ETFGI reports that assets invested ETFs and ETPs listed in globally reached a record high of US$5.78 trillion at the end of September 2019

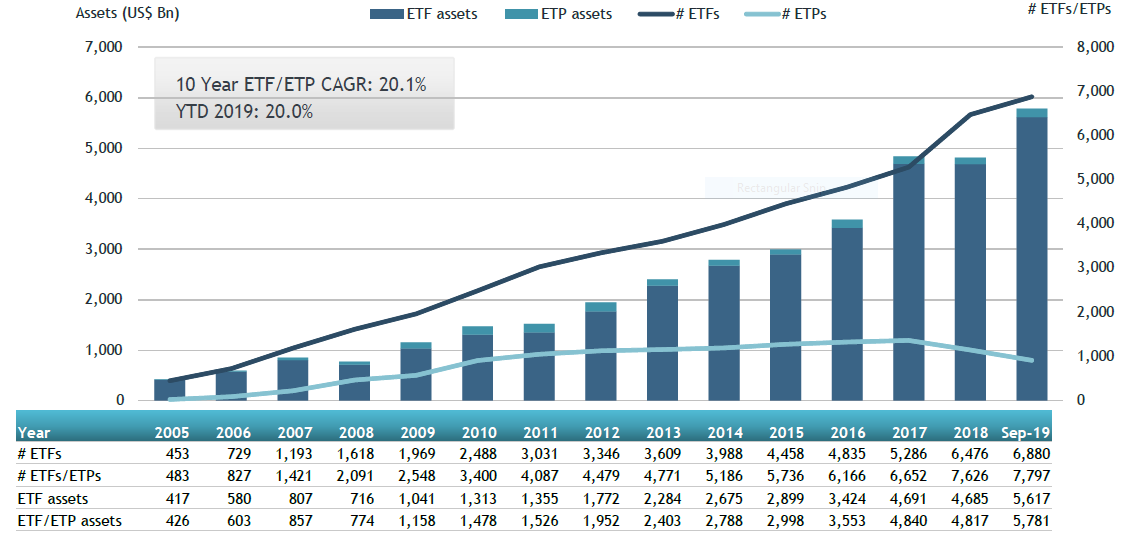

LONDON —October 21, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed Globally gathered net inflows of US$77.17 billion in September, bringing year-to-date net inflows to US$350.25 billion which is on par with the US$351.09 gathered at this time last year. Assets invested in the Global ETF/ETP industry have increased by 2.6%, from US$5.64 trillion at the end of August, to US$5.78 trillion at the end of September, according to ETFGI's September 2019 Global ETFs and ETPs industry insights landscape report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

• Assets invested in the Global ETF/ETP industry reach a record $5.78 trillion at the end of September.

• September 2019, ETFs/ETPs listed Globally gathered $77.17 billion in net inflows, second highest on record.

• Year to date NNA is $350.25 billion which is on par with the $351.09 billion gathered YTD in 2018.

“The S&P 500 gained 1.9% during September despite slowing economic growth, ongoing trade disputes and a presidential impeachment inquiry. Shifting the focus to the S&P Developed ex-U.S. BMI, the index was up 3.0%, as 23 of 25 countries gained during the month; the highest gainer in the month was Korea (up 6.4%), while Hong Kong continued to decline (down 0.8%). From an Emerging Markets standpoint, the S&P Emerging BMI gained 1.4%, with 15 of the 23 reporting gains. Globally, equities reclaimed prior month losses, gaining 2.1%, as measured by the S&P Global BMI (38 out of 50 countries reporting gains).” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of September 2019

At the end of September 2019, the Global ETF/ETP industry had 7,797 ETFs/ETPs, with 15,662 listings, from 422 providers on 69 exchanges in 58 countries.

In September 2019, ETFs/ETPs gathered net inflows of $77.17 billion. Fixed income ETFs/ETPs listed Globally attracted net inflows of $23.40 billion in September, bringing net inflows for 2019 to $171.53 billion, considerably greater than the $74.14 billion in net inflows fixed income products had attracted by the end of September 2018. Equity ETFs/ETPs listed Globally gathered net inflows of $45.88 billion in September, bringing net inflows for 2019 to $134.90 billion, substantially less than the $250.91 billion in net inflows equity products had attracted by the end of September 2018. Commodity ETFs/ETPs gathered $3.97 billion in net inflows bringing net inflows to $18.26 billion for 2019, which is greater than the $3.15 billion in net outflows suffered through September 2018.

Substantial inflows can be attributed to the top 20 ETF's by net new assets, which collectively gathered $38.51 billion in September, the SPDR S&P 500 ETF Trust gathered $8.62 billion alone.

Top 20 ETFs by net new inflows September 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

274,225.69 |

(9,941.31) |

8,617.45 |

|

iShares Russell 2000 ETF |

IWM US |

43,639.24 |

(1,163.78) |

3,700.26 |

|

Vanguard Total Stock Market ETF |

VTI US |

121,199.19 |

10,126.96 |

2,984.41 |

|

Vanguard Total International Bond ETF |

BNDX US |

22,988.08 |

8,458.41 |

2,711.82 |

|

iShares Core S&P 500 ETF |

IVV US |

184,344.59 |

9,347.17 |

1,954.66 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

18,404.23 |

7,378.45 |

1,885.52 |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

35,135.99 |

11,191.79 |

1,615.68 |

|

TOPIX Exchange Traded Fund |

1306 JP |

91,016.82 |

13,613.48 |

1,582.31 |

|

iShares 3-7 Year Treasury Bond ETF |

IEI US |

9,125.28 |

716.02 |

1,391.32 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

ACWIU SW |

2,059.75 |

1,201.74 |

1,389.94 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to CHF) A-acc |

ACWIS SW |

1,617.29 |

929.85 |

1,231.63 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

18,177.39 |

3,989.12 |

1,209.84 |

|

iShares Intermediate-Term Corporate Bond ETF |

IGIB US |

8,326.08 |

2,473.21 |

1,172.98 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

25,024.07 |

4,695.52 |

1,141.44 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

10,428.16 |

3,119.88 |

1,108.31 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to EUR) A-acc |

ACWIE SW |

1,741.94 |

891.27 |

1,035.97 |

|

iShares Core FTSE 100 UCITS ETF |

ISF LN |

9,554.65 |

2,173.59 |

1,025.27 |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund |

1357 JP |

1,973.70 |

1,447.96 |

1,008.11 |

|

Invesco QQQ Trust |

QQQ US |

74,717.03 |

175.48 |

879.28 |

|

First Trust Financial AlphaDEX Fund |

FXO US |

1,796.14 |

769.17 |

864.82 |

The top 10 ETP's by net new assets collectively gathered $4.57 billion in September. The SPDR Gold Shares gathered $2.11 billion alone.

Top 10 ETPs by net new inflows September 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Gold Shares |

GLD US |

4,2926.80 |

6,544.67 |

2,106.57 |

|

iShares Gold Trust |

IAU US |

16,352.83 |

2,951.11 |

789.09 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

989.89 |

1,025.63 |

385.78 |

|

VelocityShares Daily 2x VIX Short Term ETN |

TVIX US |

1,117.69 |

1,454.71 |

288.99 |

|

Xtrackers Physical Gold Euro Hedged ETC |

XAD1 GY |

2,345.13 |

317.39 |

193.53 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

597.09 |

727.45 |

192.19 |

|

United States Oil Fund LP |

USO US |

1,426.84 |

(343.60) |

188.82 |

|

WisdomTree Physical Swiss Gold |

SGBS LN |

2,379.64 |

1,384.41 |

176.04 |

|

WisdomTree Physical Platinum |

PHPT LN |

498.60 |

250.23 |

129.61 |

|

iShares Physical Gold ETC |

SGLN LN |

6,638.62 |

1,548.15 |

123.48 |

Investors have tended to invest in ETFs and ETPs providing exposure to US and global equities, Corporate and broad/aggregate fixed income during September.

Please contact deborah.fuhr@etfgi.com if you have any questions, suggestions or would like to discuss subscribing to any of ETFGI’s research or consulting services.

####

Register to attend the ETFGI Global ETFs Insights Summit on December 2, 2019 in Toronto at the St. Regis Toronto Hotel. Register here attendees are eligible for 6 hours FP Canada-Approved CE Credits.

Registration is also open for the ETFGI Global ETFs Insights Summit in New York on April 2, 2020 click here to register and in London on May 19, 2020 click here to register

Free registration is offered to all buyside investors and financial advisors. Standard rates apply for everyone else. To view the Toronto agenda and register click Register here. Attendees are eligible for 6 hours FP Canada-Approved CE Credits. Register for the ETFGI Global ETFs Insights Summit in New York on April 2, 2020 click here to register and in London on May 19, 2020 click here to register

The summits are designed to provide the opportunity for institutional investors and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others about investing, regulatory, liquidity, pricing, trading, and technological developments impacting ETFs, and the impact that ETFs have on the markets in the respective jurisdictions.

Sponsored Workshop

During the afternoon attendees will separated into small groups, to have the opportunity to discuss with their peers a number of topics of importance relating to the use, implementation and trading of ETFs, as well as raise any questions with, and obtain guidance from, outside experts.

The ETFGI Global ETFs Insights Summit 2019 and 2020 schedule is:

Toronto – December 2, 2019 click here to register – eligible for 6 hours FP Canada-Approved CE Credits

New York – April 2, 2020 click here to register

London – May 19, 2020 click here to register

Toronto – September 2020

Hong Kong – November 2020

If you have any questions on attending, sponsoring or speaking please email deborah.fuhr@etfgi.com

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research, event and consultancy firm launched in 2012 in London by Deborah Fuhr. The firm offers paid for subscription research services, consulting services and events covering trends in the global ETF industry. ETFGI’s services are unique in their breadth and depth of coverage starting with the basic annual subscription service which provides monthly Global Industry Insight Landscape reports covering flows, trends and rankings in each region of the world where ETFs, ETPs are listed, a monthly directory and access to a database with fact sheets for all products listed and cross listed globally plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports and database and factsheet for all ETFs/ETPs listed globally

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com

- ETFGI Global ETFs Insights Summits 2019 and 2020

- Toronto – Dec 2, 2019 register here receive 6 hours FP Canada-Approved CE Credits

- New York – April 2, 2020 register here

- London – May 19, 2020 register here

- Toronto – September 2020

- Hong Kong – November 2020

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Episode 7 of ETF TV features Eric M. Pollackov Global Head of ETF Capital Markets at Invesco sharing his views on active and passive investing being a collaboration of capabilities, the need for education and innovations developing in non-transparent active and Crypto ETPs

Episode 8 of ETF TV features Shaun Baskett, Director Index Sales at Cboe Europe sharing his views on the role of regulation, trade transparency and liquidity for ETFs

Episode 9 of ETF TV features Sergey Dolomanov, Partner at WILLIAM FRY sharing his views on the value of ETFs being the delivery of better value and choice for investors and the development of active and ESG strategies with Hamish McArthur of ETF TV and Deborah Fuhr of ETFGI

Episode 10 of ETF TV features Jim Goldie, head of ETF Capital Markets (EMEA) at Invesco, sharing his views on the growth in the use of fixed income ETFs, how they can have tighter spreads than the index and provide cost efficient execution, with Hamish McArthur of ETF TV

Please contact us if you are interested in sponsoring an mini segment or a full episode.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,300 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV