ETFGI reports Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gather net inflows of US$1.06 Bn during October 2018

LONDON — November 27, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$1.06 Bn during October. Total assets invested ESG ETFs and ETPs fell 2.91% from US$22.5 Bn at the end of September, to US$21.85 Bn, according to ETFGI’s October 2018 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in ESG ETFs and ETPs listed globally fell 2.91% to $21.85 Bn by the end of October.

- ESG ETFs and ETPs listed globally gathered $1.06 Bn in net new assets during October.

- Year-to-date, ESG ETFs/ETPs assets have increased 25.9% compared to 2.5% for all ETFs/ETPs listed globally.

“Few markets managed to avoid the October sell off, as investors grew jittery at the prospects of further rate hikes from the US treasury and any hope of resolutions to trade disputes appeared to be diminishing, be it in Europe or the US. Developed and developing markets saw similar declines during the month. Aside from the US, where strong year-to-date performance cushioned the fall, October pushed many indices deeper into negative territory for the year. The S&P 500 fell 6.84% over the month, retaining a 3.1% gain year-to-date, while European markets fell 7.82%, bringing year-to-date decline to 9.56%. EM markets down 7.60% and Frontier markets down 3.36%, bringing year to date declines to 15.07% and 10.68%, respectively.” according to Deborah Fuhr, managing partner and a founder of ETFGI.

At the end of October 2018, there were 200 ESG classified ETFs/ETPs, with 447 listings, assets of $21.85 Bn, from 60 providers listed on 25 exchanges in 23 countries. Following net inflows of $1.06 Bn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally decreased by 2.91%, from $22.5 Bn at the end of September 2018, to $21.9 Bn.

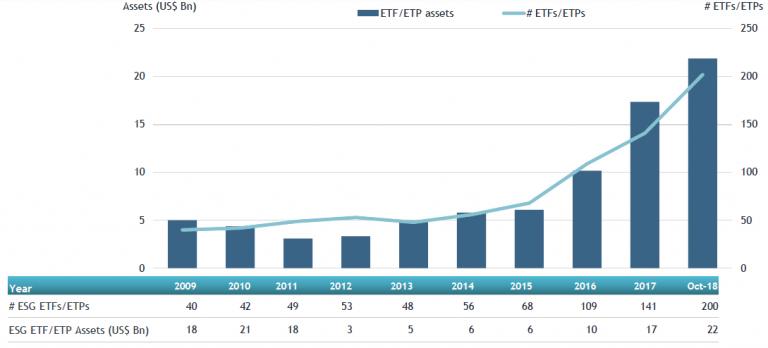

Global ESG ETF and ETP asset growth as at end of October 2018

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily, with 200 ESG ETFs/ETPs listed globally at the end of October. 62 new ESG ETFs/ETPs have launched during 2018, with 11 during October alone.

Substantial inflows during October can be attributed to the top 20 ESG ETFs/ETPs by net new assets, which collectively gathered $1.02 Bn. The BNP Paribas Easy Msci Europe SRI (SRIE FP) gathered $160 Mn, the largest net inflow in October.

Top 20 ESG ETFs/ETPs by net new assets October 2018

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

BNP Paribas Easy Msci Europe SRI |

SRIE FP |

209 |

0 |

216 |

160 |

|

Think Sustainable World UCITS ETF |

TSWE NA |

297 |

1 |

173 |

153 |

|

BNP Paribas Easy MSCI EM SRI UCITS ETF Cap |

EMSR FP |

147 |

0 |

111 |

100 |

|

iShares MSCI USA SRI UCITS ETF |

SUAS LN |

396 |

0 |

309 |

87 |

|

iShares MSCI EAFE ESG Optimized ETF |

ESGD US |

420 |

4 |

322 |

68 |

|

UBS ETF (LU) - MSCI EMU SRI UCITS ETF (EUR) A-dis |

UIMR GY |

683 |

1 |

280 |

58 |

|

BNP Paribas Easy Low Carbon 100 Europe UCITS ETF |

ECN FP |

427 |

0 |

262 |

58 |

|

iShares ESG US Aggregate Bond ETF |

EAGG US |

55 |

0 |

55 |

55 |

|

BNP Paribas MSCI Europe Small Caps ex Weap UCITS ETF |

EESM FP |

121 |

0 |

35 |

34 |

|

JPMorgan Glob Research Enhanced Equity UCITS ETF |

JREG LN |

28 |

0 |

29 |

29 |

|

iShares MSCI EMU ESG Screened UCITS ETF - Acc |

SAUM LN |

27 |

0 |

27 |

27 |

|

BNP Paribas Easy MSCI KLD 400 US SRI UCITS ETF |

EKLD FP |

55 |

0 |

53 |

24 |

|

iShares MSCI Europe SRI UCITS ETF |

IESE LN |

379 |

0 |

(17) |

23 |

|

Global X Adaptive US Factor ETF |

AUSF US |

78 |

1 |

52 |

23 |

|

iShares MSCI USA ESG Select ETF |

SUSA US |

753 |

3 |

114 |

22 |

|

SPDR SSGA Gender Diversity Index ETF |

SHE US |

357 |

1 |

(8) |

22 |

|

iShares MSCI EM ESG Optimized ETF |

ESGE US |

337 |

3 |

231 |

22 |

|

Vanguard ESG US Stock ETF |

ESGV US |

26 |

2 |

22 |

19 |

|

Amundi Index MSCI USA SRI UCITS ETF DR |

USRI FP |

28 |

0 |

30 |

18 |

|

iShares MSCI ACWI Low Carbon Target ETF |

CRBN US |

517 |

2 |

47 |

17 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

If you are interested in sponsorship or attending the 2019 ETFs Global Markets Roundtable conferences, please contact Deborah Fuhr at deborah.fuhr@etfgi.com

Schedule of Conferences - Specific Dates/Locations to be Announced Shortly

· EMEA (London) – Spring 2019

· US/Latin America (New York) – Spring 2019

· Latin America (Toronto) – Spring/Summer 2019

· APAC (Hong Kong) – Fall 2019

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honoured to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” a not for profit organization to connect, support and inspire Women and Men in the ETF ecosystem. WE has over 4,200 members in chapters around the world. www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Twitter: @deborahfuhr

LinkedIn: ETF Network

LinkedIn: Women In ETFs