ETFGI reports assets invested in Active ETFs/ETPs listed globally reached a new record high of 40 billion US dollars at the end of Q3 2016

ETFGI reports assets invested in Active ETFs/ETPs listed globally reached a new record high of 40 billion US dollars at the end of Q3 2016

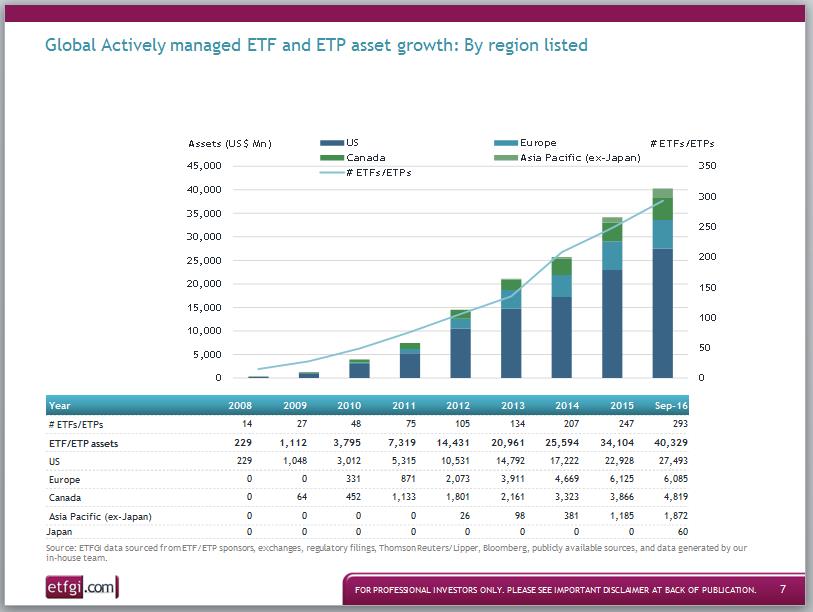

Record levels of assets were also reached at the end of June for active ETFs/ETPs listed in the United States at US$27.49 Bn, Canada with US$4.82 Bn, and in Asia Pacific ex-Japan with US$1.87 Bn.

At the end of Q3 2016, the Global active ETF/ETP industry had 293 ETFs/ETPs, with 389 listings, assets of US$40 Bn, from 56 providers listed on 18 exchanges in14 countries.

“Although there was a rally after the FOMC's vote to leave interest rates unchanged in September, the S&P 500 ended the month flat and the SJIA with a moderate decline of 0.4%. Developed markets ex-US and Emerging markets were up 1.5% and 1.2%, respectively" according to Deborah Fuhr, co-founder and managing partner at ETFGI.

In September 2016, active ETFs/ETPs saw net inflows of US$574 Mn. YTD through end of Q3 2016, active ETFs/ETPs saw net inflows of US$3.86 Bn.

PIMCO is the largest ETF/ETP provider in terms of assets with US$8.07 Bn, reflecting 20.0% market share; Source is second with US$5.49 Bn and 13.6% market share, followed by First Trust with US$5.44 Bn and 13.5% market share. The top three ETF/ETP providers, out of 46, account for 47.1% of Global ETF/ETP assets.

Just 9 out of the 293 active ETFs/ETPs have greater than US$1 Bn in assets, and hold a combined total of US$21 Bn, or 51.2%, of global active ETF/ETP assets.

Please visit our website www.etfgi.com to register for our free weekly newsletter and updates, to find ETFGI Press Releases on ETF/ETP industry trends, daily postings of some of the top articles from financial publications around the world in the Industry News tab, details of upcoming Events, monthly videos on industry trends in Views, our twitter feed @etfgi, and to use our directory of firms in the ETF Ecosystem. You are invited to join our group "ETF Network" on Linkedin. Please contact deborah.fuhr@etfgi.com if you would like to discuss subscribing to ETFGI’s research or consulting services.

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem. Launched in 2012 by Deborah Fuhr and partners in London the firm offers paid for research subscription services: the ETFGI annual research service provides monthly reports on trends in the global ETF and ETP industry, access to the ETFGI database of all ETFs/ETPs listed globally with factsheets which are updated monthly, ETFGI annual review of institutions and mutual funds that use ETFs and ETPs, the Active ETF landscape report and the Smart Beta ETF Landscape report.

Deborah Fuhr is the managing partner and co-founder of ETFGI, she previously served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. Fuhr also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

Below is a link to a video which provides overviews of our website.

· ETFGI Website Tour (7 minutes)

ETFs are typically open-ended, index-based funds, with active ETFs accounting for 1.1% market share. They can be bought and sold like ordinary shares on a stock exchange and offer broad exposure across developed, emerging and frontier markets, equities, fixed income and commodities. ETFs are used widely by institutional investors and increasingly by financial advisors and retail investors to:

• equitize cash

• implement diversified exposure to a market

• comprise a core or satellite investment

• be a long term strategic investment

• implement tactical adjustments to portfolios

• use as building blocks to create entire portfolios

• allow investors to hedge the market

• use as an alternative to futures and other derivative products

Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs