ETFGI reports record year for ETFs and ETPs listed in Japan with over 50% increase in invested assets during first 11 months of 2017

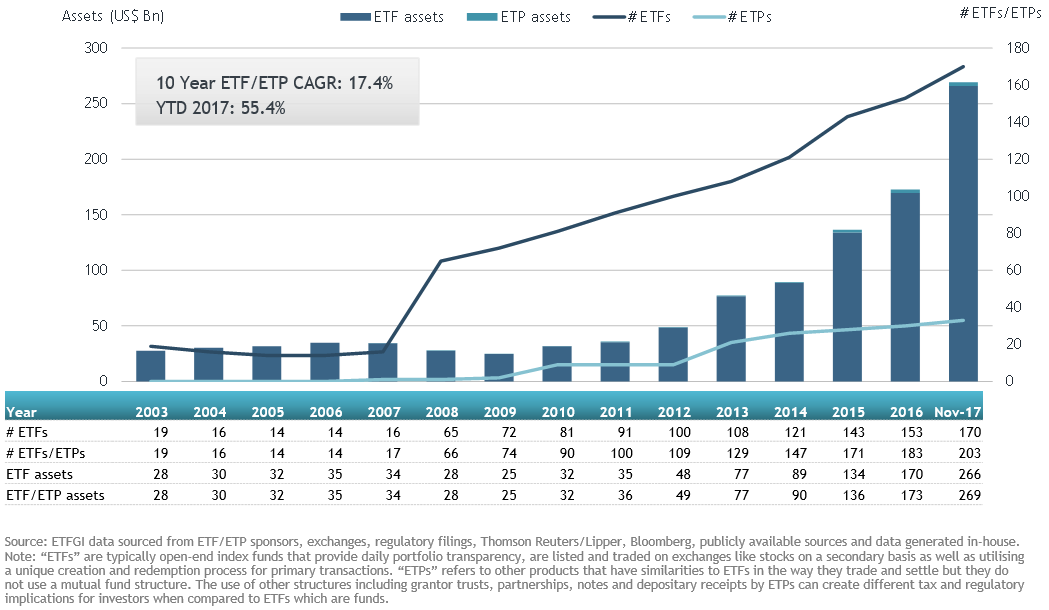

LONDON — December 21, 2017 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs/ETPs listed in Japan increased by over 50% during the first 11 months of 2017 to reach a new high of US$269 billion at the end of November.

According to ETFGI’s November 2017 Japan ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs grew by 55.4% during the first 11 months of 2017, from $84.6 Bn at the end of 2016. With one month of 2017 still to go the increase of $96.0 Bn represented the greatest absolute annual increase on record, more than doubing the previous record of US$46.8 Bn set for the whole of 2015.

If the trend continues through December, 2017 is also on track to see the greatest percentage increase in assets since initial growth in use of ETFs in Japan in the early 2000s.

Year-to-date, through end of November 2017, ETFs and ETPs listed in Japan saw record net inflows of US$48.6 Bn; 39.0% more than net inflows for the whole of 2016. The majority of these flows can be attributed to the top 20 ETFs by net new assets, which collectively gathered US$49.5 Bn during 2017. The TOPIX Exchange Traded Fund (1306 JP) on its own accounted for net inflows of US$15.3 Bn.

Top 20 ETFs by net new assets: Japan

|

Name |

Ticker |

Assets |

ADV |

NNA |

|

TOPIX Exchange Traded Fund |

1306 JP |

58,055 |

62.5 |

15,302 |

|

Daiwa ETF TOPIX |

1305 JP |

27,981 |

5.4 |

7,935 |

|

Listed Index Fund TOPIX |

1308 JP |

26,819 |

8.4 |

7,756 |

|

Nikkei 225 Exchange Traded Fund |

1321 JP |

47,207 |

84.1 |

3,621 |

|

Listed Index Fund 225 |

1330 JP |

24,445 |

22.4 |

2,989 |

|

MAXIS TOPIX ETF |

1348 JP |

8,239 |

2.5 |

2,727 |

|

MAXIS NIKKEI225 ETF |

1346 JP |

11,885 |

10.7 |

2,159 |

|

Daiwa ETF NIKKEI 225 |

1320 JP |

21,760 |

20.0 |

1,486 |

|

NEXT FUNDS JPX-Nikkei Index 400 Exchange Traded Fund |

1591 JP |

5,056 |

4.0 |

1,187 |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund |

1357 JP |

1,486 |

293.3 |

916 |

|

NEXT FUNDS Tokyo Stock Exchange REIT Index ETF |

1343 JP |

2,299 |

2.5 |

510 |

|

MAXIS JPX-Nikkei Index 400 ETF |

1593 JP |

2,216 |

1.2 |

479 |

|

DIAM ETF TOPIX |

1473 JP |

1,008 |

0.0 |

367 |

|

SMAM Nikkei 225 ETF |

1397 JP |

628 |

0.0 |

317 |

|

iShares JPX Nikkei 400 ETF |

1364 JP |

1,038 |

0.2 |

308 |

|

Daiwa ETF Tokyo Stock Exchange REIT Index |

1488 JP |

364 |

0.0 |

307 |

|

iShares Core TOPIX ETF |

1475 JP |

838 |

1.1 |

290 |

|

MAXIS J-REIT ETF |

1597 JP |

788 |

0.2 |

278 |

|

Daiwa ETF JPX-Nikkei 400 |

1599 JP |

1,469 |

0.4 |

264 |

|

DIAM ETF JPX-Nikkei 400 |

1474 JP |

834 |

0.0 |

251 |

Equity ETFs/ETPs saw year-to-date net inflows of $50.1 Bn, which is greater than the net inflows of $34.3 Bn over the same period last year.

###

Attribution Policy: The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us.

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997. ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs