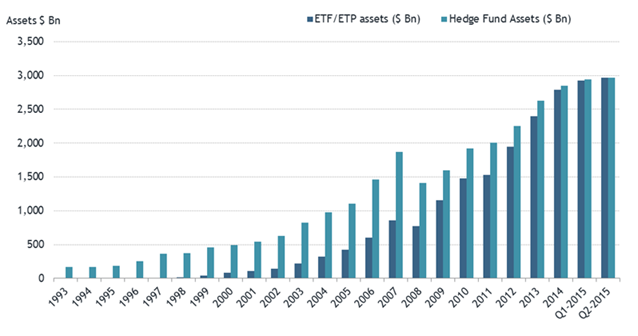

According to our analysis there was US$2.971 trillion invested in the 5,823 ETFs/ETPs listed globally at the end of Q2 2015, assets were down slightly from their record high of US$3.015 trillion at the end of May 2015, while assets in the global hedge fund industry, according to a new report published by Hedge Fund Research HFR, reached a new record high of US$2.969 trillion invested in 8,497 hedge funds, which is US$2 billion smaller than the assets in the global ETF/ETP industry.

This is a significant achievement for the global ETF/ETP industry, which just celebrated its 25th anniversary on March 9th while the hedge fund industry has existed for 66 years. Below is a chart which illustrates how the assets in the ETF/ETP industry have been gaining on the assets invested in the hedge fund industry, more notably since the financial crisis in 2008.

Global assets invested in ETFs/ETPs and hedge funds, at the end of Q2 2015

Sources: ETFGI and Hedge Fund Research HFR.

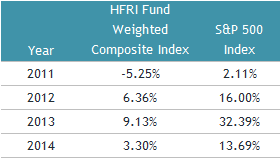

In Q1 2015 the performance of the HFRI Fund Weighted Composite Index was 2.3%, which is only 1.3% higher than the 1% return of the S&P 500 Index. Many investors have been disappointed with the performance of hedge funds over the past few years as the HFRI Fund Weighted Composite Index has delivered returns significantly below the returns of the S&P 500 Index, according to S&P Dow Jones.

Annual returns of the HFRI Fund Weighted Composite Index and the S&P 500 Index

Sources: Hedge Fund Research HFR, S&P Dow Jones Indices

With the positive performance of equity markets many investors have been happy with index returns and fees. This situation has benefited ETFs/ETPs, which offer an enormous toolbox of index exposures to various markets and asset classes, including hedge fund indices and some active and smart beta exposures.

The ETF structure offers intraday liquidity, transparency, small minimum investment sizes and at costs that are lower than many other investment products, including futures in many cases. According to our research the asset-weighted average annual cost for ETFs/ETPs is 31 basis points or less than one third of a percent, while fees charged by the majority of hedge funds are 2% of assets and 20% of profits.

Accordingly, net inflows into ETFs/ETPs have been significantly higher than net inflows into hedge funds over the past few years. In the first half of 2015, net inflows into hedge funds globally were US$39.7 billion, while net inflows into ETFs/ETPs globally were US$152.3 billion over the same period.

Net New Asset (NNA) flows into ETFs/ETPs and hedge funds globally

Sources: ETFGI and Hedge Fund Research HFR

Please email contact@etfgi.com or deborah.fuhr@etfgi.com if you would like to subscribe to ETFGI's monthly global ETF and ETP industry insights reports containing over 300 pages of charts and analysis, ETFGI's Institutional Users of ETFs and ETPs report or custom analysis. Professional investors can register on ETFGI’s website to receive updates, press releases and ETFGI’s free monthly newsletter.