ETFGI reports assets invested in ETFs/ETPs listed in Canada reached a new record of US$104 Bn at the end of July 2017

ETFGI reports assets invested in ETFs/ETPs listed in Canada reached a new record of US$104 Bn at the end of July 2017

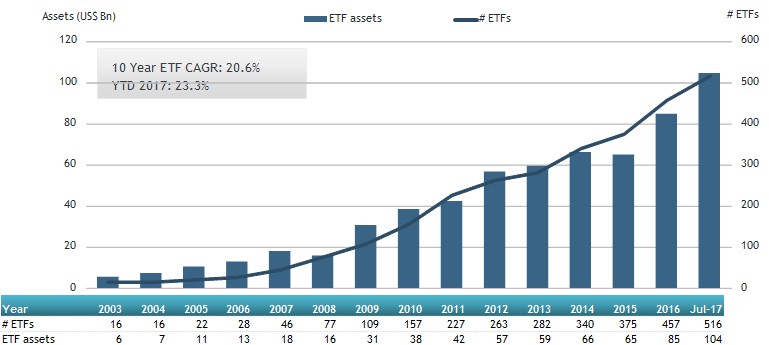

LONDON — August 22, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs/ETPs listed in Canada reached a new record of US$104 Bn at the end of July 2017, surpassing the prior record of US$101 Bn set at the end of June 2017, according to data from ETFGI’s July 2017 global ETF and ETP industry insights report.

ETFs/ETPs listed in Canada gathered US$113 Mn in net new assets in July, marking the 10th consecutive month of net inflows. Year to date, net inflows stand at a record level of US$11.56 Bn which is significantly greater than the US$8.51 Bn in net inflows at this point last year.

At the end of July 2017, the Canadian ETF industry had 516 ETFs, with 631 listings and assets of US$104 Bn from 24 providers on 2 exchanges.

“Most equity markets continued to see gains in July. The S&P 500 gained 2% with Telecom and Info Tech as the top performing sectors, up 6% and 4%, respectively. International equities, and especially emerging markets, were up 3% and 6%, respectively. Political risks remain a focus for investors - the ability of the Trump administration to move forward on policy goals and hearings on Capitol Hill, Brexit negotiations, and North Korea is still an area of concern.” According to Deborah Fuhr, managing partner at ETFGI.

Equity ETFs/ETPs saw net outflows of US$528 Mn in July, bringing year to date net inflows to US$5.06Bn, which is greater than the net inflows of US$4.14 Bn over the same period last year.

Fixed income ETFs and ETPs experienced net inflows of US$145 Mn in July, growing year to date net inflows to US$3.31 Bn, which is less than the same period last year which saw net inflows of US$3.55 Bn.

Commodity ETFs/ETPs saw net inflows of US$32 Mn in July. Year to date, net outflows are at US$1 Mn, compared to net inflows of US$225 Mn over the same period last year.

BMO AM gathered the largest net ETF/ETP inflows in July with US$621 Mn, followed by QuantShares with US$106 Mn and Mackenzie with US$98 Mn net inflows.

YTD, BMO AM gathered the largest net ETF inflows with US$5.22 Bn, followed by Vanguard with US$1.69 Bn and iShares with US$984 Mn net inflows.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs