ETFGI reports ETFs and ETPs listed in Europe gathered net inflows of US$2.15 Bn during April 2018

ETFGI PRESS RELEASE:

ETFGI reports ETFs and ETPs listed in Europe gathered net inflows of US$2.15 Bn during April 2018

30 May 2018

LONDON — May 30, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Europe gathered US$2.15 Bn in net inflows during April 2018, less than half of the net new assets gathered during the same month in 2017. Year-to-date net inflows for 2018 reached US$29.55 Bn at the end of April which is less than the US$40.59 Bn in net inflows at this point last year. (All dollar values in USD unless otherwise noted.)

Highlights

- Net new assets gathered by ETFs/ETPs listed in Europe were $2.15 Bn, which is less than half of the net new assets gathered in April 2017

- April 2018 marked the 43rd consecutive month of net inflows into ETFs/ETPs listed in Europe

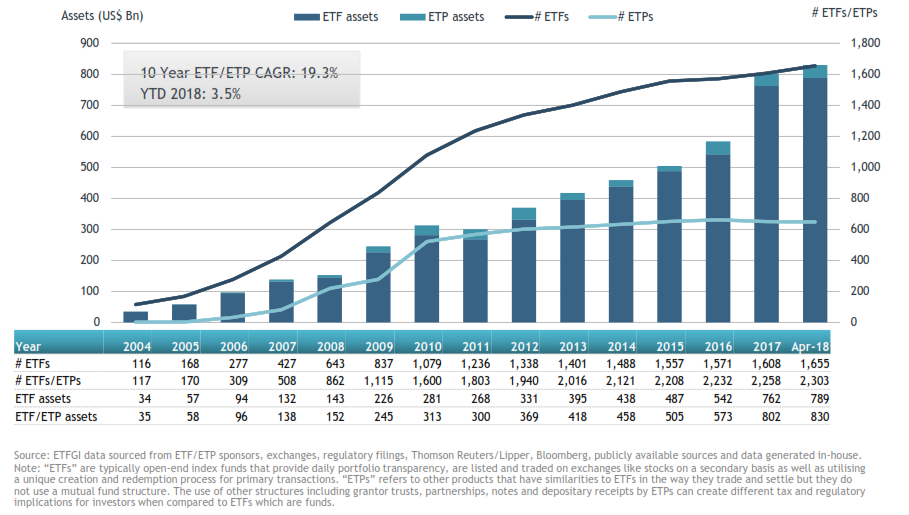

- Due to market moves assets invested in ETFs/ETPs listed in Europe increased by 0.54%, or $4.45 Bn, during April, to $830.21 Bn

According to ETFGI’s April 2018 European ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs listed in Europe increased by $4.45 Bn during April 2018.

European ETF and ETP asset growth as at end of April 2018

At the end of April 2018, the European ETF industry had 1,655 ETFs, with 6,355 listings, assets of $788.51 Bn, from 56 providers on 26 exchanges in 22 countries. At the end of April 2018, the European ETF/ETP industry had 2,303 ETFs/ETPs, with 7,613 listings, assets of $830.21 Bn, from 66 providers on 27 exchanges in 22 countries.

April 2018 marked the 43rd consecutive month of net inflows into ETFs/ETPs listed in Europe.

The $2.15 Bn gathered during the month was 58.88% less than the $5.23 Bn in net inflows during this month last year.

The majority of net new inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $15.47 Bn during 2018. The iShares Core MSCI EM IMI UCITS ETF (EMIM LN) on its own accounted for net inflows of $1.78 Bn.

Top 20 ETFs by net new assets: Europe

|

Name |

Country listed |

Ticker |

Assets |

ADV |

NNA |

|

iShares Core MSCI EM IMI UCITS ETF |

UK |

EMIM LN |

10,342 |

35.7 |

1,775 |

|

Vanguard S&P 500 UCITS ETF |

UK |

VUSA LN |

22,993 |

59.1 |

1,588 |

|

iShares $ Treasury Bond 7-10yr UCITS ETF |

UK |

IBTM LN |

3,125 |

26.2 |

1,078 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

UK |

IBTS LN |

3,285 |

18.1 |

889 |

|

iShares Automation & Robotics UCITS ETF |

UK |

RBTX LN |

2,336 |

15.0 |

883 |

|

Xtrackers S&P 500 Swap UCITS ETF |

Germany |

D5BM GY |

3,483 |

33.1 |

848 |

|

AMUNDI ETF MSCI Emerging Markets UCITS ETF |

France |

AEEM FP |

4,467 |

39.4 |

822 |

|

Xtrackers MSCI EMU INDEX UCITS ETF (DR) - 1D |

UK |

XD5E LN |

3,004 |

59.2 |

756 |

|

iShares S&P 500 Information Technology Sector UCITS ETF |

UK |

IITU LN |

1,176 |

3.2 |

722 |

|

SPDR MSCI Europe Financials ETF |

France |

STZ FP |

1,436 |

8.4 |

646 |

|

iShares MSCI World EUR Hedged UCITS ETF (Acc) |

UK |

IWDE LN |

2,038 |

23.7 |

618 |

|

iShares S&P 500 EUR Hedged UCITS ETF (Acc) |

UK |

IUSE LN |

3,737 |

28.2 |

611 |

|

UBS ETF (IE) MSCI Emerging Markets SF UCITS ETF (USD) A-acc |

Switzerland |

EGUSAS SW |

3,502 |

5.0 |

602 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

UK |

SEML LN |

7,421 |

49.5 |

578 |

|

Xtrackers MSCI Emerging Markets Index UCITS ETF |

Germany |

XMME GY |

1,324 |

22.6 |

545 |

|

Source Bloomberg Commodity UCITS ETF |

UK |

CMOD LN |

1,466 |

0.8 |

535 |

|

Lyxor S&P 500 UCITS ETF - D-USD |

UK |

LSPU LN |

2,283 |

53.9 |

526 |

|

UBS ETF (IE) MSCI USA hedged EUR UCITS ETF (EUR) A-acc |

Switzerland |

USEUWH SW |

1,882 |

6.2 |

487 |

|

Xtrackers II Eurozone Government Bond UCITS ETF DR |

Germany |

XGLE GY |

2,592 |

64.7 |

480 |

|

iShares Italy Govt Bond UCITS ETF |

UK |

IITB LN |

925 |

19.0 |

479 |

Similarly, the top 10 ETPs by net new assets collectively gathered $1.90 Bn year-to-date during 2018.

Top 10 ETPs by net new assets: Europe

|

Name |

Country listed |

Ticker |

Assets |

ADV |

NNA |

|

Xtrackers Physical Gold ETC (EUR) |

Germany |

XAD5 GY |

1,321 |

13.9 |

671 |

|

Invesco Physical Gold ETC |

UK |

SGLD LN |

5,067 |

10.2 |

318 |

|

ETFS Nickel |

UK |

NICK LN |

328 |

4.2 |

193 |

|

Xtrackers Physical Gold Euro Hedged ETC |

Germany |

XAD1 GY |

1,847 |

8.5 |

160 |

|

ETFS Industrial Metals DJ-UBSCISM |

UK |

AIGI LN |

311 |

6.5 |

151 |

|

Xetra Gold EUR |

Germany |

4GLD GY |

7,531 |

18.0 |

130 |

|

UBS ETC Composite USD |

UK |

CMCI LN |

117 |

- |

84 |

|

ETFS Physical Swiss Gold |

UK |

SGBS LN |

692 |

1.7 |

79 |

|

ETFS Physical Silver |

UK |

PHAG LN |

1,012 |

4.9 |

58 |

|

Xtrackers Physical Platinum Euro Hedged ETC |

Germany |

XAD3 GY |

86 |

0.2 |

57 |

Equity ETFs/ETPs listed in Europe suffered net outflows of $1.00 Bn during April, bringing net inflows for 2018 to $21.64 Bn, which is lower than the $24.20 Bn in net inflows at this point last year.

This is the first time in two years were the Equity ETFs/ETPs listed in Europe saw net outflows, the last occasion being on May 2016.

The majority of inflows in Equity ETFs/ETPs went to the Vanguard S&P 500 UCITS ETF and the iShares Core MSCI EM IMI UCITS ETF; they ranked as first and second respectively in terms of Equity ETFs/ETPs by net new assets in April. Notably, the top three ETFs/ETPs by net outflows in April had European Equity exposure (Euro STOXX 50, Europe 600, and DAX).

Fixed income ETFs and ETPs had net inflows of $1.45 Bn during April, bringing net inflows for 2018 to $4.91, which is less than the $8.89 Bn in net inflows at this point last year.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

FEATURED EVENTS

You are invited to register for the 2018 ETFs Global Markets Roundtable conference, organized by ETFGI and Capital Markets Strategies, in Toronto on Thursday May 31st at Vantage Venues, 150 King Street West, Toronto, ON M5H 1J9. Click here to register and view the entire agenda.

The conference is designed to provide the opportunity for institutional investors and financial advisors, as well as other market participants, to hear from the regulators, leading ETF issuers, major brokers, stock exchanges, law firms and others about regulatory, liquidity, pricing, trading, and technological developments impacting the use and trading of ETFs, and the impact that ETFs have on the markets and market structure.

Complimentary registration is available for investment advisors, as well as buyside traders, portfolio managers and others at institutional investor firms. The current program, and registration information, can be found here. https://www.eventbrite.com/e/etfs-global-markets-roundtable-canada-toronto-tickets-42159327684

Buyside/Investment Adviser Workshop: The day will start off with an exclusive buyside/investment adviser workshop. Separated into small groups, participants will have the opportunity to discuss with their peers a number of topics of importance relating to ETFs, as well as raise any questions with, and obtain guidance from, outside experts.

Conference panel sessions will include:

• A “Fireside Chat” on the Future of the ETF Industry

• Impact of Regulatory Developments on ETFs

• Exploring Key Trends in Institutional ETF Trading

• Market Maker Roundtable

• Exchange Roundtable discussing the role of exchanges in the ETF ecosystem

• Bringing New ETFs to Market – An Examination of Innovation and Distribution in the ETF Industry

Confirmed panelists to date are listed below.

Stephen Bain, CFA, Managing Director, Global Equities, RBC Capital Markets

Ari Burstein, President, Capital Markets Strategies

Prerna Chandak, AVP, Exchange Traded Funds, Mackenzie Investments

Roger Chandhok, Global Equity Derivatives, National Bank Financial Group

Mario Cianfarani, CFA, Head of ETF Capital Markets, Vanguard Investments Canada

Carol E. Derk, Partner, Borden Ladner Gervais

Christopher Doll, Vice-President, ETF Sales & Strategy, Invesco Canada

Dan Draper, Managing Director of Global ETFs, PowerShares by Invesco

Deborah Fuhr, Managing Partner, ETFGI LLP

Margaret Gunawan, Managing Director, Head of Canada Legal & Compliance at BlackRock

Peter Haynes, CFA, Managing Director, Index Products, TD Securities Inc.

Steve Hawkins, President & Co-CEO, Horizons ETFs

Naseem Husain, Manager, ETF Capital Markets Specialist, RBC GAM

David LaValle, Managing Director, US Head of ETF Capital Markets, Global SPDR Business, State Street Global Advisors

Ronald C. Landry, MBA, CPA, CGA, CIBC Mellon

Joe Mahoney, Institutional Sales & Trading, Jane Street

David Mann, Head of ETF Capital Markets, Franklin Templeton Investments

Darren McKall, Manager, Investment Funds and Structured Products, Ontario Securities Commission

Tyler Mordy, CFA, President & CIO, Forstrong Global

John Reade, Chief Market Strategist, World Gold Council

Kevin Rusli, Partner, Blake, Cassels & Graydon LLP

Stacey Steinberg, VP, Exchange Traded Funds, Mackenzie Investments

Jonathan Sylvestre, Head, Business Strategy, Equities Trading, TMX Group

Joacim Wiklander, Chief Business Officer, NEO Exchange

Any questions regarding the ETFs Global Markets Roundtable can be directed to Deborah Fuhr at deborah.fuhr@etfgi.com

THANK YOU TO OUR SPONSORS, SPEAKERS AND ATTENDEES!

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 by Deborah Fuhr and partners in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs