ETFs/ETPs listed in the United States gathered 239.8 billion US dollars in net new assets in 2015, according to ETFGI

ETFs/ETPs listed in the United States gathered 239.8 billion US dollars in net new assets in 2015, according to ETFGI

LONDON — January 13, 2016 — ETFs/ETPs listed in the United States gathered US$239.8 billion in net new assets in 2015 although it is a large amount it is less than the record US$244.3 billion gathered in 2014. In December US$38.0 billion of net new assets were gathered making it the largest asset gathering month for the year and marking the 11th consecutive month of positive net inflows.

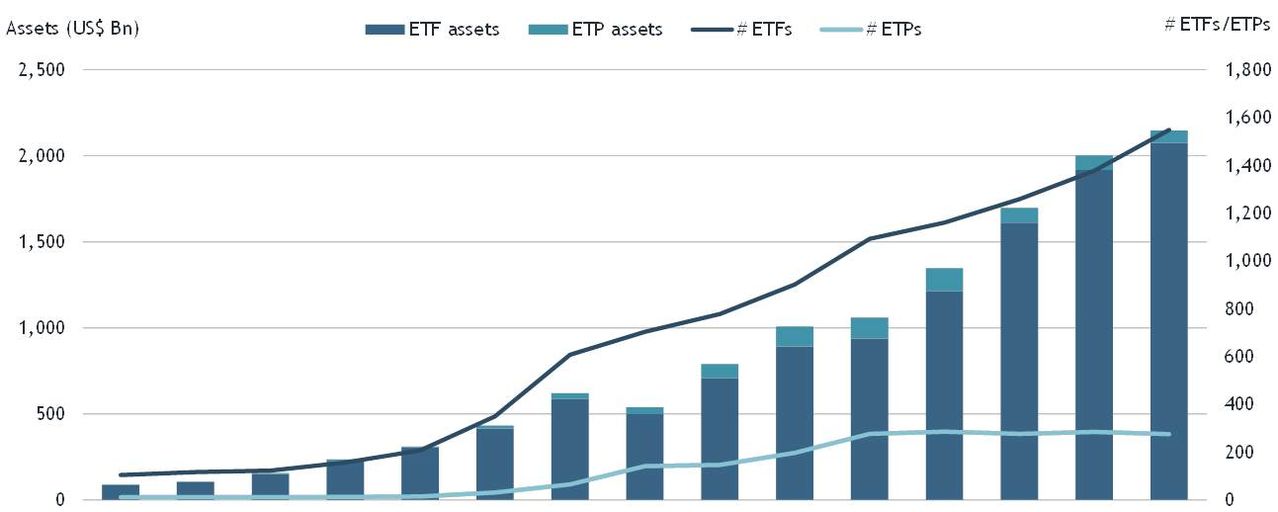

During 2015 there has been growth on most measures: the number of ETFs/ETPs has increased from 1,662 to 1,843, assets under management have increased from US$2.002 trillion to US$2.130 trillion, and the number of providers has increased from 71 to 94.

At the end of 2015, the US ETF/ETP industry had 1,843 ETFs/ETPs, assets of US$2,130 Bn, from 94 providers on 3 exchanges, according to preliminary data from ETFGI’s year-end 2015 global ETF and ETP industry insights report.

During 2015 record levels of net new assets have been gathered by ETFs/ETPs listed globally with net inflows of US$372.0 Bn marking a 10% increase over the prior record set in 2014. In Canada net inflows at US$13.1 Bn are up 8% over the prior record set in 2012 and in Europe net inflows climbed to US$82.0 Bn, representing a 45% increase on the record set in 2014. In Japan, net inflows were up 142% on the prior record set in 2013, standing at US$39.5 Bn at the end of 2015.

“2015 was a turbulent year for the markets due to uncertainty in China which spilled over into global markets, concerns about the Middle East and a collapse in energy prices. The S&P 500 ended the year up 1%, emerging markets declined 14% on the heels of a stronger U.S. dollar and commodity price declines. Developed markets ended the year down 1% after recovering some losses in the fourth quarter.

The robust level of asset gathering in 2015 shows that more investors are using ETFs/ETPs in more ways due to the market turmoil: retail is using more ETFs through Robo-advisors, institutions are using ETFs as alternatives to futures, and financial advisors are using more ETFs especially in multi-asset portfolios.” according to Deborah Fuhr, Managing Partner of ETFGI.

In December 2015, ETFs/ETPs listed in the United States saw net inflows of US$38.1 Bn. Equity ETFs/ETPs gathered the largest net inflows with US$36.0 Bn, followed by fixed income ETFs/ETPs with US$1.3 Bn, while commodity ETFs/ETPs experienced net outflows of US$612 Mn.

In 2015, ETFs/ETPs have seen net inflows of US$239.8 Bn. Equity ETFs/ETPs gathered the largest net inflows in 2015 with US$172.7 Bn, followed by fixed income ETFs/ETPs with US$50.3 Bn, and commodity ETFs/ETPs with US$ 249 Mn.

Year to date iShares gathered the largest net ETF/ETP inflows in 2015 with US$105.9 Bn, followed by Vanguard with US$76.3 Bn and WisdomTree with US$16.9 Bn net inflows.

iShares is the largest ETF/ETP provider in terms of assets with US$824 Bn, reflecting 38.7% market share; Vanguard is second with US$482 Bn and 22.6% market share, followed by SPDR ETFs with US$414 Bn and 19.4% market share. The top three ETF/ETP providers, out of 94, account for 80.8% of US ETF/ETP assets.

S&P Dow Jones has the largest amount of ETF/ETP assets tracking its benchmarks with 34.1% market share; MSCI is second with 14.9% market share, followed by FTSE Russell with 14.3% and Barclays with 11.5% market share.

Please contact deborah.fuhr@etfgi.com if you would like to discuss subscribing to ETFGI’s research or consulting services.

Please visit our website www.etfgi.com to register for future updates and to find ETFGI Press Releases on ETF/ETP industry trends, daily postings of some of the top articles from financial publications around the world in the Industry News tab, details of upcoming Events, monthly videos on industry trends in Views, our twitter feed @etfgi , and to use our directory of firms in the ETF Ecosystem. Please join our group "ETF Network" on Linkedin

###

Note to editors

ETFs are typically open-ended, index-based funds, with active ETFs accounting for 1.1% market share. They can be bought and sold like ordinary shares on a stock exchange and offer broad exposure across developed, emerging and frontier markets, equities, fixed income and commodities. ETFs are used widely by institutional investors and increasingly by financial advisors and retail investors to:

• equitize cash

• implement diversified exposure to a market

• comprise a core or satellite investment

• be a long term strategic investment

• implement tactical adjustments to portfolios

• use as building blocks to create entire portfolios

• allow investors to hedge the market

• use as an alternative to futures and other derivative products

Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering paid for research subscription services: the ETFGI annual research service provides monthly reports on trends in the global ETF and ETP industry, access to the ETFGI database of all ETFs/ETPs listed globally with factsheets which are updated monthly, ETFGI annual review of institutions and mutual funds that use ETFs and ETPs, the Active ETF landscape report and the Smart Beta ETF Landscape report.

Deborah Fuhr is the managing partner and co-founder of ETFGI, she previously served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. Fuhr also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates. Shane Kelly and Matthew Murray are co-founders and partners in ETFGI.

Four new reports: 1) the ETFGI Active ETF Landscape report, 2) the ETFGI Smart Beta ETF Landscape report, 3) the ETFGI EM and FM Landscape report, and 4) the ETFGI Institutional Users of ETFs and ETPs 2014 report.

The ETFGI annual research subscription service includes:

1) The detailed ETFGI Global ETF and ETP monthly Insights report containing over 300 pages of charts and analysis on 6,146 ETFs/ETPs, with 11,750 listings, assets of US$2.99 trillion, from 276 providers listed on 64 exchanges in 51 countries.

2) The ETFGI monthly directory of ETFs and ETPs in pdf approx. 300 pages.

3) A web tool accessible through our website allows users to have access to the view of ETFs and ETPs listed globally.

Below is a link to a video which provides overviews of our website www.etfgi.com

· ETFGI Website Tour (7 minutes)

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs