ETFGI reports Environmental, Social, and Governance (ESG) ETFs and ETPS listed globally gather net inflows of US$856 Mn during November 2018

ETFGI reports Environmental, Social, and Governance (ESG) ETFs and ETPS listed globally gather net inflows of US$856 Mn during November 2018

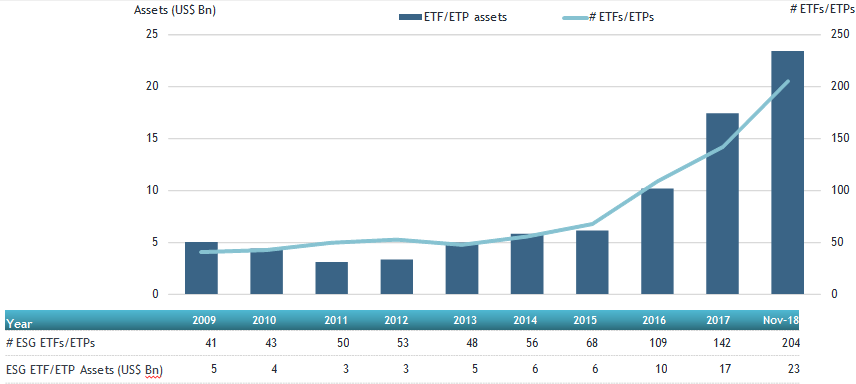

LONDON — December 27, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that Environmental, Social, and Governance (ESG) ETFs and ETPs listed globally gathered net inflows of US$856 Mn during November. Total assets invested ESG ETFs and ETPs increased by 6.64% from US$21.77 Bn at the end of October, to US$23.22 Bn, according to ETFGI’s November 2018 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in ESG ETFs and ETPs listed globally rose 6.64% to $23.22 Bn by the end of November.

- ESG ETFs and ETPs listed globally gathered $856 Mn in net new assets during November.

- Year-to-date, ESG ETFs/ETPs assets have increased 33.8% compared to 4.6% for all ETFs/ETPs listed globally.

“While trade talks continue to make noise in the headlines, the very real prospect of slowing global growth appears to be filtering into market sentiment. A seemingly more reposed approach to monetary policy along with the China-US trade truce provided enough of a tailwind to lift US markets to finish in the green by the end of November, with the S&P 500 gaining 2.04% over the month bringing the year-to-date gain to 5.11%. Apart from the Eurozone, where various domestic issues continue to dominate, most developed markets closed the month with marginal gains, the S&P developed ex-US BMI was up 0.17% in November with year-to-date declines of 9.66%. EM and Frontier markets bounced back from the October fall, finishing up 4.61% and 1.94% respectively, softening year-to-date declines to 11.15% and 8.95%” according to Deborah Fuhr, managing partner and a founder of ETFGI.

At the end of November 2018, there were 204 ESG classified ETFs/ETPs, with 473 listings, assets of $23.22 Bn, from 62 providers listed on 25 exchanges in 23 countries. Following net inflows of $856 Mn and market moves during the month, assets invested in ESG ETFs/ETPs listed globally increased by 6.64%, from $21.77 Bn at the end of October 2018, to $23.22 Bn.

Global ESG ETF and ETP asset growth as at end of November 2018

![]()

| Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily, with 205 ESG ETFs/ETPs listed globally at the end of November. 66 new ESG ETFs/ETPs have launched during 2018, with 4 during November alone. Substantial inflows during November can be attributed to the top 20 ESG ETFs/ETPs by net new assets, which collectively gathered $873 Mn in during November. The UBS ETF (LU) MSCI World Socially Responsible UCITS ETF (UIMM GY) gathered $140 Mn, the largest net inflow in November. Top 20 ESG ETFs/ETPs by net new assets November 2018

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services. ### Attribution Policy

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. |