ETFGI reports ETFs and ETPs listed in Europe gather US$9.79 billion during January 2019

Press release

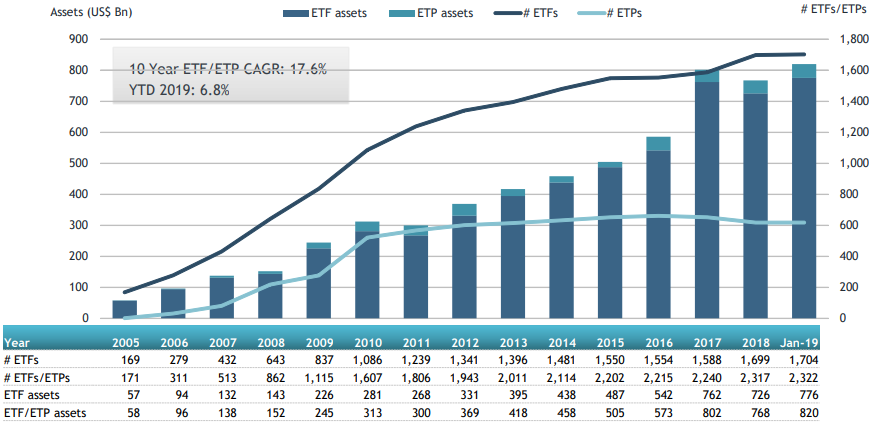

LONDON — February 20, 2019 - ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$US$9.79 billion in January. Assets invested in the European ETF/ETP industry finished the month up 6.83%, from US$767.78 billion at the end of December, to US$820.23 billion, according to ETFGI's January 2019 European ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the European ETF/ETP industry rise 6.83% in January.

- During January 2019, ETFs/ETPs listed in Europe attracted US$9.79 Bn in net inflows.

- 52nd consecutive month of net inflows into ETFs/ETPs listed in Europe.

“In January, equity markets rebounded from Q4 when global equities suffered steep declines amid persistent worries over trade and economic growth. Fed chair Powell revised his stance on where he believes the neutral rate of interest lies, easing fears of a dramatic and painful tightening cycle. Energy’s decline during the Q4 rout subdued inflation in developed economies taking hiking pressure off central banks while provided stimulus to consumers and businesses, giving stronger core metrics. The S&P 500 finished January up 8.01%, the best January since 1987, while the S&P Topix 150 gained 7.26% and the S&P Europe 350 gained 6.23%. Emerging and Frontier markets were up 7.77% and 4.61% respectively, hampered by dollar strength.” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of January 2019, the European ETF/ETP industry had 2,322 ETFs/ETPs, from 70 providers listed on 28 exchanges. Following net inflows of $9.79 Bn and market moves during the month, assets invested in the European ETF/ETP industry increased by 6.83% from $767.78 Bn at the end of December, to $820.23 Bn.

Growth in European ETF and ETP assets as of the end of January 2019

Equity ETFs/ETPs listed in Europe attracted net inflows of $1.91 Bn in January, bringing net inflows for 2019 to $1.91 Bn, less than the $13.98 Bn in net inflows equity products had attracted by the end of January 2018. Fixed income ETFs/ETPs listed in Europe attracted net inflows of $6.82 Bn in January, bringing net inflows for 2019 to $6.82 Bn, considerably greater than the $1.73 Bn in net inflows fixed income products had attracted by the end of January 2018.

Substantial inflows can be attributed to the top 20 ETFs/ETPs's by net new assets, which collectively gathered $8.50 Bn in January, the PIMCO US Dollar Short Maturity ETF (MINT LN) gathered $735.99 Mn alone.

Top 20 ETFs/ETPs by net new assets January 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3,153 |

736 |

736 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

7,639 |

693 |

693 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

7,224 |

662 |

662 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

JPEA LN |

978 |

600 |

600 |

|

iShares Core MSCI EM IMI UCITS ETF |

EMIM LN |

11,909 |

597 |

597 |

|

UBS ETF-MSCI Japan UCITS ETF (JPY) - Acc |

JPNA SW |

913 |

574 |

574 |

|

iShares Core FTSE 100 UCITS ETF |

ISF LN |

7,870 |

453 |

453 |

|

iShares Edge MSCI EM Minimum Volatility UCITS ETF |

EMMV LN |

1,063 |

420 |

420 |

|

ETFS Physical Gold |

PHAU LN |

7,292 |

406 |

406 |

|

Invesco US Treasury 7-10 Year UCITS ETF GBP Hdg Dist |

TRXS LN |

396 |

390 |

390 |

|

XACT Nordic High Dividend Low Volatility UCITS ETF |

XACTHDIV SS |

713 |

382 |

382 |

|

Xetra Gold EUR |

4GLD GY |

8,050 |

337 |

337 |

|

iShares € Ultrashort Bond UCITS ETF |

ERNE LN |

3,061 |

316 |

316 |

|

Xtrackers II USD Emerging Markets Bond UCITS ETF |

XUEM GY |

763 |

316 |

316 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

8,805 |

303 |

303 |

|

Xtrackers II Eurozone Government Bond UCITS ETF DR |

XGLE GY |

3,139 |

280 |

280 |

|

Invesco S&P 500 ETF |

SPXS LN |

4,268 |

272 |

272 |

|

iShares Global Govt Bond UCITS ETF |

SGLO LN |

1,221 |

268 |

268 |

|

Xtrackers MSCI USA Financials Index UCITS ETF DR |

XUFN GY |

259 |

248 |

248 |

|

AMUNDI ETF MSCI Emerging Markets - B |

AUEM FP |

2,931 |

246 |

246 |

Investors tended to invest in international Fixed income products.

Investors tended to invest in international Fixed income products.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

2019 ETFs Global Markets Roundtable events

2019 ETFs Global Markets Roundtable events

We are excited to announce that registrations are open for the 2019 series of the ETFs Global Markets Roundtables in New York on May 21, London on June 12, Toronto on Sept 24 and Hong Kong in Oct 2019 at www.etfsglobalmarkets.com

The events were created by Ari Burstein, President, Capital Markets Strategies and Deborah Fuhr, Managing Partner and Founder, ETFGI. The first conference was held in 2017 in New York and expanded in 2018 to 4 events in New York, London, Toronto, and Hong Kong.

The events are designed to be interesting, educational, engaging and relevant forums for substantive discussion of capital markets, business, technological and regulatory developments in the markets impacting ETFs in the respective jurisdictions.

Qualified traders, portfolio managers, Chief Investment officers, ETF strategists, fund selectors at family offices, pension funds, insurance companies, hedge funds, asset managers, endowments, foundations, financial advisors, robos, wire houses and online brokerage firms can register to attend at no cost at www.etfsglobalmarkets.com

The schedule for the events is:

· US/Latin America (New York) – May 21, 2019, Metropolitan Club, New York

· EMEA (London) – June 12, 2019, The Waldorf Hilton, London

· Canada (Toronto) – September 24, 2019, Vantage Venues, Toronto

· APAC (Hong Kong) – October 2019– Specific Date to be Announced Shortly

Please contact us if you have any questions or are interested in discussing sponsorship and speaking opportunities.

We look forward to seeing you at one of our events.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

New Service: ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2019

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include she was the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 4,500 members, including women and men, in chapters in major financial centres around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr on Linkedin and twitter: ![]()

![]()

ETFGI on Linkedin and twitter: ![]()

![]()

ETF Network on Linkedin: ![]()

Women in ETFs Linkedin (group and company) and twitter: ![]()

![]()