ETFGI reports assets invested in ETFs and ETPs listed globally reached a new milestone of US$6.37 trillion at the end of January 2020

LONDON — February 13, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of

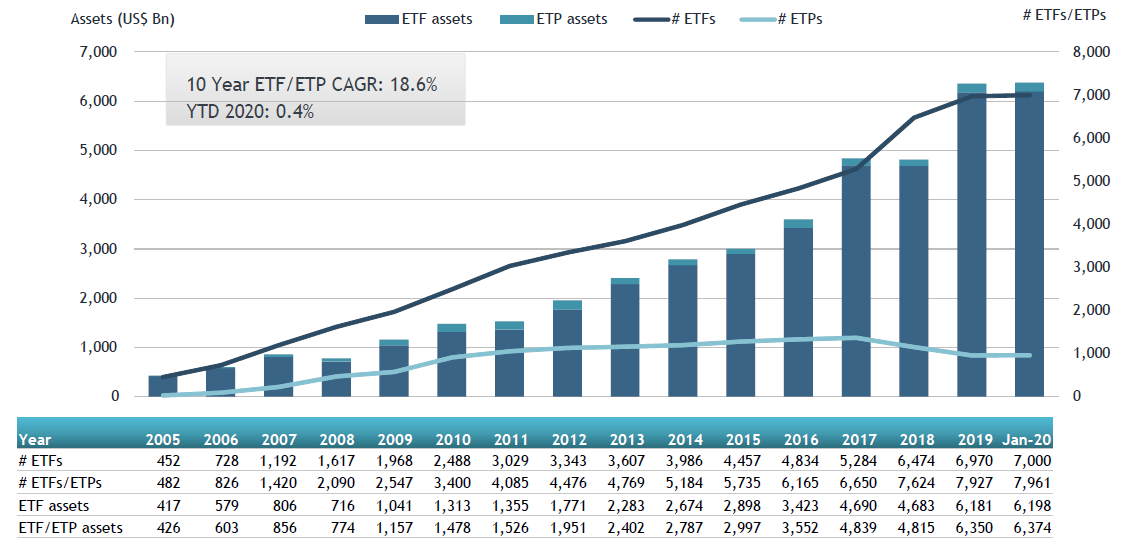

US$67.15 billion at the end of January 2020, which is significantly higher than the US$17.23 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry increased by 0.4%, from US$6.35 trillion at the end of December 2019, to US$6.37 trillion at the end of January, according to ETFGI's January 2020 Global ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets in Global ETFs and ETPs industry reached a new milestone of $6.37 trillion at the end of January.

- The $67.15 Bn in net inflows gathered in January is the 8th highest monthly inflow on record and significantly larger than the $17.23 Bn gathered in January 2019.

- Year-to-date net inflows of $67.15 Bn are the 2nd highest behind only January 2018 with $105.59 Bn.

- Equity products have gathered more net inflows than fixed income products as of the end of January.

"During January the S&P 500 lost 0.04% as markets were affected by the Coronavirus (nCoV) outbreak and offset any optimism on the trade talks with China. Global equities as measured by the S&P Global BMI were also down 1.33% and the S&P Emerging BMI declined 4.3% as well.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of January 2020

The Global ETFs/ETPs industry had 7,961 ETFs/ETPs, with 15,944 listings from 440 providers on 70 exchanges in 58 countries at the end of January.

During January 2020, ETFs/ETPs listed globally gathered net inflows of $67.15 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $34.39 Bn during January, substantially greater than the $8.94 Bn in net outflows equity products attracted during January 2019. Fixed income ETFs/ETPs listed globally attracted net inflows of $21.13 Bn during January, slightly lower than the $23.67 Bn in net inflows fixed income products attracted during January 2019. Commodity ETFs/ETPs reported $4.14 Bn in net inflows during January, which is greater than the $2.77 Bn in net inflows gathered through January 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $32.85 Bn at the end of January, the iShares Core MSCI EAFE ETF (IEFA US) gathered $2.59 Bn alone.

Top 20 ETFs by net new inflows January 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

74,956.79 |

2,585.78 |

2,585.78 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

139,508.97 |

2,506.04 |

2,506.04 |

|

Vanguard Total Bond Market ETF |

|

BND US |

51,596.18 |

2,277.09 |

2,277.09 |

|

iShares Core S&P 500 ETF |

|

IVV US |

200,971.86 |

2,214.24 |

2,214.24 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

72,788.91 |

2,163.27 |

2,163.27 |

|

iShares MBS ETF |

|

MBB US |

23,300.50 |

2,027.77 |

2,027.77 |

|

iShares Trust iShares ESG MSCI USA ETF |

|

ESGU US |

3,391.61 |

1,956.27 |

1,956.27 |

|

Vanguard S&P 500 ETF |

|

VOO US |

132,425.32 |

1,930.25 |

1,930.25 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

28,165.35 |

1,887.02 |

1,887.02 |

|

Vanguard Small-Cap ETF |

|

VB US |

28,598.30 |

1,772.45 |

1,772.45 |

|

Vanguard FTSE Developed Markets ETF |

|

VEA US |

77,936.00 |

1,680.51 |

1,680.51 |

|

iShares MSCI EM ESG Optimized ETF |

|

ESGE US |

1,983.60 |

1,227.37 |

1,227.37 |

|

E FundSI SOE The Belt and Road ETF |

|

515110 CH |

1,153.13 |

1,220.24 |

1,220.24 |

|

Industrial Select Sector SPDR Fund |

|

XLI US |

11,601.43 |

1,195.60 |

1,195.60 |

|

Vanguard Growth ETF |

|

VUG US |

49,019.07 |

1,124.24 |

1,124.24 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

25,827.16 |

1,104.56 |

1,104.56 |

|

iShares 0-5 Year High Yield Corporate Bond ETF |

|

SHYG US |

4,627.37 |

1,066.00 |

1,066.00 |

|

Bharat Bond ETF - April 2023 |

|

BETF423 IN |

989.99 |

996.81 |

996.81 |

|

Consumer Discretionary Select Sector SPDR Fund |

|

XLY US |

15,277.10 |

966.95 |

966.95 |

|

TOPIX Exchange Traded Fund |

|

1306 JP |

100,054.05 |

950.51 |

950.51 |

The top 10 ETPs by net new assets collectively gathered $3.53 Bn in January. The iShares Physical Gold ETC (SGLN LN) gathered $863.09 Mn alone.

Top 10 ETPs by net new inflows January 2019: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC |

SGLN LN |

8,199.86 |

863.09 |

863.09 |

|

iShares Gold Trust |

IAU US |

18,937.78 |

597.49 |

597.49 |

|

SPDR Gold Shares |

GLD US |

45,988.67 |

509.57 |

509.57 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

432.26 |

338.97 |

338.97 |

|

United States Oil Fund LP |

USO US |

1,290.47 |

313.67 |

313.67 |

|

Invesco Gold ETC |

SGLD LN |

7,671.87 |

245.92 |

245.92 |

|

GBS Bullion Securities |

GBS LN |

4,251.08 |

199.87 |

199.87 |

|

United States Natural Gas Fund LP |

UNG US |

530.76 |

166.75 |

166.75 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,104.84 |

158.83 |

158.83 |

|

Xetra Gold EUR |

4GLD GY |

10,523.81 |

139.84 |

139.84 |

Investors have tended to invest in core Equity and core Fixed Income ETFs during January.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

Register now to join us at the ETFGI Global ETFs Insights Summits in New York on April 2nd at The Metropolitan Club, New York at http://bit.ly/2ouHTbE

Free registration and CPD educational credits are offered to buyside investors and financial advisors. Register at http://bit.ly/2ouHTbE

The summits are designed to provide the opportunity for institutional investors and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments have on ETFs.

Panel Discussions will offer an opportunity for a substantive and in-depth discussion on topics which include:

- ETFs and Their Impact on the Markets, Trading and Market Structure

- Regulatory Impact on Investor choice – ETF rule, Non-Transparent Active, Derivatives Rule< Best Interest Rule

- How to Trade ETFs – ETF Hub, trading platforms, liquidity

- Portfolio construction – outlook for the markets, how and when to use ETFs, mutual funds, shares and/or futures

- Trends in ESG and thematic investing

- The future trends that will impact the use and development of ETFs in the next 5 – 10 years

Workshops - During the afternoon attendees will separated into small groups, to have the opportunity to discuss with their peers on a number of topics of importance relating to the use, implementation and trading of ETFs, as well as raise any questions with, and obtain guidance from, outside experts.

The 2020 events are being organised based on the success of the ETFGI Global ETFs Insights Summit in Toronto on Dec 2, 2019 See the speakers, agenda, and sponsors for the Toronto summit here:

Watch the

Mario Cianfarani, CFA, Head of Institutional & Retirement Distribution, Vanguard Investments Canada

Carol Derk, Lawyer, Borden Ladner Gervais

Michael Greenberg, CFA, CAIA, Vice President, Portfolio Manager, Multi-Asset Solutions, Franklin Templeton

Ronald Landry, MBA CPA CGA, Head of Product and Canadian ETF Services, CIBC Mellon

Patrick McEntyre, Managing Director, Electronic Trading & Services, National Bank Financial

Jos Schmitt, President & CEO, Executive Director, NEO Exchange

Amol Sodhi, Vice President & Director, Asset Allocation, TD Asset Management

at https://www.etftv.net/highlights-etfgi-global-etfs-insights-summit-toronto/

If you are interested in sponsoring or speaking at the event please contact deborah.fuhr@etfgi.com

We look forward to seeing you at one of our events in 2020

The ETFGI Global ETFs Insights Summits 2020 schedule:

New York – April 2, 2020 at The Metropolitan Club, New York register now

London – May 19, 2020 at The Waldorf Hilton, London register now early bird rate ends March 31st

Toronto – September 2020

Hong Kong – November 2020

ETFGI SERVICES

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports and database and factsheet for all ETFs/ETPs listed globally

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com

- ETFGI Global ETFs Insights Summits 2020

New York – April 2, 2020 register now

London – May 19, 2020 register now early bird rate ends March 31st

Toronto – September 2020

Hong Kong – January 2020

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs.

Go to www.ETFtv.net to watch episodes 1 - 12

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Episode 7 of ETF TV features Eric M. Pollackov Global Head of ETF Capital Markets at Invesco sharing his views on active and passive investing being a collaboration of capabilities, the need for education and innovations developing in non-transparent active and Crypto ETPs

Episode 8 of ETF TV features Shaun Baskett, Director Index Sales at Cboe Europe sharing his views on the role of regulation, trade transparency and liquidity for ETFs

Episode 9 of ETF TV features Sergey Dolomanov, Partner at WILLIAM FRY sharing his views on the value of ETFs being the delivery of better value and choice for investors and the development of active and ESG strategies with Hamish McArthur of ETF TV and Deborah Fuhr of ETFGI

Episode 10 of ETF TV features Jim Goldie, head of ETF Capital Markets (EMEA) at Invesco, sharing his views on the growth in the use of fixed income ETFs, how they can have tighter spreads than the index and provide cost efficient execution, with Hamish McArthur of ETF TV

Episode 11 of ETF TV features Elena Philipova, Global head of ESG proposition at Refinitiv, sharing her views on the changing landscape of ESG application within the investment industry

Episode 12 of ETF TV features Elena Philipova, Global head of ESG proposition at Refinitiv,sharing her views on the regional differences in approach to supporting investment based on environmental, social and governance factors

Episode 13 of ETF TV features Tom Stephens, head of international ETF Capital Markets at JP Morgan Asset Management, Active ETFs will be the next level. The use of fixed income exchange-traded funds for long term investment as well as for shorter term liquidity management and portfolio transitions

Episode 14 of ETF TV episode features Manuela Sperandeo, EMEA head of smart beta, sustainable and thematic ETFs at BlackRock explains how to define the category, assess it in the context of investment strategy, and to implement it in practicality.

Episode 15 of ETF TV features Ivan Gilmore, head of exchange-traded products and global product development at the London Stock Exchange sees innovation in trading protocols and ESG products are transforming the ETF landscape, plus his thoughts on active vs passive and governance.

Episode 16 of ETF TV features Deborah Fuhr and Dan Barnes - The ETF Rule in the US will lead to many new issues in the market across 2020; the ‘non-transparent active’ ETFs – in reality as transparent as mutual funds, and better described as periodically-disclosed ETFs, will increase in number. New smart-beta strategies and launches of funds based on existing smart-beta strategies will also grow.

Episode 17 of ETF TV features Highlights from ETFGI Global ETFs Insights Summit Toronto.

Please contact us if you are interested in sponsoring a mini segment or a full episode.

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Past awards for Ms Fuhr include the ETF.com’s 2018’s Lifetime Achievement Award, the recipient of the 100 Women in Finance 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding contributions to the field of index investing and she named one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,300 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV