ETFGI reports assets invested in ETFs and ETPs listed in Europe reach a new record of 658 billion US dollars at the end of April 2017

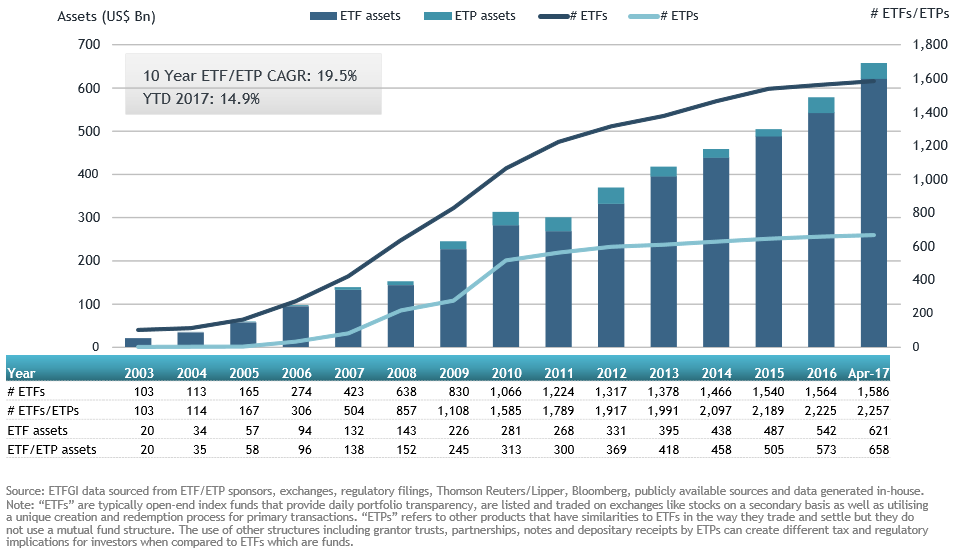

LONDON — May 17, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today assets invested in ETFs/ETPs listed in Europe reached a new record high of US$658 billion at the end April 2017 surpassing the prior record of US$640 billion set at the end of Q1 2017.

At the end of April 2017, the European ETF/ETP industry had 2,257 ETFs/ETPs, with 7,128 listings, assets of US$658 Bn, from 60 providers listed on 27 exchanges in 21 countries.

“Investors continued to favour equities over fixed income and commodities as equity markets performed positively in April. The S&P 500 was up 1%, international equity markets outside the US and emerging markets were both up 2% in April. Investors were captivated by a closely-fought first round of the French elections during April,” according to Deborah Fuhr, managing partner and a founder of ETFGI.

ETFs and ETPs listed in Europe gathered net inflows of US$5.20 Bn in April marking the 32nd month of positive net new asset flows. Year to date, net inflows stand at $40,562 Mn. At this point last year there were net inflows of $14,989 Mn.

Equity ETFs/ETPs saw net inflows of US$2.97 Bn in April, bringing year to date net inflows to US$24.20 Bn, which is greater than the net outflows of US$4.79 Bn over the same period last year.

Fixed income ETFs and ETPs experienced net inflows of US$1.04 Bn in April, growing year to date net inflows to US$8.86 Bn, which is less than the same period last year which saw net inflows of US$13.38 Bn.

Commodity ETFs/ETPs accumulated net inflows of US$450 Mn in April. Year to date, net inflows are at US$5.17 Bn, compared to net inflows of US$5.33 Bn over the same period last year.

Amundi ETF gathered the largest net ETF/ETP inflows in April with US$1.82 Bn, followed by UBS ETFs with US$1.24 Bn and Lyxor AM with US$910 Mn net inflows.

YTD, iShares gathered the largest net ETF/ETP inflows YTD with US$10.04 Bn, followed by Lyxor AM with US$5.51 Bn and Amundi ETF with US$5.44 Bn net inflows.

###

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

The 2017 ETFs Trading and Market Structure Conference organised by Ari Burstein, Kreab and Deborah Fuhr, ETFGI will be held on June 7, 2017 in New York City. The conference will focus on regulatory and technological developments in the markets impacting the trading of ETFs.

Keynote speakers include: Adena T. Friedman, President and Chief Executive Officer, Nasdaq; a “fireside chat” with Chris Concannon, President and Chief Operating Officer, CBOE Holdings and Jim Ross, Executive Vice President, State Street Global Advisors (SSGA); and Tom Farley, President, NYSE Group. Panelists include senior representatives from all of the exchanges, major broker-dealers and market makers, ETF issuers, law firms, as well as staff from the US Securities and Exchange Commission and FINRA.

Panel discussions will cover the following topics:

- Impact of Regulatory Developments on ETFs

- Exchange Roundtable - Competition for ETF listings

- Creating Better Trading Systems and Trading Tools for ETFs

- Understanding ETF Liquidity and the Active/Passive Debate

- New ETF Product Approvals and Bringing New ETFs to Market

Click here to register.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem. Launched in 2012 by Deborah Fuhr and partners in London the firm offers paid for research subscription services: the ETFGI annual research service provides monthly reports on trends in the global ETF and ETP industry, access to the ETFGI database of all ETFs/ETPs listed globally with factsheets which are updated monthly, ETFGI annual review of institutions and mutual funds that use ETFs and ETPs, the Active ETF landscape report and the Smart Beta ETF Landscape report.

Deborah Fuhr is the managing partner and co-founder of ETFGI, she previously served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. Fuhr also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Below is a short description of the 8 subscription services ETFGI currently offers. We welcome your feedback and suggestions on our current research as well as suggestions for new research.

ETFGI annual research service – paid subscription

ETFGI annual review of institutions and mutual funds that use ETFs and ETPs – paid subscription

ETFGI Active ETF landscape annual report service – paid subscription

ETFGI Smart Beta ETF Landscape annual report service – paid subscription

ETFGI and Kreab 2017 ETF Trading and Market Structure Conference – paid registration

ETFGI EM and FM report – paid subscription

ETFGI monthly Highlights – free subscription

ETFGI weekly newsletter – free subscription

Below is a link to a video which provides overviews of our website www.etfgi.com

ETFGI Website Tour (7 minutes)

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs