ETFGI reports assets invested in ETFs/ETPs listed in the United States reach a new record 2.865 trillion US dollars at the end of April 2017

ETFGI reports assets invested in ETFs/ETPs listed in the United States reach a new record 2.865 trillion US dollars at the end of April 2017

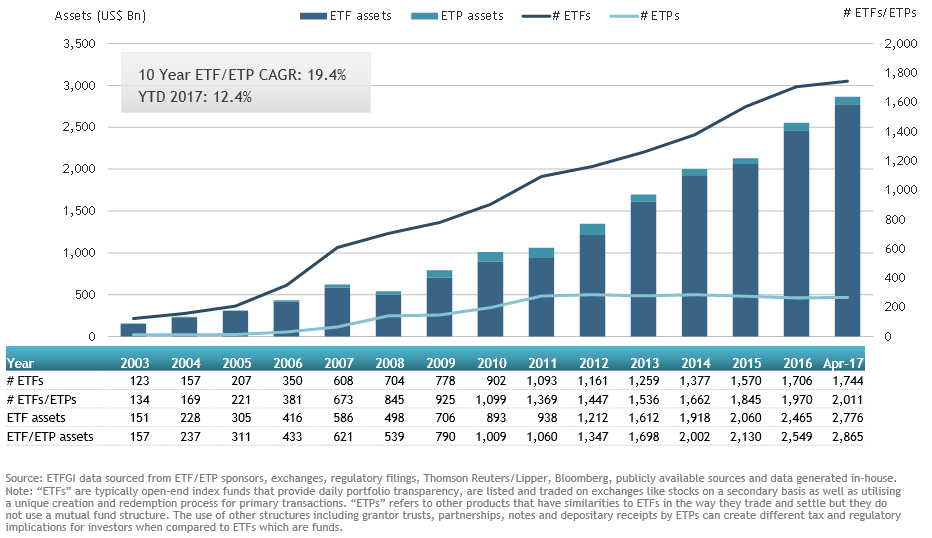

LONDON — May 11, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs/ETPs listed in the United States reach a new record 2.865 trillion US dollars at the end of April 2017, according to preliminary data from ETFGI’s April 2017 global ETF and ETP industry insights report.

The US ETF/ETP industry had 2,011 ETFs/ETPs, assets of US$2.865 trillion, from 112 providers on 3 exchanges at the end of April 2017.

“Investors continued to favour equities over fixed income and commodities as equity markets performed positively in April. The S&P 500 was up 1%, international equity markets outside the US and emerging markets were both up 2% in April. Investors were captivated by a closely-fought first round of the French elections during April,” according to Deborah Fuhr, managing partner and a founder of ETFGI.

In April 2017, ETFs/ETPs listed in the US gathered US$36.09 Bn a record amount of net inflows for April marking the14th consecutive month of net inflows. Equity ETFs/ETPs gathered the largest net inflows with US$26.41 Bn, followed by fixed income ETFs/ETPs with US$8.83 Bn, while commodity ETFs/ETPs experienced net outflows of US$889 Mn.

Year to date, net inflows stand at a record level of US$169.71 Bn. At this point last year there were net inflows of US$45.31 Bn.

iShares gathered the largest net ETF/ETP inflows in April with US$24.21 Bn, followed by Vanguard with US$9.93 Bn and Schwab ETFs with US$2.53 Bn net inflows.

YTD, iShares gathered the largest net ETF/ETP inflows of US$78.53 Bn, followed by Vanguard with US$50.43 Bn and Schwab ETFs with US$9.21 Bn of net inflows.

###

You are invited to attend the ETFGI and Kreab 2017 ETF Trading and Market Structure Conference on Wed, Jun 7, 2017 at 8:00 AM in New York City. The cost to attend is $595 per person, early bird registration is $495 per person until May 7th. To view the full agenda and register, click here.

Speakers include:

Adena T. Friedman President and Chief Executive Officer, Nasdaq

Chris Concannon President and Chief Operating Officer, CBOE Holdings

Thomas W. Farley, President of NYSE

Jim Ross Executive Vice President, State Street Global Advisors (SSGA)

Christine Podolak Senior Director, Exchange Traded Products Surveillance andInvestigations FINRA

Barry Pershkow Senior Special Counsel US Securities and Exchange Commission

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Please visit our website www.etfgi.com to register for our free Weekly Newsletter and updates, to find ETFGI Press Releases on ETF/ETP industry trends, daily postings of some of the top articles from financial publications around the world in the Industry News tab, details of upcoming Events, monthly videos on industry trends in Views, our twitter feed @etfgi , and to use our directory of firms in the ETF Ecosystem. You are invited to join our group "ETF Network" on Linkedin. Please contact deborah.fuhr@etfgi.com if you would like to discuss subscribing to ETFGI’s research or consulting services.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI the leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem. Launched in 2012 by Deborah Fuhr and partners in London the firm offers paid for research subscription services: the ETFGI annual research service provides monthly reports on trends in the global ETF and ETP industry, access to the ETFGI database of all ETFs/ETPs listed globally with factsheets which are updated monthly, ETFGI annual review of institutions and mutual funds that use ETFs and ETPs, the Active ETF landscape report and the Smart Beta ETF Landscape report.

Deborah Fuhr is the managing partner and co-founder of ETFGI, she previously served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. Fuhr also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Below is a short description of the 8 subscription services ETFGI currently offers. We welcome your feedback and suggestions on our current research as well as suggestions for new research.

ETFGI annual research service – paid subscription

ETFGI annual review of institutions and mutual funds that use ETFs and ETPs – paid subscription

ETFGI Active ETF landscape annual report service – paid subscription

ETFGI Smart Beta ETF Landscape annual report service – paid subscription

ETFGI and Kreab 2017 ETF Trading and Market Structure Conference – paid registration

ETFGI EM and FM report – paid subscription

ETFGI monthly Highlights – free subscription

ETFGI weekly newsletter – free subscription

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs