ETFGI reports assets invested in ETFs and ETPs listed globally reached a record of US$5.25 trillion at the end of September 2018

LONDON — October 15, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that assets invested in ETFs and ETPs listed globally reached a new high of US$5.25 trillion, following net inflows of US$52.18 billion and market moves during September. The trend towards products providing exposure to the US continued, with equity based products tracking the core US indices seeing substantial inflows, according to ETFGI’s September 2018 Global ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets in ETFs and ETPs listed globally reached a record $5.25 Tn in September.

- Net new assets gathered by ETFs/ETPs listed globally were $52.18 Bn in September.

- 56th consecutive months of net inflows into ETFs/ETPs listed globally.

“Developed markets were broadly up during September following positive economic data from the US, Japan and Eurozone, despite the US-China trade dispute and on-going political tension in Europe. Developed Markets ex-US gained 0.68% during the month while the S&P 500’s winning streak tapered off, gaining only 0.57%, with mid to small cap US equities closing down. Developing markets downward trend continued, with EM markets down 1.37% and Frontier markets down 0.18%, bringing year to date declines to 8.08% and 7.56%, respectively.” according to Deborah Fuhr, managing partner and a founder of ETFGI.

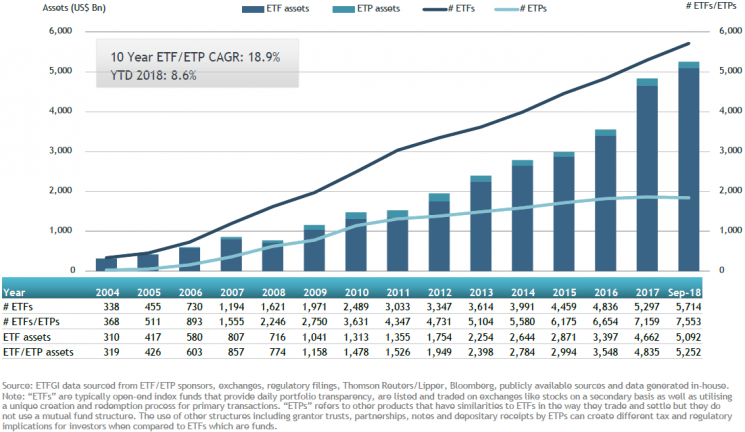

At the end of September 2018, the Global ETF/ETP industry had 7,553 ETFs/ETPs, with 14,643 listings, assets of $5.25 Tn, from 386 providers listed on 69 exchanges in 57 countries. Following net inflows of $52.18 and market moves during the month, assets invested in ETFs/ETPs listed globally increased by 0.44%, from $5.23 Tn in August 2018 to $5.25 Tn.

Growth in Global ETF and ETP assets as of the end of September 2018

Equity ETFs/ETPs listed globally attracted net inflows of $45.04 Bn in September, bringing net inflows for 2018 to $251.28 Bn, less than the $327.30 Bn in net inflows at this point last year. Fixed Income ETFs and ETPs listed globally gathered net inflows of $7.24 Bn in September, growing net inflows for 2018 to $74.10 Bn, considerably less than the $121.83 Bn in net inflows at this point last year.

September marked the 56th consecutive month of net inflows into ETFs/ETPs listed globally, Year-to-date in 2018 there have been net inflows of $351 Bn, less than the $483 Bn in net inflows at this point last year.

Substantial inflows during September can be attributed to the top 20 ETFs by net new assets, which collectively gathered $30.1 Bn. The SPDR S&P 500 ETF (SPY US) gathered $5.01 Bn, the largest net inflow in September.

Top 20 ETFs by net new assets September 2018: Global

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

279,360 |

16,975 |

(13,065) |

5,009 |

|

Vanguard S&P 500 ETF |

VOO US |

104,429 |

619 |

12,435 |

4,543 |

|

iShares Russell 2000 ETF |

IWM US |

49,840 |

2,664 |

3,172 |

2,490 |

|

TOPIX Exchange Traded Fund |

1306 JP |

77,349 |

32 |

17,033 |

2,472 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

9,182 |

891 |

2,639 |

1,652 |

|

Communication Services Select Sector SPDR Fund |

XLC US |

2,035 |

103 |

2,031 |

1,526 |

|

iShares Core MSCI EAFE ETF |

IEFA US |

59,977 |

399 |

19,911 |

1,202 |

|

Listed Index Fund TOPIX |

1308 JP |

34,144 |

6 |

6,521 |

1,201 |

|

Nikkei 225 Exchange Traded Fund |

1321 JP |

55,934 |

70 |

5,543 |

1,194 |

|

Vanguard Total Stock Market ETF |

VTI US |

105,500 |

297 |

5,974 |

1,147 |

|

Daiwa ETF TOPIX |

1305 JP |

36,915 |

4 |

8,507 |

1,072 |

|

Health Care Select Sector SPDR Fund |

XLV US |

19,632 |

577 |

672 |

861 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

71,267 |

299 |

5,494 |

823 |

|

First Trust NYSE Arca Biotechnology Index Fund |

FBT US |

3,122 |

85 |

1,519 |

782 |

|

iShares J.P. Morgan USD EM Bond ETF |

EMB US |

14,522 |

347 |

3,185 |

772 |

|

ChinaAMC China 50 ETF |

510050 CH |

6,014 |

234 |

842 |

709 |

|

Vanguard Mid-Cap ETF |

VO US |

25,308 |

54 |

1,990 |

682 |

|

iShares Broad USD Investment Grade Corp Bond ETF |

USIG US |

2,171 |

36 |

708 |

670 |

|

iShares iBoxx $ Investment Grade Corp Bond ETF |

LQD US |

33,955 |

675 |

(3,146) |

666 |

|

Listed Index Fund 225 |

1330 JP |

28,266 |

21 |

1,811 |

628 |

Similarly, the top 10 ETPs by net new assets collectively gathered $1.16 Bn by the end of September 2018.

Top 10 ETPs by net new assets September 2018: Global

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

VelocityShares Daily 3x Inverse Natural Gas ETN |

DGAZ US |

504 |

142 |

308 |

224 |

|

iPath S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,067 |

799 |

(188) |

167 |

|

iShares Gold Trust |

IAU US |

10,212 |

130 |

1,086 |

159 |

|

Invesco Gold ETC |

SGLD LN |

4,149 |

4 |

(137) |

140 |

|

SPDR Gold MiniShares Trust |

GLDM US |

229 |

13 |

210 |

117 |

|

VelocityShares 3x Inverse Crude Oil ETN |

DWT US |

220 |

50 |

171 |

90 |

|

Shinhan Investment K200 Enhanced Condor 4/10% ETN 39 |

500039 KS |

90 |

0 |

89 |

89 |

|

BNP Paribas RICI Enhanced BRENT Oil (TR) ETC |

BNQC GY |

96 |

0 |

80 |

80 |

|

iShares Silver Trust |

SLV US |

4,762 |

114 |

193 |

47 |

|

FI Enhanced Global High Yield ETN |

FIHD US |

1,530 |

3 |

377 |

46 |

Investors have tended to invest in core, market cap and lower cost ETFs in September.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Featured Events

Inside ETFs, 7th November – 8th November 2018

Hong Kong

ETFGI is pleased to partner with Inside ETFs for the upcoming conference in Hong Kong.

ETFGI clients receive a 20% discount off registration for the conference. Note the event is free for portfolio managers, financial advisors and the press. Please click here using the code ETFGI to receive the ETFGI discount

DAY 1, November 7

10:10 – 10:50 - Industry Leader Speak Out: Asia ETFs 2025

“HK and China ETF markets to grow fastest”, “APAC ETF assets to quadruple by 2025”, etc. These headlines in the news seem to be very positive. But what should we really keep an eye on? How can the investors enjoy the benefits of the growing market? Where is the market going next? Will smart-beta work in China and Pan-Asia?

Presenter

Deborah Fuhr, Managing Partner & Co-Founder, ETFGI

DAY 2, November 8

13:50 – 14:30 - Thematic investing: Pick the best products for handsome returns

The most successful ETF issuers and investors will help you identify the hottest themes that are about to take off across the world and disclose how to access them.

Which themes to invest in and how?

Discussing outperforming strategies

How can an investor separate a passing fad from a viable theme here to stay?

What will the trends be in the next three to five years?

Presenters:

Deborah Fuhr, Managing Partner & Co-Founder, ETFGI

Harvey Liu, Senior Portfolio Manager, Fountainhead Partner

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in 2012 by Deborah Fuhr and partners in London offering consulting services and paid for research subscription services. Our service is the only global offering of monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- New service: ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

- ETFGI ESG ETFs and ETPs Landscape report

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” a not for profit organization to connect, support and inspire Women and Men in the ETF ecosystem. WE has over 4,100 members in chapters around the world.

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs