ETFGI reports a record 391.26 billion US dollars in net new assets have been invested in ETFs/ETPs listed globally in the first 7 months of 2017, surpassing the record net new assets gathered in all of 2016

ETFGI reports a record 391.26 billion US dollars in net new assets have been invested in ETFs/ETPs listed globally in the first 7 months of 2017, surpassing the record net new assets gathered in all of 2016

LONDON — August 14, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that during the first 7 months of 2017 a record level of US$391.26 Bn in net inflows have been invested in ETFs/ETPs listed globally, which is greater than the record level of US$390.42 Bn in net inflows that were invested in all of 2016. In July ETFs and ETPs listed globally gathered US$43.48 Bn in net inflows marking 41 consecutive months of net inflows.

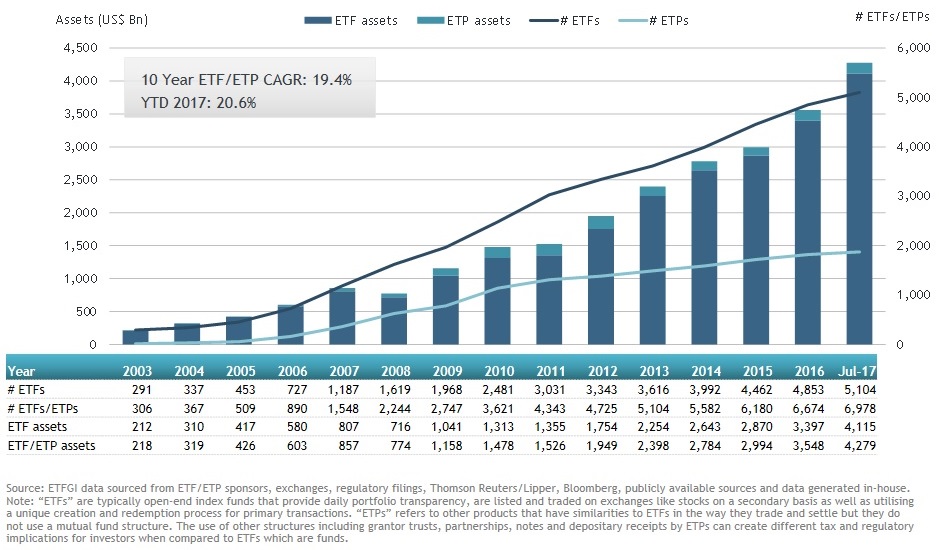

Assets invested in ETFs/ETPs listed globally increased 2.7% in July and 20.6% year-to-date growing from US$3.548 trillion to a record US$4.279 trillion, according to ETFGI’s July 2017 global ETF and ETP industry insights report, an annual paid-for research subscription service.

At the end of July 2017, the Global ETF/ETP industry had 6,978 ETFs/ETPs, with 13,192 listings, assets of US$4.279 trillion, from 329 providers listed on 69 exchanges in 56 countries.

“Most equity markets continued to see gains in July. The S&P 500 gained 2% with Telecom and Info Tech the top performing sectors, up 6% and 4%, respectively. International equities, and especially emerging markets, were up 3% and 6%, respectively. Political risks remain a focus for investors - the ability of the Trump administration to move forward on policy goals and hearings on Capitol Hill, Brexit negotiations, and North Korea is still an area of concern.” According to Deborah Fuhr, managing partner at ETFGI.

In July 2017, ETFs/ETPs gathered net inflows of US$43.48 Bn. Equity ETFs/ETPs gathered the largest net inflows with US$29.60 Bn, followed by fixed income ETFs/ETPs which gathered a record level for July of US$15.11 Bn, while commodity ETFs/ETPs experienced net outflows of US$3.12 Bn.

YTD through end of July – the first 7 months of 2017 – ETFs/ETPs have gathered a record level of net inflows of US$391.26 Bn, surpassing the US$390.42 BnBn in net inflows that were invested in all of 2016.

Equity ETFs/ETPs gathered the largest net inflows YTD with a record US$272.21 Bn, followed by fixed income ETFs/ETPs with a record level of US$96.15 Bn, and commodity ETFs/ETPs with US$4.25 Bn in net inflows.

iShares gathered the largest net ETF/ETP inflows in July with US$18.11 Bn, followed by Vanguard with US$9.49 Bn and SPDR ETFs with US$2.82 Bn net inflows.

YTD, iShares gathered the largest net ETF/ETP inflows YTD with US$158.94 Bn, followed by Vanguard with US$91.80 Bn and Schwab ETFs with US$15.33 Bn net inflows.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us.

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs