ETFGI reports ETFs and ETPs listed in the US gather net inflows of 51.4 billion US dollars during December 2018

LONDON — January 25, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in the US gathered net inflows of US$51.4 Bn during December, bringing 2018 net inflows to US$315 Bn. Assets invested in the US ETF/ETP industry finished the month down 5.59%, from US$3.59 Tn at the end of November, to US$3.39 Tn, according to ETFGI’s December 2018 US ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- During 2018, ETFs/ETPs listed in the US attracted $315 Bn in net inflows.

- Assets invested in the US ETF/ETP industry hit record high of $3.73 Tn in September 2018.

- Assets invested in US ETF/ETP industry fell 0.95% year-on-year, hit by Q4 2018 market movements

“The end of 2018 saw the trend in developed markets reverse, and although arguably predictable, the severity left many pundits scratching their heads. This end of year stress has widely been attributed to the disruption caused by trade disputes feeding into economic data, and the view policy makers are not going to be quite as accommodating as initially expected. The S&P 500 returned -9.03% during December, and down -4.38% for 2018. Developed markets ex-US fell -4.62% during December, led by Japan and Canada, bringing the yearly return to -13.21%. Relatively speaking, EM and FM fared the month better, returning -2.68% and -3.15%, finishing 2018 -13.53% and -11.82%, respectively” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of December 2018, the US ETF/ETP industry had 2,241 ETFs/ETPs, a 5.91% increase over 2017, from 148 providers listed on 3 exchanges. Following net inflows of $51.4 Bn and market moves during the month, assets invested in ETFs/ETPs listed in the US decreased by 5.59%, from $3.59 Tn at the end of November 2018, to $3.39 Tn. By the end of the year, assets invested in the US ETF/ETP industry were down 0.95% compared to that of 2017, falling from $3.42 Tn to $3.59 Tn.

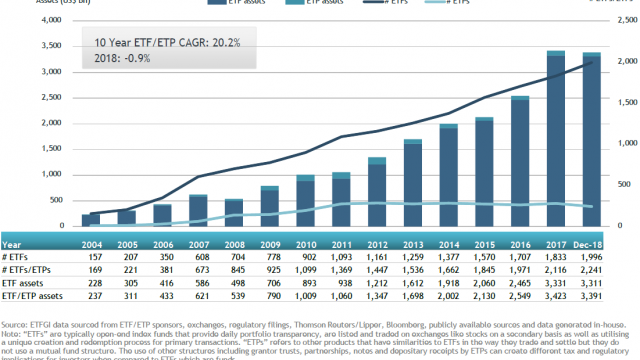

Growth in US ETF and ETP assets as of the end of December 2018

Equity ETFs/ETPs listed in the US attracted net inflows of $34.8 Bn in December, bringing net inflows for 2018 to $208 Bn, less than the $332 Bn in net inflows equity products attracted in 2017. Fixed Income ETFs and ETPs listed in the US saw net outflows of $14.1 Bn in December, bringing net inflows for 2018 to $75 Bn, less than the $114 Bn in net inflows seen in 2017.

Substantial inflows during December can be attributed to the top 20 ETFs by net new assets, which collectively gathered $38.3 Bn. The iShares 1-3 Year Treasury Bond ETF (SHY US) gathered $3.36 Bn, the largest net inflow in December.

Top 20 ETFs by net new assets December 2018: US

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

iShares 1-3 Year Treasury Bond ETF |

SHY US |

20,624 |

431 |

9,288 |

3,357 |

|

iShares Short Treasury Bond ETF |

SHV US |

20,690 |

346 |

12,672 |

3,340 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

57,078 |

751 |

5,559 |

2,669 |

|

iShares Russell 1000 Value ETF |

IWD US |

37,631 |

740 |

581 |

2,544 |

|

iShares Core S&P 500 ETF |

IVV US |

147,540 |

2,061 |

18,592 |

2,470 |

|

Vanguard Short-Term Bond ETF |

BSV US |

27,945 |

311 |

4,149 |

2,332 |

|

iShares Russell 1000 ETF |

IWB US |

17,920 |

436 |

(1,483) |

2,205 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

65,145 |

1,347 |

9,639 |

2,080 |

|

Vanguard Total Stock Market ETF |

VTI US |

93,577 |

939 |

9,848 |

1,987 |

|

iShares MSCI ACWI ETF |

ACWI US |

10,604 |

543 |

2,897 |

1,931 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

8,668 |

197 |

6,724 |

1,696 |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

18,997 |

378 |

4,223 |

1,638 |

|

iShares MSCI ACWI ex U.S. ETF |

ACWX US |

4,783 |

231 |

2,098 |

1,466 |

|

iShares MSCI EAFE ETF |

EFA US |

62,059 |

3,386 |

(10,621) |

1,419 |

|

SPDR S&P Dividend ETF |

SDY US |

16,356 |

169 |

836 |

1,309 |

|

iShares National Muni Bond ETF |

MUB US |

11,862 |

203 |

2,433 |

1,213 |

|

Vanguard Value ETF |

VTV US |

41,408 |

364 |

8,404 |

1,167 |

|

Invesco QQQ Trust |

QQQ US |

61,146 |

10,455 |

4,409 |

1,156 |

|

JPMorgan BetaBuilders Europe ETF |

BBEU US |

2,549 |

72 |

2,721 |

1,145 |

|

iShares Core MSCI Emerging Markets ETF |

IEMG US |

49,202 |

1,402 |

15,738 |

1,142 |

Similarly, the top 10 ETPs by net new assets collectively gathered $2.10 Bn by the end of December 2018.

Top 10 ETPs by net new assets December 2018: US

|

Name |

Ticker |

Assets |

ADV |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

31,518 |

1,010 |

(1,815) |

1,057 |

|

iShares Gold Trust |

IAU US |

11,545 |

158 |

1,599 |

345 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

393 |

130 |

514 |

224 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

351 |

64 |

(45) |

92 |

|

United States Oil Fund LP |

USO US |

1,473 |

338 |

(273) |

75 |

|

SPDR Gold MiniShares Trust |

GLDM US |

397 |

7 |

355 |

72 |

|

FI Enhanced Global High Yield ETN |

FIHD US |

1,391 |

6 |

528 |

70 |

|

United States Natural Gas Fund LP |

UNG US |

292 |

137 |

(443) |

68 |

|

iShares S&P GSCI Commodity-Indexed Trust |

GSG US |

1,210 |

14 |

7 |

58 |

|

Invesco CurrencyShares Euro Currency Trust |

FXE US |

317 |

31 |

66 |

44 |

Investors have tended to invest in core, market cap, fixed income and lower cost ETFs in December.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, co-founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

New Service: ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2018

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 4,500 members, including women and men, in chapters in major financial centres around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr on Linkedin and twitter:

ETFGI on Linkedin and twitter:

ETF Network on Linkedin:

Women in ETFs Linkedin (group and company) and twitter: