ETFGI reports assets invested in ETFs and ETPs listed in Europe reach an all-time high of US$ 910.34 US dollars at the end of July 2019

LONDON — August 14, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$18.55 billion in July, bringing year-to-date net inflows to US$62.74 billion. Assets invested in the European ETF/ETP industry have increased by 1.1%, from US$900.66 billion at the end of June, to US$910.34 billion, according to ETFGI's July 2019 European ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

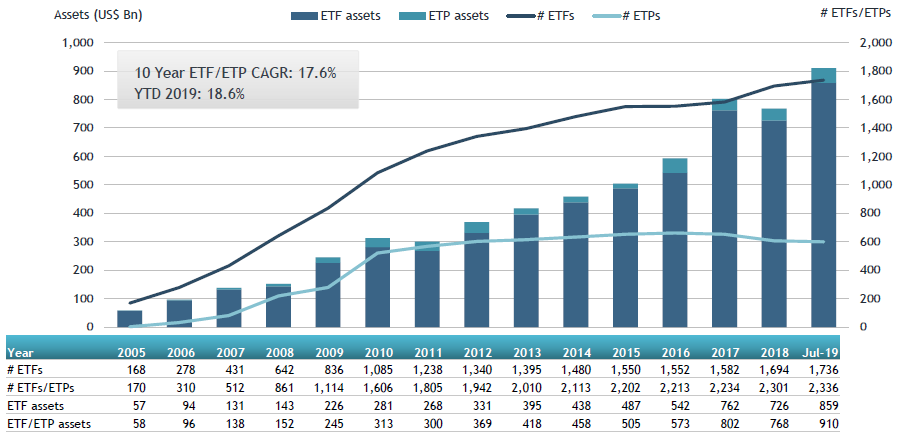

At the end of July 2019, the European ETF/ETP industry had 2,336 ETFs/ETPs, from 68 providers listed on 30 exchanges in 23 countries.

Highlights

• Assets invested in the European ETF/ETP industry reach an all-time high of $910.34 Bn.

• July marks the 58th consecutive month of flows into European listed products.

• Assets invested in the European ETF/ETP industry increased by 1.1% in July.

• During July 2019, ETFs/ETPs listed in Europe saw $18.55 Bn in net inflows.

“Despite the weak performance for European equity markets and the intensified trade dispute between US/China, the prospects for further loosening in monetary policy by FED and ECB led the European Equity ETF/ETPs to see significant inflows of US$9.97 Bn in July, and Fixed Income funds see net inflows of US$6.57 Bn” , according to Deborah Fuhr, managing partner and founder of ETFGI.

Europe ETF and ETP asset growth as at the end of July 2019

Equity ETFs/ETPs listed in Europe saw considerable net inflows of $9.97 Bn in July 2019, bringing net inflows for 2019 to $16.67 Bn, substantially less than the $24.51 Bn in net inflows equity products had attracted by the end of July 2018. Fixed income ETFs/ETPs listed in Europe attracted net inflows of $6.57 Bn in July, bringing net inflows for 2019 to $38.33 Bn, considerably greater than the

$8.48 Bn in net inflows fixed income products had attracted by the end of July 2018.

Substantial inflows can be attributed to the top 20 ETF’s by net new assets, which collectively gathered $13.35 Bn in July, the UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc (ACWIU SW) gathered $1.54 Bn alone.

Top 20 ETFs by net new assets July 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

ACWIU SW |

2304.62 |

1,364.95 |

1538.42 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to CHF) A-acc |

ACWIS SW |

1917.61 |

1,179.75 |

1373.46 |

|

iShares € High Yield Corp Bond UCITS ETF |

IHYG LN |

9483.22 |

3,856.16 |

1309.72 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to EUR) A-acc |

ACWIE SW |

2047.33 |

1,117.24 |

1191.86 |

|

iShares Core € Corp Bond UCITS ETF |

IEBC LN |

13403.46 |

4,758.32 |

1152.99 |

|

Invesco MSCI Saudi Arabia UCITS ETF |

MSAU LN |

2364.61 |

2,255.20 |

1150.49 |

|

iShares USD Treasury Bond 0-1yr UCITS ETF - Acc |

IB01 LN |

1525.44 |

1,523.15 |

1106.56 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF |

SEMB LN |

8895.35 |

1,956.27 |

742.81 |

|

iShares STOXX Europe 600 UCITS ETF (DE) |

SXXPIEX GY |

6637.08 |

(91.62) |

578.17 |

|

PIMCO Euro Short Maturity ETF |

PJS1 GY |

2689.77 |

250.62 |

412.29 |

|

iShares S&P 500 UCITS ETF |

IUSA LN |

9339.63 |

285.00 |

334.18 |

|

Invesco US Treasury 7-10 Year UCITS ETF GBP Hdg Dist |

TRXS LN |

1363.47 |

1,398.60 |

332.48 |

|

iShares Core MSCI World UCITS ETF |

IWDA LN |

18430.22 |

2,027.34 |

331.21 |

|

iShares $ High Yield Corp Bond UCITS ETF |

IHYU LN |

3437.67 |

726.11 |

321.44 |

|

iShares $ Corp Bond UCITS ETF |

LQDE LN |

4937.17 |

(594.71) |

270.31 |

|

Xtrackers Equity Low Beta Factor UCITS ETF (DR) - 1C |

XDEB GY |

425.97 |

265.32 |

258.13 |

|

iShares EURO STOXX 50 UCITS ETF |

EUN2 GY |

4495.17 |

(638.95) |

244.94 |

|

AMUNDI ETF S&P 500 UCITS ETF USD D |

500USD SW |

2217.62 |

665.56 |

235.22 |

|

iShares S&P 500 Health Care Sector UCITS ETF |

IHCU LN |

1348.90 |

159.30 |

232.95 |

|

iShares MSCI Europe ex-UK UCITS ETF |

IEUX LN |

1609.33 |

(621.07) |

231.02 |

Top 10 ETPs by net new assets July 2019: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ETFS Physical Silver |

PHAG LN |

1225.55 |

374.47 |

318.32 |

|

iShares Physical Gold ETC |

SGLN LN |

5821.02 |

983.71 |

233.29 |

|

ETFS Brent Crude |

BRNT LN |

316.69 |

22.47 |

223.79 |

|

Amundi Physical Metals PLC |

GOLD FP |

491.15 |

470.42 |

165.13 |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

2191.95 |

206.37 |

155.42 |

|

Xtrackers Physical Silver ETC (EUR) |

XAD6 GY |

319.70 |

196.29 |

135.39 |

|

Xtrackers Physical Gold ETC (EUR) |

XAD5 GY |

3013.86 |

198.02 |

130.87 |

|

ETFS Physical Swiss Gold |

SGBS LN |

2134.19 |

1,222.57 |

125.79 |

|

GBS Bullion Securities |

GBS LN |

3596.78 |

(64.91) |

58.76 |

|

ETFS Physical Platinum |

PHPT LN |

333.38 |

91.11 |

23.74 |

Investors have tended to invest in Equity and Fixed Income ETFs/ETPs in July.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Please Vote - Voting for the ETF Express 2019 USA Awards is now open. The survey is designed to assess the best ETF providers, exchanges, research providers etc. during May 2018 to May 2019. We are hoping that you would consider giving ETFGI your support by nominating ETFGI in the “Best ETF Research Provider" category - #24 by Voting Here. The team at ETFGI thank you for your support.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research, event and consultancy firm launched in 2012 in London by Deborah Fuhr. The firm offers paid for subscription research services, consulting services and events covering trends in the global ETF industry. ETFGI’s services are unique in their breadth and depth of coverage starting with the basic annual subscription service which provides monthly Global Industry Insight Landscape reports covering flows, trends and rankings in each region of the world where ETFs, ETPs are listed, a monthly directory and access to a database with fact sheets for all products listed and cross listed globally plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com)

- ETFGI Global ETFs Insights events 2020

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs.

Go to www.ETFtv.net to view

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,000 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV