ETFGI reports assets invested in the European ETF and ETP industry reached a record US$882.20 billion at the end of April 2019

LONDON — May 29, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$3.95 billion in April, bringing year-to-date net inflows to US$35.54 billion. Assets invested in the European ETF/ETP industry finished the month up 2.60%, from US$859.51 billion at the end of March to US$882.20 billion, according to ETFGI's April 2019 European ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the European ETF/ETP industry reach $882.20 Bn in April 2019, the highest on record.

- 55th consecutive month of net inflows into ETFs/ETPs listed in Europe.

- April 11th marked the 19th Anniversary of the listing of the first ETFs in Europe.

- Assets invested in the European ETF/ETP industry have risen 14.9% year-to-date.

“Markets appear to have returned to the relative calm they had grown accustomed to over the past few years. Returns for developed indices were higher in April compared to March. The S&P 500 finished April up 4.05%, with year-to-date returns of 13.7%, marking its best quarter since ‘09. The S&P Europe 350 fell -1.42% in March, as economic data from the region continues to send mixed signals, bringing year-to-date returns to 11.85%. The Topix 150 in Japan was up 1.14% in April, bringing year-to-date returns of 3.77%. Emerging & Frontier returns continued to outpace developed markets. The S&P Emerging BMI and Frontier BMI finished March up 1.11% and -0.87%%, bringing year to date returns to 6.12% and 9.87%, respectively.” according to Deborah Fuhr, managing partner and founder of ETFGI.

At the end of April 2019, the European ETF/ETP industry had 2,330 ETFs/ETPs, from 69 providers listed on 29 exchanges. Following net inflows of $3.95 Bn and market moves during the month, assets invested in the European ETF/ETP industry increased by 2.60% from $859.51 Bn at the end of March, to $882.20 Bn.

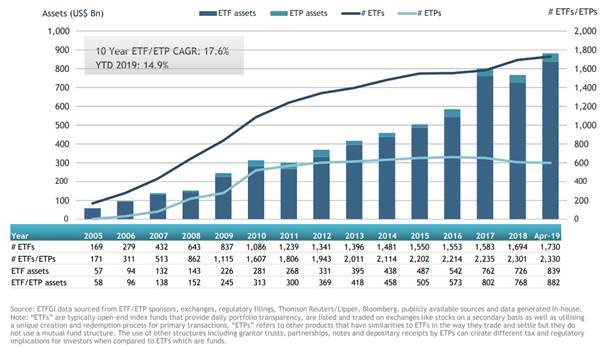

Growth in European ETF and ETP assets as of the end of April 2019

Equity ETFs/ETPs listed in Europe saw net outflows of $726.00 Mn in April, bringing net inflows for 2019 to $9.45 Bn, substantially less than the $21.27 Bn in net inflows equity products had attracted by the end of April 2018. Fixed income ETFs/ETPs listed in Europe attracted net inflows of $4.42 Bn in April, bringing net inflows for 2019 to $24.24 Bn, considerably greater than the $4.94 Bn in net inflows fixed income products had attracted by the end of April 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $8.21 Bn in April, the iShares € High Yield Corp Bond UCITS ETF gathered $836.85 Mn alone.

Top 20 ETFs by net new assets April 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

7,586.52 |

1,911.14 |

836.85 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

9,766.41 |

3,062.44 |

777.95 |

|

AMUNDI ETF S&P 500 UCITS ETF USD D |

500USD SW |

2,137.25 |

616.14 |

625.96 |

|

AMUNDI ETF S&P 500 UCITS ETF EUR C |

500 FP |

2,797.69 |

618.32 |

513.14 |

|

Xtrackers MSCI Europe Index UCITS ETF (DR) - 1D |

XIEE GY |

1,218.67 |

482.06 |

447.39 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

17,577.09 |

1,351.43 |

430.71 |

|

iShares Edge MSCI USA Quality Factor UCITS ETF |

IUQA LN |

1,058.91 |

909.93 |

430.20 |

|

Amundi Index MSCI Emerging Markets UCITS ETF DR |

AEME FP |

2,045.68 |

871.44 |

418.29 |

|

iShares MSCI Europe UCITS ETF EUR (Dist) |

IMEU LN |

5,724.31 |

388.87 |

396.05 |

|

Xtrackers MSCI Emerging Markets Index UCITS ETF |

XMME GY |

1,982.98 |

618.61 |

383.31 |

|

Invesco MSCI Saudi Arabia UCITS ETF |

MSAU LN |

718.96 |

521.51 |

351.16 |

|

Xtrackers S&P 500 Swap UCITS ETF |

D5BM GY |

5,575.98 |

725.52 |

333.16 |

|

Invesco S&P 500 ETF |

SPXS LN |

5,267.65 |

847.22 |

314.66 |

|

iShares MSCI EMU UCITS ETF |

CSEMU SW |

2,083.71 |

129.30 |

306.29 |

|

iShares Core MSCI EM IMI UCITS ETF |

EMIM LN |

13,301.45 |

1,578.59 |

305.69 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

10,899.83 |

2,326.37 |

300.73 |

|

iShares NASDAQ 100 UCITS ETF |

CSNDX SW |

3,305.64 |

663.02 |

290.20 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3,404.44 |

979.71 |

256.89 |

|

Deka DAX UCITS ETF |

ETFDAX GY |

2,339.54 |

144.42 |

246.26 |

|

iShares $ Treasury Bond 1-3yr UCITS ETF |

IBTA LN |

1,701.25 |

668.45 |

240.90 |

|

|

The top 10 ETP's by net new assets collectively gathered $732.17 Mn in April, the Invesco Gold ETC gathered $336.57 Mn alone.

Top 10 ETPs by net new assets April 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Invesco Gold ETC |

SGLD LN |

5,455.74 |

522.93 |

336.57 |

|

Xtrackers Energy Booster Euro Hedged ETC |

XCTH GY |

136.16 |

133.46 |

132.20 |

|

ETFS Copper |

COPA LN |

246.13 |

60.04 |

72.31 |

|

ETFS Industrial Metals DJ-UBSCISM |

AIGI LN |

384.30 |

187.32 |

42.37 |

|

ETFS Nickel |

NICK LN |

533.45 |

57.80 |

41.42 |

|

Xtrackers Physical Gold ETC (EUR) |

XAD5 GY |

2,452.49 |

(83.10) |

26.74 |

|

ETFS Physical Platinum |

PHPT LN |

309.32 |

62.63 |

22.41 |

|

ETFS EUR Daily Hedged Industrial Metals |

EIMT IM |

24.30 |

18.81 |

21.34 |

|

Xetra Gold EUR |

4GLD GY |

7,962.75 |

472.08 |

19.28 |

|

ETFS Coffee |

COFF LN |

111.62 |

47.65 |

17.53 |

Investors have tended to invest in fixed income ETFs in April.

2019 ETFs Global Markets Roundtable events

Register to join us in London on June12, 2019, The Waldorf Hilton, London, Additional speakers announced for the 2nd annual ETFs Global Markets Roundtable

The conference, which is free for most on the buyside(IFAs, asset managers, asset owners) and qualified press, will include industry leaders from ETF issuers, market makers, exchanges, law firms andothers. Panels will examine the latest regulatory developments, how ETFSare being used by discretionary fund managers, advisors and institutional investors, trading and market structure issues, the active/passive debate and using algosand RFQ platforms to trade ETFs. Click here to register

Speakers will include:

- Keynote: Tilman Lueder, Head of the Securities Markets Unit in DG FISMA

- Fireside Chat: Dan Draper, Managing Director and Global Head of Exchange Traded Funds, Unit Investment Trusts and Closed-End Funds at Invesco Ltd.

- Kevin Gopaul, Global Head of Exchange Traded Funds (ETFs), CEO & Country Head - Canada for BMO Global Asset Management U.S.

- Rory Tobin, EVP, Chairman of SSGA EMEA, Head of Global SPDR Business

- Ari Burstein, President, Capital Markets Strategies

- Shaun Baskett, Director, Index Sales, Cboe Europe

- Tom Digby, Head of EMEA ETF Client Trading, Invesco

- Anna Driggs, Director & Associate Chief Counsel, Global Funds Policy, Investment Company Institute/ICI Global

- Deborah Fuhr, Managing Partner andFounder, ETFGI

- Ivan Gilmore is Head of Exchange Traded Products & Global Product Development at London Stock Exchange Plc.

- Ben Grouse, Vice President, COO & Strategy - ETF & Index Investments, BlackRock

- Tara O'Reilly, Partner, Arthur Cox

- Adriano Pace, MangingDirector, Head of Equities, Tradeweb

- Isabell Moessler, ETF Business Development Manager, Markets & Global Sales, Euronext

- Frank Spiteri, Head of European Distribution, WisdomTree

- Jason Xavier, Head EMEA ETF Capital Markets, Franklin Templeton

Register to join us in Toronto on September 24, 2019, Vantage Venues, Toronto and Hong Kong in Oct 2019. The draft agendas are further information on the events are available at www.etfsglobalmarkets.com

The events were created by Ari Burstein, President, Capital Markets Strategies and Deborah Fuhr, Managing Partner and Founder, ETFGI. The first conference was held in 2017 in New York and expanded in 2018 to 4 events in New York, London, Toronto, and Hong Kong.

The events are designed to be interesting, educational, engaging and relevant forums for substantive discussion of capital markets, business, technological and regulatory developments in the markets impacting ETFs in the respective jurisdictions.

Qualified traders, portfolio managers, Chief Investment officers, ETF strategists, fund selectors at family offices, pension funds, insurance companies, hedge funds, asset managers, endowments, foundations, financial advisors, robos, wire housesandonline brokerage firms can register to attend at no cost at www.etfsglobalmarkets.com

Please contact us if you have any questions or are interested in discussing sponsorship and speaking opportunities.

We look forward to seeing you at one of our events.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research and consultancy firm launched in London offering consulting services and paid for research subscription services covering the global ETF industry. Deborah Fuhr is the Managing Partner and a founder of ETFGI. Our services are unique in their breadth and depth of coverage in monthly reports covering each region of the world where ETFs, ETPs are listed, a monthly directory and monthly fact sheets along with a database covering all global products plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

New Service: ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Basic Global ETFs and ETPs research service

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFs Global Markets Roundtable events 2019

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 4,700 members, including women and men, in chapters in major financial centres around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr on Linkedin and twitter:

ETFGI on Linkedin and twitter:

ETF Network on Linkedin:

Women in ETFs Linkedin (group and company) and twitter: