ETFGI reports that assets invested in ETFs and ETPs listed in Asia Pacific (ex-Japan) increased by US$29.3 billion during 2017 to a new record high of US$159 billion at the end of October

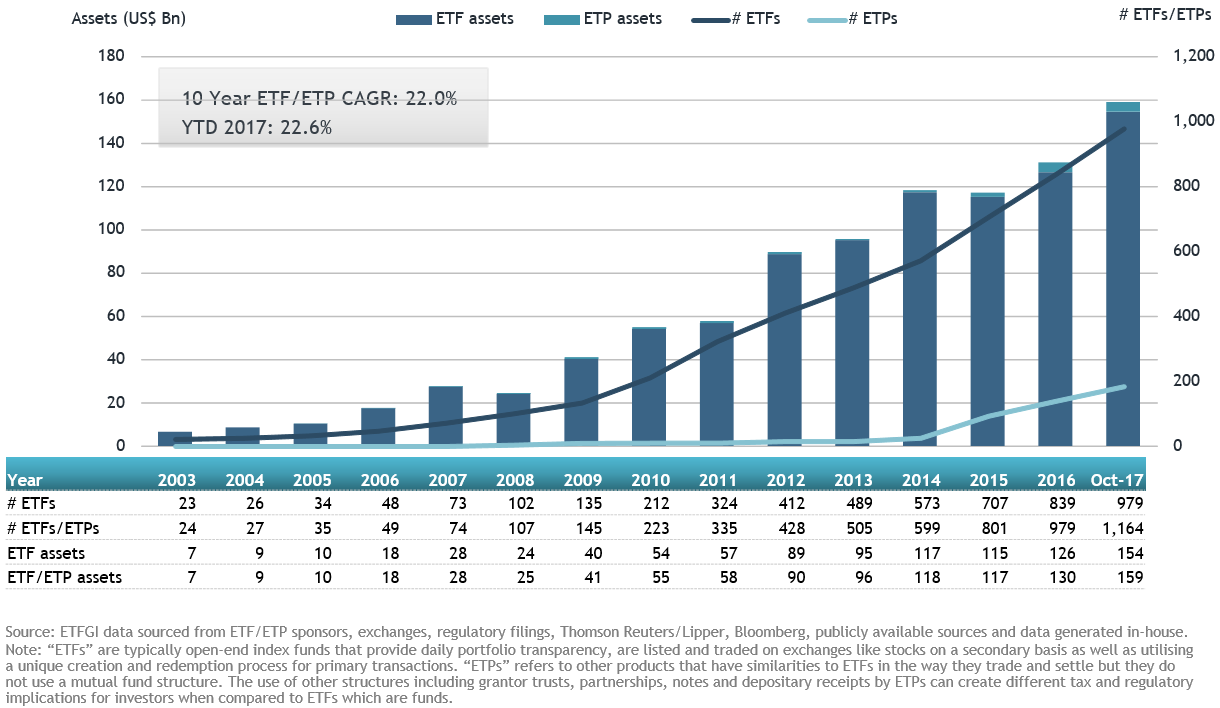

LONDON — November 22, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs/ETPs listed in Asia Pacific (ex-Japan) increased by US$29.3 billion during the first 10 months of 2017, to reach a new record high of US$159 billion at the end of October.

According to ETFGI’s October 2017 Asia Pacific (ex-Japan) ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs and ETPs increased by 22.6%, from $130 Bn at the end of 2016. The increase of US$29.3 Bn eclipsed the total increase of $12.5 Bn for the whole of 2016, and represents the greatest absolute annual increase in assets since 2012.

The top 100 ETFs/ETPs, out of 1,164, accounted for 78.6% of Asia Pacific (ex-Japan) ETF/ETP assets at the end of October 2017, and 28 ETFs/ETPs had greater than US$1 Bn in assets. Just 20 of the top ETFs by assets accounted for 49.0% of Asia Pacific (ex-Japan) ETF assets. The largest ETF, Tracker Fund of Hong Kong (TraHK) (2800 HK), on its own accounted for 7.5% of ETF assets.

Top 20 ETFs by assets: Asia Pacific (ex-Japan)

|

Name |

Country listed |

Ticker |

Assets |

ADV |

NNA |

|

Tracker Fund of Hong Kong (TraHK) |

Hong Kong |

2800 HK |

11,600 |

131.8 |

(1,533) |

|

Hang Seng Index ETF |

Hong Kong |

2833 HK |

6,969 |

1.0 |

(277) |

|

Samsung KODEX 200 ETF |

South Korea |

069500 KS |

5,933 |

241.1 |

572 |

|

ChinaAMC China 50 ETF |

China |

510050 CH |

5,209 |

134.4 |

(189) |

|

Hang Seng H-Share Index ETF |

Hong Kong |

2828 HK |

4,790 |

125.3 |

(2,086) |

|

iShares FTSE A50 China Index ETF |

Hong Kong |

2823 HK |

3,933 |

59.5 |

(901) |

|

ABF Pan Asia Bond Index Fund |

Hong Kong |

2821 HK |

3,926 |

0.1 |

65 |

|

CSOP FTSE China A50 ETF |

Hong Kong |

82822 HK |

3,336 |

98.9 |

(15) |

|

Shanghai SSE180 ETF |

China |

510180 CH |

3,079 |

2.8 |

(42) |

|

CCB Cash TianYi Traded Money Market Fund |

China |

511660 CH |

2,910 |

248.6 |

1,768 |

|

China CSI 500 ETF |

China |

510500 CH |

2,890 |

25.1 |

190 |

|

Huatai-Pinebridge CSI 300 ETF |

China |

510300 CH |

2,821 |

50.9 |

(397) |

|

Harvest CSI 300 Index ETF |

China |

159919 CH |

2,807 |

4.2 |

(353) |

|

ChinaAMC CSI 300 Index ETF |

China |

510330 CH |

2,794 |

2.2 |

(179) |

|

SPDR S&P/ASX 200 Fund |

Australia |

STW AU |

2,597 |

9.7 |

118 |

|

Mirae Asset TIGER 200 ETF |

South Korea |

102110 KS |

2,178 |

43.6 |

(2) |

|

YUANTA/P-shares Taiwan Top 50 1X Bear ETF |

Taiwan |

00632R TT |

2,135 |

18.1 |

122 |

|

Vanguard Australian Shares Index ETF |

Australia |

VAS AU |

1,932 |

6.2 |

458 |

|

CPSE ETF |

India |

CPSEBE IN |

1,878 |

1.1 |

841 |

|

iShares Core S&P 500 ETF |

Australia |

IVV AU |

1,863 |

2.6 |

165 |

Vanguard gathered the largest net ETF/ETP inflows YTD with US$1.991 Bn, followed by CCB with US$1.77 Bn and Mirae Asset ETFs with US$1.16 Bn net inflows.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us.

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs