ETFs and ETPs listed in Europe reach a new record of 640 billion US dollars at the end of Q1 2017

ETFGI reports assets invested in ETFs and ETPs listed in Europe reach a new record of 640 billion US dollars at the end of Q1 2017

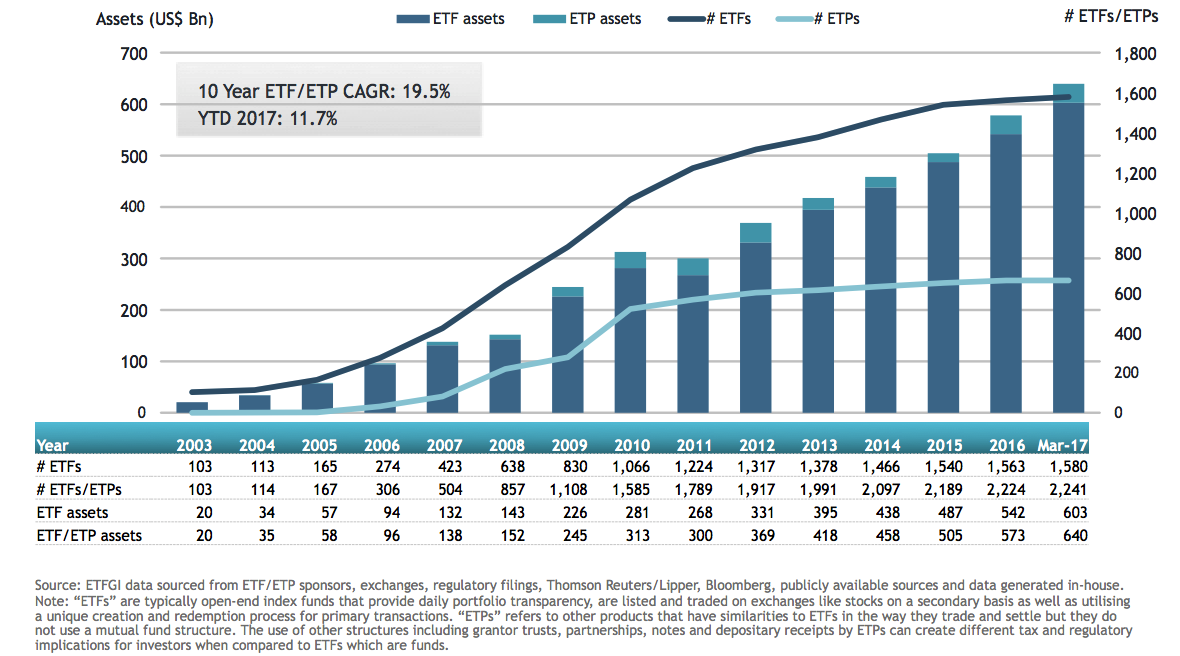

LONDON — April 26, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today assets invested in ETFs/ETPs listed in Europe reached a new record high of US$640 billion at the end Q1 2017 surpassing the prior record of US$620 billion set at the end of February 2017.

ETFs and ETPs listed in Europe gathered net inflows of US$11.36 Bn in March marking the 31st month of positive net new asset flows. Year to date, net inflows stand at US$35,37 Bn. At this point last year there were net inflows of US$10.97 Bn, according to preliminary data from ETFGI’s Q1 2017 global ETF and ETP industry insights report. At the end of March 2017, the European ETF/ETP industry had 2,241 ETFs/ETPs, with 7,055 listings, assets of US$640 Bn, from 59 providers listed on 26 exchanges in 21 countries.

“Investors have favoured equities over fixed income and commodities as equity markets have performed positively in March and in the first quarter of 2017. The S&P 500 gained 0.1% in March and 6.1% during the first quarter. International equity markets performed strongly in March and in the first quarter with the international markets

Equity ETFs/ETPs gathered net inflows of US$6.64 Bn in March, bringing

Fixed income ETFs and ETPs experienced net inflows of US$2.99 Bn in March, growing year to date net inflows to US$7.82 Bn, which is less than the same period last year which saw net inflows of US$9.21 Bn.

Commodity ETFs/ETPs accumulated net inflows of US$1,34 Bn in March. Year to date, net inflows are at US$4.72 Bn, compared to net inflows of US$4.42 Bn over the same period last year.

iShares gathered the largest net ETF/ETP inflows in March with US$3.01 Bn, followed by

In Q1, iShares gathered the largest net ETF/ETP inflows with US$10.20 Bn, followed by Lyxor AM with US$4.60 Bn and UBS ETFs with US$3.82 Bn net inflows.