ETFGI reports assets invested in ETFs and ETPs listed in US reached a new record high of 4.15 trillion US Dollars at the end of October 2019

LONDON — November 13, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in US gained net inflows of US$26.39 billion in October, bringing year-to-date net inflows to US$222.51 billion which is slightly more than the US$219.17 billion gathered at this point in 2018. Assets invested in the US ETFs/ETPs industry have increased by 2.6%, from US$4.05 trillion at the end of September, to US$4.15 trillion, according to ETFGI's October 2019 US ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the US ETFs/ETPs industry reached a new high record of $4.15 trillion.

- Asset invested in the US ETFs/ETPs industry increased 2.6% in October.

- In October 2019, ETFs/ETPs listed in US attracted $26.39 billion in net inflows.

“The Fed rate cut and the looming hope for an agreement between US-China shaped a favourable investment environment in equity markets globally which led the S&P 500® to gain 3.2% during October. International markets also gained, with the S&P Developed Ex-U.S. and the S&P Emerging BMI both up 4%. The better performance of the Equity Markets reflected into a new record high of $4.15 trillion and higher inflows of ETFs/ETPs exposed to Equity Indices rather than Fixed Income.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

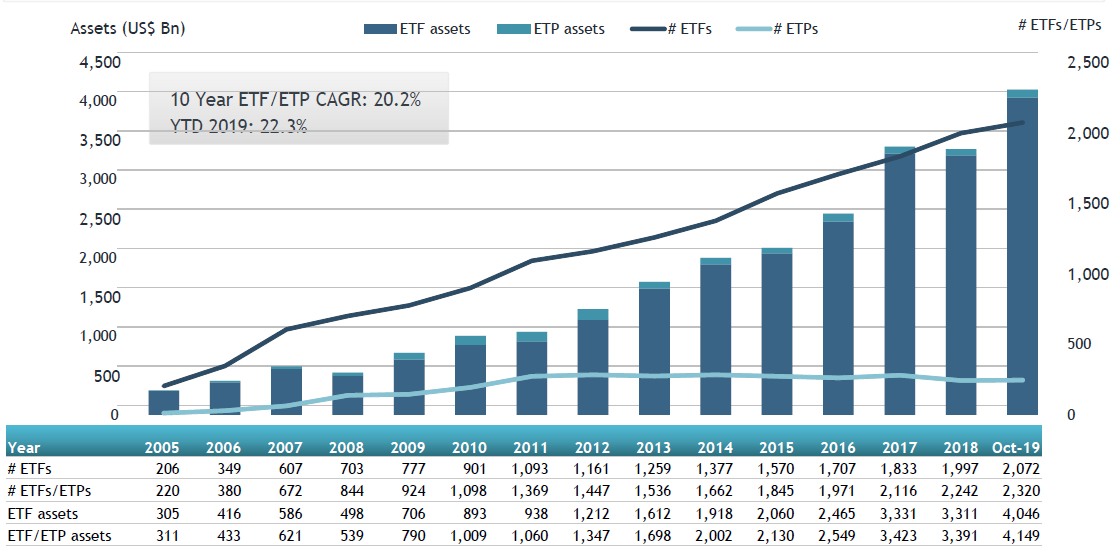

Growth in US ETF and ETP assets as of the end of October 2019

At the end of October 2019, the US ETFs/ETPs industry had 2,320 ETFs/ETPs, from 151 providers on 3 exchanges.

In October 2019, ETFs/ETPs gathered net inflows of $26.39 billion. Equity ETFs/ETPs listed in US gathered net inflows of $9.26 billion in October, bringing YTD net inflows for 2019 to $83.83 billion, less than the $143.93 billion in net inflows Equity products had attracted for the corresponding period to October 2018. Fixed Income ETFs/ETPs listed in US attracted net inflows of $12.43 billion in October, bringing YTD net inflows for 2019 to $108.82 billion, substantially more than the $51.29 billion in net inflows for the corresponding period to October 2018. Commodity ETFs/ETPs gathered $276 billion, bringing the YTD net inflows to $9.72 billion for 2019, which is significantly greater than the $3.06 billion in net outflows for the corresponding period to October 2018.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $19.62 billion in October, the Vanguard Total Stock Market ETF (VTI US) gathered $2.53 billion alone.

Top 20 ETFs by net new assets October 2019: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

VTI US |

126,893.37 |

12,659.24 |

2,532.28 |

|

iShares MSCI USA Minimum Volatility ETF |

USMV US |

36,591.52 |

12,701.27 |

1,509.48 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

13,475.16 |

4,758.23 |

1,445.19 |

|

iShares US Treasury Bond ETF |

GOVT US |

15,221.38 |

7,674.81 |

1,354.52 |

|

Vanguard Total Bond Market ETF |

BND US |

46,385.98 |

7,691.78 |

1,196.09 |

|

Financial Select Sector SPDR Fund |

XLF US |

24,270.58 |

(2,818.38) |

1,160.47 |

|

Vanguard Total International Bond ETF |

BNDX US |

23,377.24 |

9,530.43 |

1,072.02 |

|

iShares MSCI Japan ETF |

EWJ US |

12,898.20 |

(4,070.55) |

1,013.97 |

|

Vanguard Value ETF |

VTV US |

52,020.56 |

3,515.90 |

1,006.21 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

19,059.19 |

4,886.09 |

896.97 |

|

iShares MBS ETF |

MBB US |

19,602.30 |

6,721.63 |

788.60 |

|

iShares Gold Trust |

IAU US |

17,338.09 |

3,652.68 |

701.57 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

39,596.94 |

3,622.52 |

689.03 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

16,325.35 |

4,662.73 |

660.92 |

|

First Trust Value Line Dividend Index Fund |

FVD US |

8,571.06 |

3,144.60 |

651.68 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

9,494.28 |

4,323.88 |

625.68 |

|

iShares Core S&P Total U.S. Stock Market ETF |

ITOT US |

23,913.48 |

5,296.99 |

616.99 |

|

iShares Core MSCI Total International Stock ETF |

IXUS US |

17,375.90 |

3,593.85 |

588.90 |

|

iShares Intermediate-Term Corporate Bond ETF |

IGIB US |

8,950.48 |

3,051.83 |

578.62 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

VCIT US |

25,778.84 |

5,223.04 |

527.52 |

The top 10 ETPs by net new assets collectively gathered $1.80 billion in October. The iShares Gold Trust (IAU US)

gathered $702 million alone.

Top 10 ETPs by net new assets October 2019:US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Gold Trust |

IAU US |

17,338.09 |

3,652.68 |

701.57 |

|

VelocityShares Daily 2x VIX Short Term ETN |

TVIX US |

1,061.99 |

1,798.46 |

343.75 |

|

VelocityShares Daily 3x Long Natural Gas ETN |

UGAZ US |

981.48 |

844.95 |

305.53 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

577.22 |

843.26 |

115.82 |

|

Aberdeen Physical Swiss Gold Shares |

SGOL US |

1,185.96 |

187.85 |

93.87 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

928.36 |

1,095.10 |

69.46 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

373.40 |

(311.81) |

52.53 |

|

SPDR Gold MiniShares Trust |

GLDM US |

1,113.91 |

591.24 |

44.76 |

|

United States Natural Gas Fund LP |

UNG US |

315.71 |

32.24 |

40.32 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

290.45 |

287.26 |

36.65 |

Investors have tended to invest in Fixed Income and Equity ETFs.

Please contact deborah.fuhr@etfgi.com if you have any questions, suggestions or would like to discuss subscribing to any of ETFGI’s research or consulting services.

###

Register now to join the discussion with leading ETF issuers, investors, traders, analysts, regulators, and lawyers – at the ETFGI Global ETFs Insights Summit on December 2nd from 8am – 4:45pm in Toronto at the St Regis Toronto hotel.

ETFGI Global ETFs Insights Summit Toronto qualifies for 6 FP Canada-Approved CE Credits. Complimentary registration is available for buyside institutional investors and financial advisors including traders, portfolio managers and fund selectors. Register here. Attendees will receive a complimentary copy of the CFA Institute's book: "A comprehensive Guide to Exchange Traded Funds (ETFs)"

The event is designed to facilitate a discussion around the impact regulations and market structure developments are having on the ETF selection, portfolio construction, trading and product development of ETFs.

Our speaker list is continuously growing. View our events page to see the current list of confirmed speakers:

Mario Cianfarani, CFA, Head of Institutional & Retirement Distribution, Vanguard Investments Canada

Raymond Chan, Director, Investment Funds and Structured Products, Ontario Securities Commission

Prerna Chandak, VP ETF Product & Strategy, Mackenzie Investments

Michael Cooke, Senior Vice President, Head of Exchange Traded Funds, Mackenzie Investments

Carol E. Derk, Lawyer, Borden Ladner Gervais

Deborah Fuhr, Managing Partner, Founder, ETFGI

Camilo Gil, Executive Director, CIBC Capital Markets

Kevin Gopaul, Global Head Exchange Traded Funds, BMO Global Asset Management

Katie Gouinlock, Head of Canada ETF Capital Markets, Vanguard Investments Canada

Margaret Gunawan, MD, Head of Canada Legal & Compliance, BlackRock

Steve Hawkins, Board Vice Chair CETFA, President & CEO, Horizons ETFs

Naseem Husain, VP ETF Strategist, Mackenzie Investments

Ronald C. Landry, Head of Product and Canadian ETF Services, CIBC Mellon

Lisa Lake Langley, CEO & Founder, Emerge Capital Management

Jin Li, Vice President, ETF & Quantitative Research Analyst | Equity Research, BMO Capital Markets

Patrick McEntyre, Managing Director, Electronic Trading & Services, National Bank Financial

Amol Sodhi, Vice President & Director, Asset Allocation, TD Asset Management

Daniel Straus, PhD, M.Fin., Vice President, ETFs & Financial Products Research National Bank of Canada Financial Markets

Mary Jane Young, Head of ETF Trading, Director, TD Securities

Jos Schmitt, President & CEO, Executive Director, NEO Exchange

Afternoon workshop: during the afternoon attendees will separated into small groups, participants will have the opportunity to discuss with their peers several topics of importance relating to ETFs, as well as raise any questions with, and obtain guidance from, outside experts.

The ETFGI Global ETFs Insights Summits 2020 schedule is:

- New York – April 2, 2020 click here to register

- London – May 19, 2020 click here to register

- Toronto – September 2020

- Hong Kong – November 2020

To discuss sponsorship and speaking opportunities please contact deborah.fuhr@etfgi.com

We look forward to seeing you at one of our upcoming events.

ETFGI Global ETFs Insights Summit Toronto qualifies for 6 FP Canada-Approved CE Credits.

Thank you to our sponsors, speakers and media partners.

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Episode 7 of ETF TV features Eric M. Pollackov Global Head of ETF Capital Markets at Invesco sharing his views on active and passive investing being a collaboration of capabilities, the need for education and innovations developing in non-transparent active and Crypto ETPs

Episode 8 of ETF TV features Shaun Baskett, Director Index Sales at Cboe Europe sharing his views on the role of regulation, trade transparency and liquidity for ETFs

Episode 9 of ETF TV features Sergey Dolomanov, Partner at WILLIAM FRY sharing his views on the value of ETFs being the delivery of better value and choice for investors and the development of active and ESG strategies with Hamish McArthur of ETF TV and Deborah Fuhr of ETFGI

Episode 10 of ETF TV features Jim Goldie, head of ETF Capital Markets (EMEA) at Invesco, sharing his views on the growth in the use of fixed income ETFs, how they can have tighter spreads than the index and provide cost efficient execution, with Hamish McArthur of ETF TV

Episode 11 of ETF TV features Elena Philipova, Global head of ESG proposition at Refinitiv, discussing how to define sustainable investment opportunities and the changing landscape of ESG application within the investment industry

Episode 12 of ETF TV part 2 of the Difference in US and European approaches to ESG should not inhibit growth interview with Elena Philipova, global head of ESG proposition at Refinitiv with Deborah Fuhr, Managing Partner of ETFGI and co-founder of ETF TV

Episode 13 of ETF TV features Tom Stephens, head of international ETF Capital Markets at JP Morgan Asset Management, Active ETFs will be the next level. The use of fixed income exchange-traded funds for long term investment as well as for shorter term liquidity management and portfolio transitions

Episode 14 of ETF TV episode features Manuela Sperandeo, EMEA head of smart beta, sustainable and thematic ETFs at BlackRock explains how to define the category, assess it in the context of investment strategy, and to implement it in practicality

Please contact us if you are interested in sponsoring a mini segment or a full episode.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,300 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV