ETFGI reports that US-listed ETFs and ETPs suffered 10.6 billion US dollars net outflows during February 2018, the first outflows since January 2016

LONDON — April 4, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that US-listed ETFs and ETPs suffered US$10.6 billion net outflows during February 2018, the first outflows since January 2016 and the largest monthly amount since January 2014, when net outflows were US$15.6 billion. Year-to-date net inflows reached US$68.2 billion at the end of February. (All dollar values in USD unless otherwise noted.)

Highlights

- US-listed ETFs/ETPs suffered $10.6 Bn net outflows during February 2018, the largest since January 2014, which saw $15.6 Bn in net outflows

- Equity ETFs/ETPs experienced $14.30 Bn net outflows, the largest since February 2016, with $15.2 Bn

- SPDR ETFs experienced outflows of $25.3 Bn, the first since January 2015, when $26.7 Bn net outflows were recorded

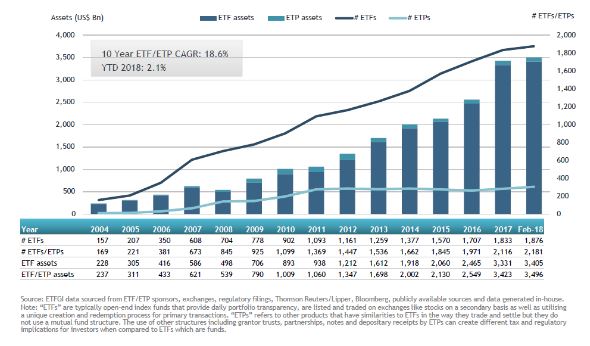

According to ETFGI’s February 2018 US ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs listed in the US decreased by a record $145 Bn during February 2018. The decrease of 3.99%, from $3.64 Tn at the end of January 2018 to $3.50 Tn at the end of February, also represents the worst monthly growth in assets since January 2016, which saw a monthly decrease of 4.68% from $2.13 to $2.03 Tn.

US ETF and ETP asset growth as at the end of February 2018

February 2018 marked the first month of net outflows from ETFs/ETPs listed in the US since January 2016, which saw $468 Bn in net outflows. At this point last year, year-to-date net inflows were 23.6% higher, with $89.2 Bn gathered during the first two months of 2017.

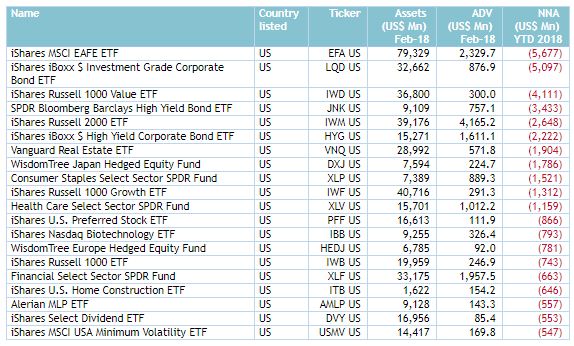

The majority of these flows can be attributed to the top 20 ETFs by net outflows, which collectively have suffered $37.0 Bn during 2018. The iShares MSCI EAFE ETF (EFA US) on its own accounted for net outflows of $5.68 Bn.

Top 20 ETFs by net YTD net outflows: US

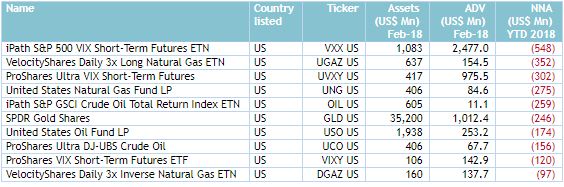

Similarly, the top 10 ETPs by net outflows collectively experienced $2.53 Bn during February 2018.

Top 10 ETPs by YTD net outflows: US

Equity ETFs/ETPs listed in the US suffered net outflows of $14.3 Bn during February, bringing net inflows for 2018 to $50.5 Bn, which is less than the $59.6 Bn in net inflows at this point last year. Fixed income ETFs and ETPs gathered net inflows of $930 Mn, growing net inflows for 2018 to $9.71 Bn, which is less than the $23.7 Bn in net inflows at this point last year.

During February investors chose to move from US Equity ETFs to Fixed Income and Commodities products.

###

Featured Events

The 2018 ETFs Global Markets Roundtable series of conferences are designed as educational events to provide the opportunity for buyside traders and portfolio managers from the institutional investor community, as well as other market participants and professionals involved in the ETF space, to hear current thoughts from industry leaders on ETF trends, market structure and regulation, and obtain a better understanding of liquidity, how to trade and use ETFs, and of the impact that ETFs have on the markets and market structure. The conference series is building on the event organized in June 2017 by Ari Burstein and Deborah Fuhr.

Free registration for qualified buyside portfolio managers and traders.

London April 19, 2018 - Agenda and registration New York May 15, 2018 - Agenda and registration Toronto May 31, 2018 Asia Q4 2018

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 by Deborah Fuhr and partners in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” a not for profit organization to connect, support and inspire Women and Men in the ETF ecosystem. WE has over 3,600 members in chapters around the world.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs