ETFGI reports assets invested in Smart Beta equity ETFs/ETPs listed globally have increased 21.9% in 2017 to reach a new record of US$644 billion at the end of September

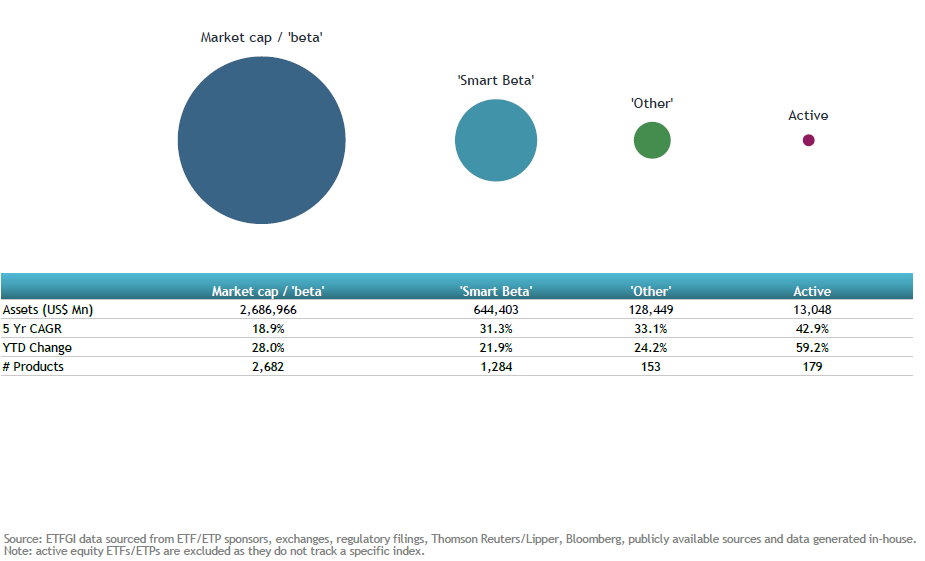

LONDON — October 19, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in Smart Beta equity ETFs/ETPs listed globally have increase 21.9% in the first 9 months of the year to reach a new record of US$644 Bn at the end of September, according to ETFGI’s September 2017 global smart beta equity ETF and ETP industry insights monthly report which is part of an annual paid for research subscription service.

Record levels of assets were reached at the end of September for equity smart beta ETFs/ETPs listed globally with US$644.40 Bn, in the United States with US$571.45 Bn, in Europe with US$48.44 Bn, in Canada with US$14.40 Bn and in Asia Pacific (ex-Japan) with US$6.08 Bn.

In September 2017, smart beta equity ETFs/ETPs gathered a record level of US$6.42 Bn in net inflows marking 19 consecutive months of net inflows and a level of US$53.38 Bn in year to date net inflows which is greater than the US$36.53 Bn in net inflows at this point last year. Combining market moves and net inflows, smart beta equity ETF/ETP assets have increased by 21.9% from US$528.76 Bn to US$644.40 Bn, with a 5-year CAGR of 31.3%.

At the end of September 2017, there were 1,284 smart beta equity ETFs/ETPs, with 2,189 listings, assets of US$644 Bn, from 161 providers listed on 40 exchanges in 33 countries.

“The US market typically has performed poorest during the month of September. This year the S&P 500 was up 2.06% in September and is up 14.24% year to date. The S&P 500 Value outperformed S&P 500 Growth up 3.28% and 1.11% respectively, furthering the perception of stronger economic fundamentals. Energy and Financials were September's top performing sectors, up 9.94% and 5.14%, respectively. The S&P Developed Ex-U.S. BMI gained 2.57% in September and is up 20.76% year to date. Emerging markets declined 0.55% in September due to headwinds including a rising dollar but is up 26.95% year to date. The uncertainty of Brexit negotiations and North Korea are still areas of concern for investors.” According to Deborah Fuhr, Managing Partner and co-founder of ETFGI.

88.7% of Smart Beta assets are invested in the 628 ETFs/ETPs that are domiciled and listed in the United States and 76.8% of the assets are invested in the 511 ETFs/ETPs that provide Smart Beta exposure to the US market.

iShares gathered the largest 'smart beta' ETF/ETP net inflows in September with US$2.63 Bn, followed by Vanguard with US$1.06 Bn and PowerShares with US$390 Mn net inflows.

Products tracking MSCI 'smart beta' indices gathered the largest net ETF/ETP inflows in September with US$1.65 Bn, followed by CRSP with US$1.05 Bn and S&P Dow Jones with US$1.01 Bn net inflows.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us.

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Note to editors

ETFs are typically open-ended, index-based funds, with active ETFs accounting for 1.1% market share. They can be bought and sold like ordinary shares on a stock exchange and offer broad exposure across developed, emerging and frontier markets, equities, fixed income and commodities. ETFs are used widely by institutional investors and increasingly by financial advisors and retail investors to:

equitize cash

implement diversified exposure to a market

comprise a core or satellite investment

be a long term strategic investment

implement tactical adjustments to portfolios

use as building blocks to create entire portfolios

allow investors to hedge the market

use as an alternative to futures and other derivative products

Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds.

Services

Below is a short description of the 8 subscription services ETFGI currently offers. We welcome your feedback and suggestions on our current research as well as suggestions for new research.

ETFGI Currency Hedged ETF Landscape report (paid subscription) ***New publication***

ETFGI EM and FM report (paid subscription) ***New publication***

ETFGI report on platforms in the UK (paid subscription) ***New publication***

ETFGI Weekly Newsletter ***Premium version for paid subscribers***

ETFGI Global Leveraged/Inverse ETF and ETP industry insights (paid subscription) ***New publication***

ETFs and ETPs providing equity exposure to China (paid subscription) ***New publication***

ETFs Global Markets Roundtables 2018 (paid) ***New***

ETFGI annual research service (paid subscription)

ETFGI Active ETF Landscape annual report service (paid subscription)

ETFGI Smart Beta ETF Landscape annual report service (paid subscription)

ETFGI Weekly Newsletter (free subscription)

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs