ETFGI reports assets invested in the global ETFs industry extended lead over hedge fund industry to US$2.54 trillion at the end of Q3 2019

LONDON — October 28, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in the global ETFs and ETPs industry extended its lead over the global hedge fund industry to US$2.54 trillion at the end of Q3 2019, an increase of 2.52% since of Q2 2019. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in global ETFs and ETPs industry extend lead over assets in global hedge fund industry to $2.54 trillion at the end of September

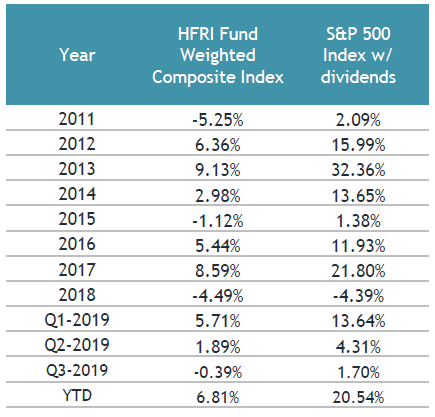

- Year to date through the end of Q3 the HFRI Fund Weighted Composite Index has returned 6.81% underperforming the S&P 500 Index with dividends which has delivered 20.54%

-

Hedge fund suffered net outflows of $6.8 billion in Q3 while ETFs/ETPs gathered net inflows of $140.79 billion

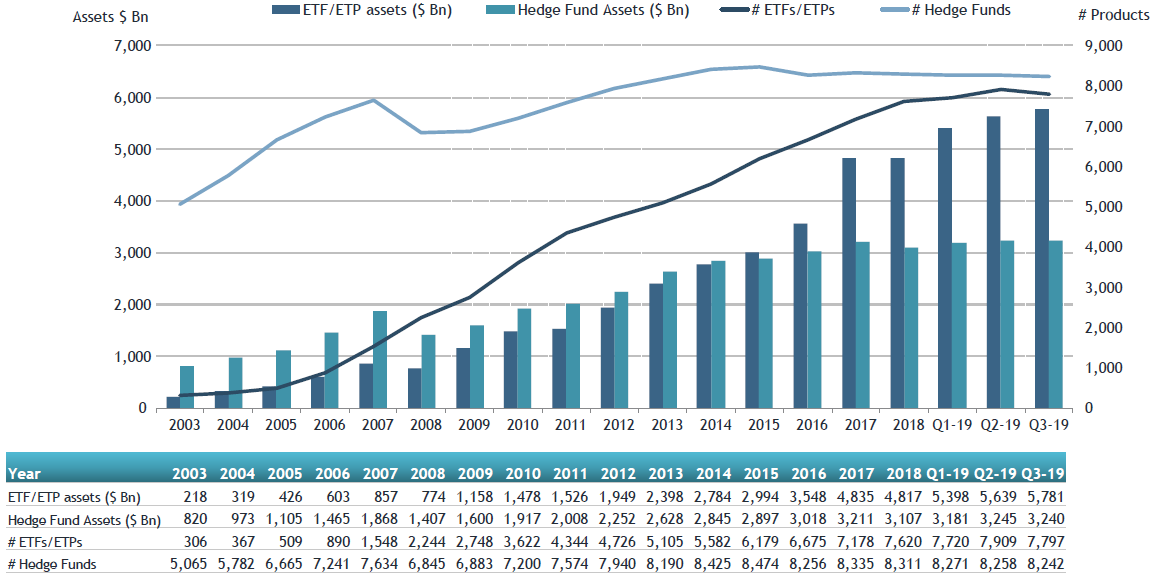

Assets invested in the global ETF/ETP industry first surpassed those invested in the hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETF/ETP industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis a record $5.78 trillion were invested in 7,787 ETFs/ETPs listed globally at the of Q3 2019, representing growth in assets of 2.52% over the quarter. Over the same period assets invested in hedge funds globally shrunk by 0.17%, to $3.24 trillion in

8,242 hedge funds, according to a report by Hedge Fund Research.

During the third quarter of 2019, ETFs/ETPs listed globally gathered $140.79 billion in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. In contrast, HFR reported that hedge fund suffered net outflows of $6.8 billion in Q3 2019.

Growth in global ETF/ETP and global hedge fund assets, as at end of September 2019

In Q3 2019 the performance of the HFRI Fund Weighted Composite Index was down 0.39%; which is less than the 1.70% return of the S&P 500 Index with dividends. This is the first time this year that the performance of the HFRI Fund Weighted Composite Index fell into negative territory. Year to date through the end of Q3 the HFRI Fund Weighted Composite Index has returned 6.81% underperforming the S&P 500 Index with dividends which has delivered 20.54%.

Sources: Hedge Fund Research HFR, ETFGI

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Register to attend the ETFGI Global ETFs Insights Summit on December 2, 2019 in Toronto at the St. Regis Toronto Hotel. Free registration is offered to all buyside investors and financial advisors. Standard rates apply for everyone else. Register here attendees are eligible for 6 hours FP Canada-Approved CE Credits.

Registration is also open for the ETFGI Global ETFs Insights Summit in New York on April 2, 2020 click here to register and in London on May 19, 2020 click here to register

The summits are designed to provide the opportunity for institutional investors and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others about investing, regulatory, liquidity, pricing, trading, and technological developments impacting ETFs, and the impact that ETFs have on the markets in the respective jurisdictions.

Sponsored Workshop

During the afternoon attendees will separated into small groups, to have the opportunity to discuss with their peers a number of topics of importance relating to the use, implementation and trading of ETFs, as well as raise any questions with, and obtain guidance from, outside experts.

The ETFGI Global ETFs Insights Summit 2019 and 2020 schedule is:

Toronto – December 2, 2019 click here to register – eligible for 6 hours FP Canada-Approved CE Credits

New York – April 2, 2020 click here to register

London – May 19, 2020 click here to register

Toronto – September 2020

Hong Kong – November 2020

If you have any questions on attending, sponsoring or speaking please email deborah.fuhr@etfgi.com

Attribution Policy

The information contained herein is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

About ETFGI

ETFGI is an independent research, event and consultancy firm launched in 2012 in London by Deborah Fuhr. The firm offers paid for subscription research services, consulting services and events covering trends in the global ETF industry. ETFGI’s services are unique in their breadth and depth of coverage starting with the basic annual subscription service which provides monthly Global Industry Insight Landscape reports covering flows, trends and rankings in each region of the world where ETFs, ETPs are listed, a monthly directory and access to a database with fact sheets for all products listed and cross listed globally plus you receive insights from us. Visit www.etfgi.com to learn more.

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports and database and factsheet for all ETFs/ETPs listed globally

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com

- ETFGI Global ETFs Insights Summits 2019 and 2020

- Toronto – Dec 2, 2019 register here receive 6 hours FP Canada-Approved CE Credits

- New York – April 2, 2020 register here

- London – May 19, 2020 register here

- Toronto – September 2020

- Hong Kong – November 2020

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Episode 7 of ETF TV features Eric M. Pollackov Global Head of ETF Capital Markets at Invesco sharing his views on active and passive investing being a collaboration of capabilities, the need for education and innovations developing in non-transparent active and Crypto ETPs

Episode 8 of ETF TV features Shaun Baskett, Director Index Sales at Cboe Europe sharing his views on the role of regulation, trade transparency and liquidity for ETFs

Episode 9 of ETF TV features Sergey Dolomanov, Partner at WILLIAM FRY sharing his views on the value of ETFs being the delivery of better value and choice for investors and the development of active and ESG strategies with Hamish McArthur of ETF TV and Deborah Fuhr of ETFGI

Episode 10 of ETF TV features Jim Goldie, head of ETF Capital Markets (EMEA) at Invesco, sharing his views on the growth in the use of fixed income ETFs, how they can have tighter spreads than the index and provide cost efficient execution, with Hamish McArthur of ETF TV

Episode 11 of ETF TV features part 1 Elena Philipova, Global head of ESG proposition at Refinitiv, sharing her views on the changing landscape of ESG application within the investment industry

Episode 12 of ETF TV features part 2 Elena Philipova, Global head of ESG proposition at Refinitiv, sharing her views on the regional differences in approach to supporting investment based on environmental, social and governance factors

Please contact us if you are interested in sponsoring an mini segment or a full episode.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,300 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV