ETFGI reports ETFs and ETPs listed in Canada gather net inflows of 1.74 billion US dollars during December 2018

LONDON — January 25, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Canada gathered net inflows of US$1.74 Bn during December, bringing 2018 net inflows to US$15.69 Bn. Assets invested in the Canadian ETF/ETP industry finished the month down 4.60%, from US$121 Bn at the end of November, to US$115 Bn, according to ETFGI’s December 2018 Canadian ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- During 2018, ETFs/ETPs listed in Canada attracted $15.69 Bn in net inflows.

- Assets invested in the Canadian ETF/ETP industry hit record highs of $131 Bn in August 2018.

- Assets invested in the Canadian ETF/ETP industry decreased 1.24% year-on-year.

“The end of 2018 saw the trend in developed markets reverse, and although arguably predictable, the severity left many pundits scratching their heads. This end of year stress has widely been attributed to the disruption caused by trade disputes feeding into economic data, and the view policy makers are not going to be quite as accommodating as initially expected. The S&P 500 returned -9.03% during December, and down -4.38% for 2018. Developed markets ex-US fell -4.62% during December, led by Japan and Canada, bringing the yearly return to -13.21%. Relatively speaking, EM and FM fared the month better, returning -2.68% and -3.15%, finishing 2018 -13.53% and -11.82%, respectively” according to Deborah Fuhr, managing partner and founder of ETFGI.

By the end of December 2018, the Canadian ETF/ETP industry had 662 ETFs/ETPs, a 14.39% increase over 2017, from 33 providers listed on 2 exchanges. Following net inflows of $1.74 Bn and market moves during the month, assets invested in Canadian listed ETFs/ETPs decreased by 4.60%, from $121 Bn at the end of November 2018, to $115 Bn. By the end of the year, assets invested in the Canadian ETF/ETP industry were down 1.24% compared to that of 2017, falling from $121 Bn to $117 Bn.

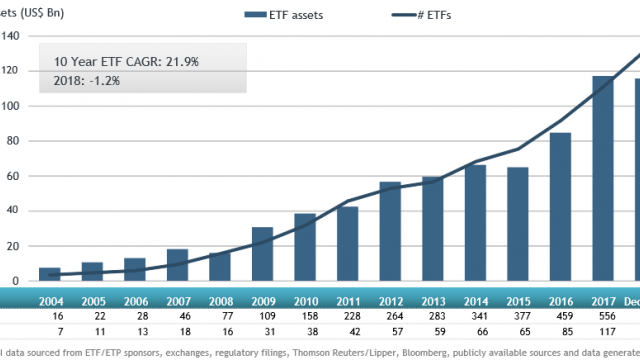

Growth in Canadian ETF and ETP assets as of the end of December 2018

Equity ETFs/ETPs listed in Canada saw net inflows of $752 Mn in December, bringing net inflows for 2018 to $7.83 Bn, less than the $8.87 Bn in inflows equity products attracted in 2017. Fixed Income ETFs and ETPs listed in Canada saw net inflows of $977 Mn in December, bringing net inflows for 2018 to $1.41 Bn, less than the $3.97 Bn in net inflows seen in 2017.

Substantial inflows during December can be attributed to the top 20 ETFs by net new assets, which collectively gathered $2.48 Bn. BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF (ZMU CN) gathered $581 Mn, the largest net inflow in December.

Top 20 ETFs by net new assets December 2018: Canada

|

Name |

Ticker |

Class Assets |

ADV |

NNA |

NNA |

|

BMO Mid-Term US IG Corporate Bond Hedged to CAD Index ETF |

ZMU CN |

795 |

29 |

420 |

581 |

|

BMO High Yield US Corporate Bond Hedged to CAD Index ETF |

ZHY CN |

729 |

29 |

446 |

480 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

3,113 |

39 |

379 |

283 |

|

iShares Core Canadian Universe Bond Index ETF |

XBB CN |

1,751 |

20 |

28 |

150 |

|

iShares S&P/TSX Capped Financials Index Fund |

XFN CN |

768 |

23 |

2 |

110 |

|

BMO S&P 500 Index ETF |

ZSP CN |

3,563 |

16 |

590 |

89 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

1,475 |

8 |

481 |

79 |

|

iShares S&P/TSX Capped Energy Index ETF |

XEG CN |

587 |

28 |

8 |

75 |

|

BMO S&P/TSX Capped Composite Index ETF |

ZCN CN |

2,838 |

15 |

881 |

73 |

|

iShares Canadian Corporate Bond Index Fund |

XCB CN |

1,192 |

9 |

(122) |

71 |

|

iShares Core MSCI All Country World ex Canada Index ETF |

XAW CN |

610 |

4 |

310 |

69 |

|

BMO S&P 500 Hedged To CAD Index ETF |

ZUE CN |

840 |

5 |

133 |

67 |

|

RBC Target 2024 Corporate Bond Index Etf |

RQL CN |

54 |

3 |

54 |

53 |

|

iShares Canadian Select Dividend Index ETF |

XDV CN |

951 |

7 |

(3) |

49 |

|

Vanguard FTSE Canada All Cap Index ETF |

VCN CN |

1,154 |

9 |

476 |

48 |

|

iShares Premium Money Market Fund |

CMR CN |

252 |

5 |

181 |

46 |

|

Mackenzie US Investment Grade Corporate Bond Index ETF CAD-Hedged |

QUIG CN |

174 |

2 |

182 |

41 |

|

PIMCO Monthly Income Fund |

PMIF CN |

585 |

5 |

414 |

39 |

|

iShares Edge MSCI Multifactor Canada Index ETF |

XFC CN |

63 |

2 |

50 |

38 |

|

iShares S&P/TSX SmallCap Index Fund |

XCS CN |

117 |

2 |

29 |

38 |

Investors have tended to invest in core, fixed income, market cap and lower cost ETFs in December.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

New Service: ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 4,500 members, including women and men, in chapters in major financial centres around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr on Linkedin and twitter:

ETFGI on Linkedin and twitter:

ETF Network on Linkedin:

Women in ETFs Linkedin (group and company) and twitter: