ETFs/ETPs listed globally gathered record inflows of US$66 billion and assets reached a new high of US$3.913 trillion at the end of Q1 2017

ETFs/ETPs listed globally gathered record inflows of 66 billion US dollars and assets reached a new high of 3.913 trillion US dollars at the end of Q1 2017

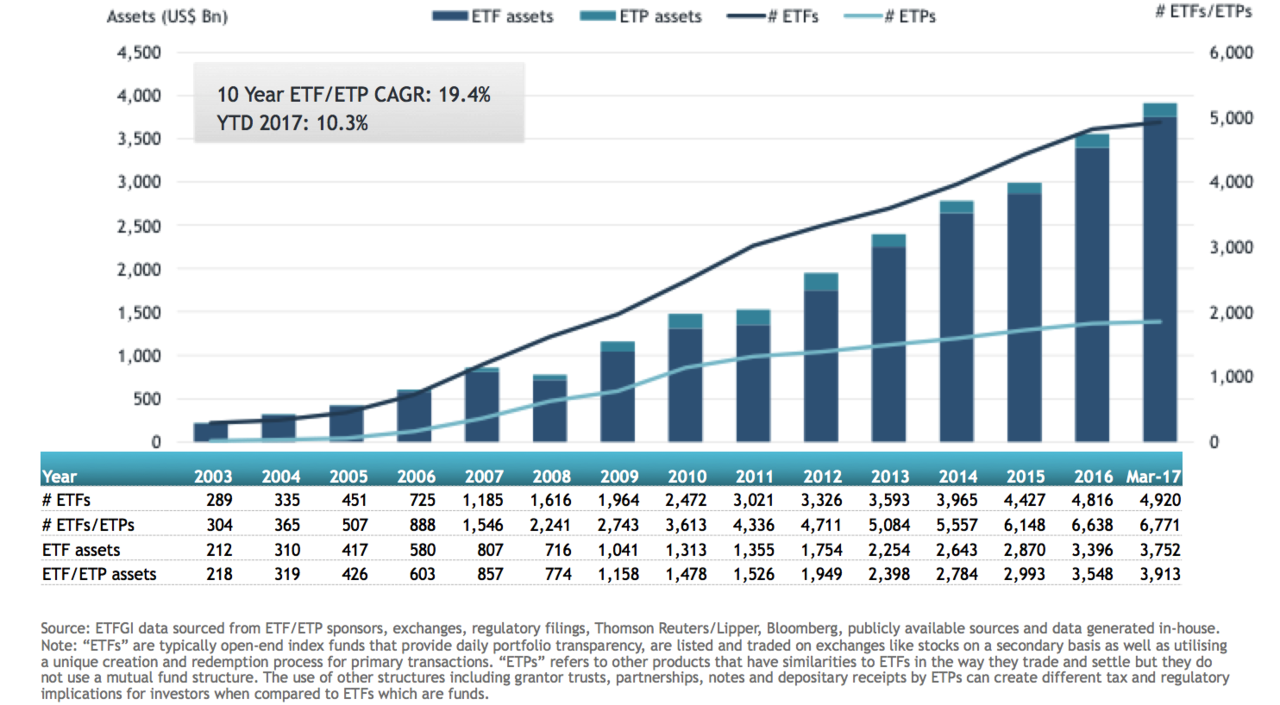

LONDON — April 25, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today following on from the strong start to the year assets invested in ETFs/ETPs listed globally reached a new record high of US$3.913 trillion at the end Q1 2017 surpassing the prior record of US$3.844 trillion set at the end of February 2017 according to preliminary data from ETFGI’s Q1 2017 global ETF and ETP industry insights report.

ETFs and ETPs listed globally gathered record net inflows of $66.27 Bn in March marking the 38th consecutive month of net inflows. Year to date, a record US$197.26 Bn in net new assets have been gathered. At this point last year there were net inflows of US$69.97 Bn. At the end of March 2017, the Global ETF/ETP industry had 6,771 ETFs/ETPs, with 12,750 listings, assets of US$3.913 trillion, from 306 providers listed on 67 exchanges in 55 countries.

“Investors have favoured equities over fixed income and commodities as equity markets have performed positively in March and in the first quarter of 2017. The S&P 500 gained 0.1% in March and 6.1% during the first quarter. International equity markets performed strongly in March and in the first quarter with the international markets

Equity ETFs/ETPs gathered net inflows of US$49.07 Bn in March, bringing

Fixed income ETFs and ETPs experienced net inflows of US$11.68 Bn in March, growing year to date net inflows to US$39.20 Bn, which is less than the same period last year which saw net inflows of US$41.62 Bn.

Commodity ETFs/ETPs accumulated net inflows of US$1.30 Bn in March. Year to date, net inflows are at US$8.87 Bn, compared to net inflows of US$14.56 Bn over the same period last year.

iShares gathered the largest net ETF/ETP inflows in March with US$27.33 Bn, followed by Vanguard with US$13.64 Bn and Nomura AM with US$3.70 Bn net inflows.

In Q1 2017, iShares gathered the largest net ETF/ETP inflows with US$65.36 Bn, followed by Vanguard with US$42.81 Bn and SPDR ETFs with US$13.87 Bn net inflows.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem. Launched in 2012 by Deborah Fuhr and partners in London the firm offers paid for research subscription services: the ETFGI annual research service provides monthly reports on trends in the global ETF and ETP industry, access to the ETFGI database of all ETFs/ETPs listed globally with factsheets which are updated monthly, ETFGI annual review of institutions and mutual funds that use ETFs and ETPs, the Active ETF landscape report and the Smart Beta ETF Landscape report.

Deborah Fuhr is the managing partner and co-founder of ETFGI, she previously served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. Fuhr also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

Below is a link to a video which provides overviews of our website www.etfgi.com

ETFGI Website Tour (7 minutes)

Note to Editors

ETFs are typically open-ended, index-based funds, with active ETFs accounting for 1.1% market share. They can be bought and sold like ordinary shares on a stock exchange and offer broad exposure across developed, emerging and frontier markets, equities, fixed income and commodities. ETFs are used widely by institutional investors and increasingly by financial advisors and retail investors to:

- equitize cash

- implement diversified exposure to a market

- comprise a core or satellite investment

- be a long term strategic investment

- implement tactical adjustments to portfolios

- use as building blocks to create entire portfolios

- allow investors to hedge the market

- use as an alternative to futures and other derivative products

Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs