ETFGI reports assets invested in the US ETFs and ETPs industry broke through the US$4 trillion milestone at the end of July 2019

LONDON — August 16, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that assets invested in the US ETFs and ETPs industry broke through the US$4 trillion milestone at the end of July. ETFs and ETPs listed in US gathered net inflows of US$33.90 billion in July, bringing year-to-date net inflows to US$149.76 billion. Assets invested in the US ETF/ETP industry have increased by 1.6%, from US$3.96 trillion at the end of June, to a new record of US$4.02 trillion, according to ETFGI's July 2019 US ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the US ETFs/ETPs industry reached break through the $4 Trillion milestone.

- Asset invested in the US ETFs/ETPs industry increased 1.6% in July.

- July 2019, ETFs/ETPs listed in US gathered $33.90 Bn in net inflows.

“The S&P 500® gained 1.4% in July, as strong earnings combined with signs of economic growth and expectations of a rate cut by the Federal Reserve supported equity gains. International markets posted losses, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both down 1%, with headwinds including U.S. dollar strength. Boris Johnson began his term as U.K. Prime Minister with demands for a renegotiation of the E.U. withdrawal agreement, issuing a threat to otherwise leave without one. Pound sterling fell to near its lowest in two years. according to Deborah Fuhr, managing partner, founder and owner of ETFGI.

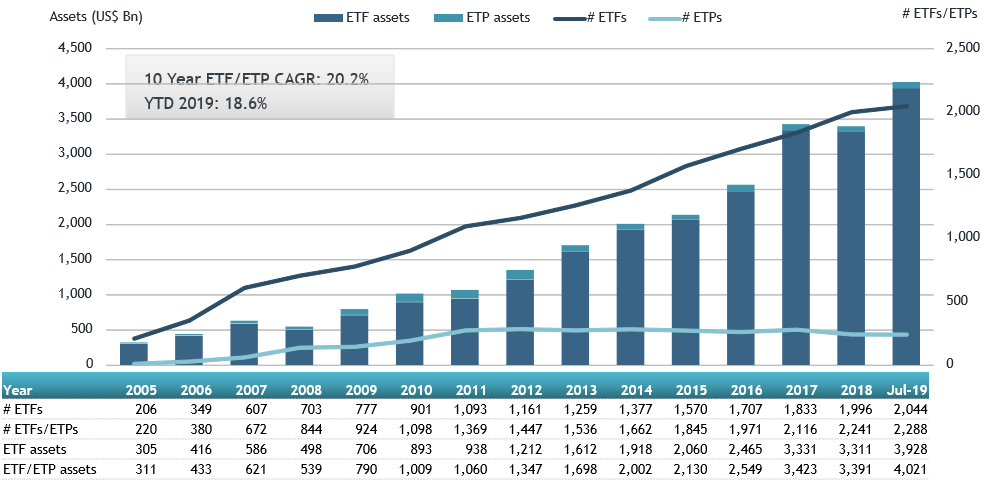

Growth in US ETF and ETP assets as of the end of July 2019

At the end of July 2019, the US ETF/ETP industry had 2,280 ETFs/ETPs, from 151 providers listed on 3 exchanges.

In July 2019, ETFs/ETPs gathered net inflows of $33.90 Bn. Equity ETFs/ETPs listed in US attracted the largest net inflows of $23.62 Bn in July, bringing net inflows for 2019 to $64.92 Bn, considerably less than the $89.77 Bn in net inflows equity products had attracted by the end of July 2018. Fixed Income ETFs/ETPs listed in US attracted net inflows of $7.56 Bn in July, bringing net inflows for 2019 to $73.10 Bn, substantially more than the $46.61 Bn in net inflows Fixed Income products had attracted by the end of July 2018. Commodity ETFs/ETPs gathered $2.34 Bn bringing net inflows to $2.49 Bn for 2019 which is significantly greater than the $968 Mn in net outflows gathered through July 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $26.23 Bn in July, the SPDR S&P 500 ETF Trust (SPY US) gathered $4.08 Bn alone.

Top 20 ETFs by net new assets July 2019: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

280545.29 |

(7,835.94) |

4078.52 |

|

iShares Core S&P 500 ETF |

IVV US |

180229.16 |

4,877.21 |

3383.59 |

|

Vanguard S&P 500 ETF |

VOO US |

118712.26 |

11,733.64 |

2442.70 |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

30647.10 |

7,390.56 |

1583.39 |

|

Vanguard Total Stock Market ETF |

VTI US |

118172.13 |

6,257.92 |

1462.96 |

|

iShares Russell 2000 ETF |

IWM US |

43454.22 |

(2,942.89) |

1389.74 |

|

iShares MBS ETF |

MBB US |

18303.33 |

5,522.32 |

1364.80 |

|

SPDR Gold Shares |

GLD US |

37780.35 |

1,775.03 |

1352.13 |

|

SPDR S&P Dividend ETF |

SDY US |

20122.73 |

1,493.49 |

1273.37 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

18659.23 |

4,417.65 |

1037.82 |

|

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF |

GSLC US |

6209.20 |

1,795.26 |

1031.49 |

|

Vanguard Total Bond Market ETF |

BND US |

42416.83 |

4,149.92 |

869.07 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

13749.46 |

2,709.75 |

838.26 |

|

Vanguard Total International Bond ETF |

BNDX US |

19197.47 |

4,959.22 |

668.09 |

|

Utilities Select Sector SPDR Fund |

XLU US |

10741.64 |

1,257.91 |

632.03 |

|

Vanguard Mid-Cap ETF |

VO US |

27035.06 |

989.77 |

613.97 |

|

iShares Gold Trust |

IAU US |

14125.64 |

1,265.26 |

605.38 |

|

Vanguard FTSE Developed Markets ETF |

VEA US |

71541.62 |

166.92 |

562.33 |

|

iShares Silver Trust |

SLV US |

5874.60 |

629.74 |

529.97 |

|

iShares Russell 1000 ETF |

IWB US |

21078.97 |

(222.66) |

514.07 |

The top 10 ETP's by net new assets collectively gathered $3.50 Bn in July. The SPDR Gold Shares (GLD US) gathered $1.35 Bn alone.

Top 10 ETPs by net new assets July 2019:US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

37780.35 |

1775.03 |

1352.13 |

|

iShares Gold Trust |

IAU US |

14125.64 |

1265.26 |

605.38 |

|

iShares Silver Trust |

SLV US |

5874.60 |

629.74 |

529.97 |

|

VelocityShares Daily 2x VIX Short Term ETN |

TVIX US |

1005.89 |

1316.82 |

378.05 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

985.90 |

1057.74 |

246.76 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

567.24 |

734.78 |

95.13 |

|

VelocityShares Daily 3x Long Natural Gas ETN |

UGAZ US |

641.44 |

717.45 |

90.36 |

|

SPDR Gold MiniShares Trust |

GLDM US |

880.50 |

408.65 |

77.71 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

293.83 |

256.09 |

66.25 |

|

Large Cap Growth Index-Linked Exchange Traded Notes due 2028 |

FRLG US |

1038.13 |

417.55 |

61.30 |

Investors have tended to invest in Equity/Fixed Income ETFs in July.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Please Vote - Voting for the ETF Express 2019 USA Awards is now open. The survey is designed to assess the best ETF providers, exchanges, research providers etc. during May 2018 to May 2019. We are hoping that you would consider giving ETFGI your support by nominating ETFGI in the “Best ETF Research Provider" category - #24 by Voting Here. The team at ETFGI thank you for your support.

###

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research, event and consultancy firm launched in 2012 in London by Deborah Fuhr. The firm offers paid for subscription research services, consulting services and events covering trends in the global ETF industry. ETFGI’s services are unique in their breadth and depth of coverage starting with the basic annual subscription service which provides monthly Global Industry Insight Landscape reports covering flows, trends and rankings in each region of the world where ETFs, ETPs are listed, a monthly directory and access to a database with fact sheets for all products listed and cross listed globally plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports and database and factsheet for all ETFs/ETPs listed globally

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com

- ETFGI Global ETFs Insights summit Toronto December 2, 2019

- ETFGI Global ETFs Insights summits 2020

If you are interested in sponsoring, speaking at or attending our upcoming events please contact deborah.fuhr@etfgi.com

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs.

Go to www.ETFtv.net to view

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,000 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV