Global ETF Industry Extends Lead Over Global Hedge Fund Industry To US$1.3 Trillion Through Q3 2017

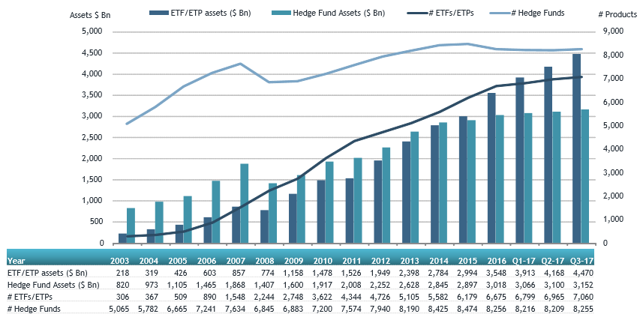

ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in the global ETF/ETP industry extended their lead over assets invested in the global hedge fund industry to US$1.318 trillion at the end of Q3 2017, an increase of 23% over the gap at the end of Q2 2017.

According to ETFGI’s analysis a record US$4.470 trillion were invested in 7,060 ETFs/ETPs listed globally at the of Q3 2017, representing growth in assets of 7.2% over the quarter. Over the same period assets invested in hedge funds globally grew by only 1.7%, to a record US$3.152 trillion in 8,255 hedge funds at the of Q3 2017, according to a report by Hedge Fund Research.

Assets invested in the global ETF/ETP industry first surpassed those invested in the hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETF/ETP industry has outpaced growth in the hedge fund industry since the financial crisis in 2008:

Sources: Hedge Fund Research HFR, ETFGI

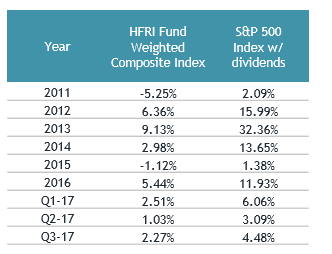

Investors have become disappointed with the high fees, performance and lack of liquidity of hedge funds over the past few years. In Q3 2017, the performance of the HFRI Fund Weighted Composite Index was 2.27%, significantly lower than the 4.48% return of the S&P 500 Index. In each of the past six years the performance of the HFRI Fund Weighted Composite Index was significantly lower than the return of the S&P 500 Index:

Annual returns of the HFRI Fund Weighted Composite Index and the S&P 500 Index.

Sources: Hedge Fund Research HFR, S&P Dow Jones Indices

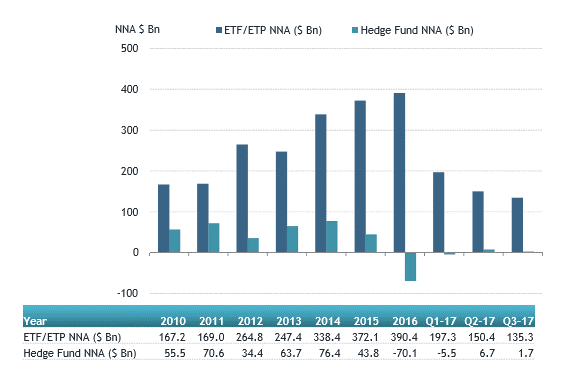

During Q3 2017, ETFs/ETPs listed globally gathered US$135.3 Bn in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. The end of September 2017 marked the 44th consecutive month of net inflows into ETFs/ETPs. In contrast, HFR reported that hedge fund investors created US$1.7 Bn during Q3 2017.

Net New Asset (NNA) flows into ETFs/ETPs and hedge funds globally, as at end of September 2017

Sources: Hedge Fund Research HFR, ETFGI

For reference, the top 20 ETFs account for 29.6% of global ETF assets. The largest ETF: SPDR S&P 500 ETF Trust (SPY US) on its own accounts for 5.7% of assets.

Source: ETFGI

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us.

Please visit our website www.etfgi.com to view our ETFGI Press Releases on ETF/ETP industry trends, daily postings of some of the top articles from financial publications around the world in the Industry News tab, details of upcoming Events, monthly videos on industry trends in Views, and to use our directory of firms in the ETF Ecosystem. You are invited to follow our twitter feeds @etfgi and @deborahfuhr and on Linkedin follow ETFGI and Deborah Fuhr and join our group "ETF Network".

On our website you can download a free copy of the “A Comprehensive Guide to Exchange Traded Funds (ETFs)” was published by the CFA Institute Research Foundation in May 2015. By Joanne M. Hill, Dave Nadig, Matt Hougan and Deborah Fuhr. The link to download the book is http://etfgi.com/news/industry

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates. She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include: she was the recipient of the 100 Women in Finance 2017, European Industry Leadership Award as well as the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and was she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” a not for profit organization to connect, support and inspire Women and Men in the ETF ecosystem. WE has over 3,300 members in chapters around the world.

Services

ETFGI currently offers the following subscription services:

• ETFGI Basic Global ETFs and ETPs Annual research service

• ETFGI Global Institutional Users of ETFs and ETPs Landscape report*

• ETFGI Global Active ETF ETFs and ETPs Landscape report

• ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

• ETFGI Global Currency Hedged ETFs and ETPs Landscape report *

• ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report *

• ETFGI Global EM and FM ETFs and ETPs Landscape report *

• ETFGI China ETFs and ETPs Landscape report *

• ETFGI Trends in ETF Adoption by fund platforms in the UK report*

• Custom reports and analysis

• Consulting services

• ETFGI Weekly Newsletter – Premium*

• ETFGI Weekly Newsletter (free subscription)

*New publication/service

• ETFs Global Markets Roundtables 2018 *

Note to editors

ETFs are typically open-ended, index-based funds, with active ETFs accounting for 1.1% market share. They can be bought and sold like ordinary shares on a stock exchange and offer broad exposure across developed, emerging and frontier markets, equities, fixed income and commodities. ETFs are used widely by institutional investors and increasingly by financial advisors and retail investors to:

• equitize cash

• implement diversified exposure to a market

• comprise a core or satellite investment

• be a long term strategic investment

• implement tactical adjustments to portfolios

• use as building blocks to create entire portfolios

• allow investors to hedge the market

• use as an alternative to futures and other derivative products

Exchange Traded Products (ETPs) are products that have similarities to ETFs in the way they trade and settle but do not use an open-end fund structure. The use of other structures including unsecured debt, grantor trusts, partnerships, and commodity pools by ETPs can, in addition to a significantly different risk profile, create different tax and regulatory implications for investors when compared to ETFs, which are funds.

Contact

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Website: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs

Disclaimer

This message is intended solely for the addressee and may contain confidential information. If you have received this message in error, please send it back to us, and immediately and permanently delete it. Do not use, copy or disclose the information contained in this message or in any attachment.

ETFGI LLP is a limited liability partnership registered in England and Wales with registered number OC372221. Registered address is 130 Jermyn Street, 2nd Floor, St James’s, London SW1Y 4UR.

ETFGI LLP has taken every reasonable precaution to ensure that any attachment to this e-mail has been swept for viruses. However, we cannot accept liability for any damage sustained as a result of software viruses and would advise that you carry out your own virus checks before opening any attachment.