ETFGI reports that ETFs and ETPs listed in U.S. gathered net inflows of US$7.81 billion during March 2020

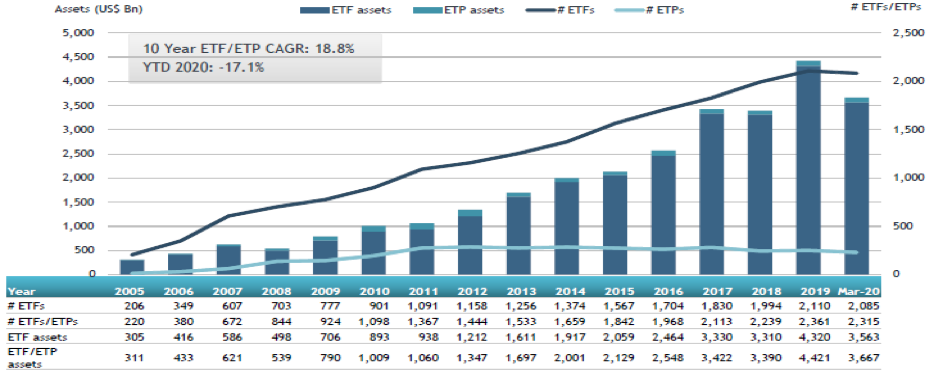

LONDON— April 20, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in U.S. gathered net inflows of US$7.81 billion during March, bringing year-to-date net inflows to US$59.86 billion which is higher than the US$51.24 billion inflows gathered at this point last year. Assets invested in the US ETFs/ETPs industry have decreased by 12.2%, from US$4.18 trillion at the end of February, to US$3.67 trillion, according to ETFGI's March 2020 US ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs/ETPs listed in U.S. attracted $7.81 billion in net inflows with Equity products being the most attractive among all asset classes.

- Year-to-date net inflows are $59.86 billion which is higher than the $51.24 billion had gathered at the end of March 2019.

- Only 5 new ETFs were listed in the U.S. March

- During Q1 2020 trading volumes in U.S. bond ETFs grew to $1.3 trillion compared to the $2.6 trillion traded in all of 2019

“At the end of March, the S&P 500 was down 12.35% as the pandemic (Covid-19) forced US government to take strict measures and set some form of lockdown around the states reinforcing the fear for deep recession and high unemployment. Outside the U.S., the S&P Developed ex-U.S. BMI plummeted nearly 14.29%. The S&P Emerging BMI dove 16.97% during the month and Global equities as measured by the S&P Global BMI plunged 14.32% as well.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in US ETF and ETP assets as of the end of March 2020

At the end of March 2020, the US ETFs/ETPs industry had 2,315 ETFs/ETPs, from 160 providers listed on 3 exchanges.

ETFs/ETPs listed in the U.S. gathered net inflows of $7.81 billion during March. Equity ETFs/ETPs listed in U.S. reported net inflows of $15.60 billion during March, bringing YTD net inflows for 2020 to $28.04 billion, greater than the $16.14 billion in net inflows Equity products had attracted for the corresponding period to March 2019.

Commodity ETFs/ETPs listed in U.S. attracted net inflows of $5.31 billion during March, bringing YTD net inflows for 2020 to $9.61 billion, much higher than the $155 million in net inflows for the corresponding period in 2019. Fixed Income ETFs/ETPs reported outflows of $13.53 billion, bringing the YTD net inflows to $10.78 billion for 2020, which is lower than the $30.72 billion in net inflows for the corresponding period to March 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $74.15 billion at the end of March, the SPDR S&P 500 ETF Trust (SPY US)gathered $13.10 billion alone.

Top 20 ETFs by net new assets March 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

SPY US |

240,742.93 |

(17,772.90) |

13,096.01 |

|

SPDR Bloomberg Barclays 1-3 Month T-Bill ETF |

BIL US |

18,079.13 |

9,204.05 |

8,663.95 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

39,777.48 |

5,158.73 |

8,402.24 |

|

Vanguard S&P 500 ETF |

VOO US |

120,113.83 |

13,376.20 |

8,096.70 |

|

iShares 1-3 Year Treasury Bond ETF |

SHY US |

23,263.67 |

5,065.79 |

5,546.28 |

|

Invesco QQQ Trust |

QQQ US |

83,478.25 |

5,722.38 |

5,321.35 |

|

Vanguard Total Stock Market ETF |

VTI US |

114,896.34 |

8,868.56 |

3,500.13 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

HYG US |

15,359.34 |

(1,795.43) |

3,403.27 |

|

iShares Short Treasury Bond ETF |

SHV US |

23,453.76 |

2,318.08 |

3,104.14 |

|

iShares MSCI ACWI ETF |

ACWI US |

10,071.36 |

966.46 |

2,069.47 |

|

iShares Core S&P Total U.S. Stock Market ETF |

ITOT US |

21,463.41 |

1,699.77 |

1,839.37 |

|

SPDR Bloomberg Barclays High Yield Bond ETF |

JNK US |

8,395.01 |

(2,170.57) |

1,591.09 |

|

iShares Russell 2000 ETF |

IWM US |

33,033.48 |

(1,628.37) |

1,416.08 |

|

Energy Select Sector SPDR Fund |

XLE US |

6,445.36 |

1,622.36 |

1,342.40 |

|

ProShares UltraPro QQQ |

TQQQ US |

3,787.40 |

1,887.80 |

1,267.59 |

|

Vanguard Dividend Appreciation ETF |

VIG US |

36,417.27 |

1,788.39 |

1,216.57 |

|

Technology Select Sector SPDR Fund |

XLK US |

24,156.40 |

426.59 |

1,165.51 |

|

Vanguard Short-Term Treasury ETF |

VGSH US |

7,301.94 |

1,189.72 |

1,072.72 |

|

iShares S&P 500 Growth ETF |

IVW US |

22,060.50 |

920.75 |

1,026.61 |

|

iShares Edge MSCI USA Quality Factor ETF |

QUAL US |

15,104.31 |

2,279.39 |

1,012.13 |

The top 10 ETPs by net new assets collectively gathered $7.98 billion at the end of March.

The United States Oil Fund LP (USO US)gathered $2.14 billion alone.

Top 10 ETPs by net new assets March 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

United States Oil Fund LP |

USO US |

2,348.08 |

2,732.92 |

2,144.59 |

|

SPDR Gold Shares |

GLD US |

48,939.51 |

3,938.21 |

1,831.78 |

|

ProShares Short VIX Short-Term Futures |

SVXY US |

809.18 |

732.03 |

733.83 |

|

iShares Gold Trust |

IAU US |

20,211.55 |

1,623.88 |

713.43 |

|

Invesco DB US Dollar Index Bullish Fund |

UUP US |

976.67 |

749.38 |

680.47 |

|

VelocityShares 3x Long Crude Oil ETN |

UWT US |

135.76 |

1,201.97 |

592.19 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

397.85 |

872.03 |

563.56 |

|

iShares Silver Trust |

SLV US |

5,501.27 |

426.36 |

330.93 |

|

SPDR Gold MiniShares Trust |

GLDM US |

1,615.11 |

417.94 |

214.33 |

|

iPath Series B S&P GSCI Crude Oil ETN |

OIL US |

182.24 |

184.04 |

178.12 |

Investors have tended to invest in Equity and Commodity ETFs at the end of March.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Due to the corona virus situation in New York and London, we have postponed our April 2ndNew York and May 19thLondon events.

Register now to join us at the ETFGI Global ETFs Insights Summit in New York which has been postponed from April 2nduntil the fall of 2020. Free registration and CPD educational credits are offered to buyside institutional investors, financial advisors and RIAs.

Our summits are designed to provide the opportunity for institutional investors, RIAs and financial advisors, to hear from the leading ETF issuers, banks, exchanges, law firms and others around the impact that market structure and regulations have on ETF product development for ESG and non-transparent active, due diligence, suitability, the use and trading, and technological developments of ETFs.

Speakers include:

- Barbara Novick, Vice Chairman, BlackRock

- Rick Redding, CEO, Index Industry Association

- Kathleen H. Moriarty, Partner, Chapman and Cutler LLP

- Jeffrey B. Baccash, Director, Global Head of ETF Solutions, BNP Paribas Securities Services

- Kevin R. Gopaul, Global Head, Exchange Traded Funds, BMO Global Asset Management

- Eric M. Pollackov, Global Head of ETF Capital Markets, Invesco Ltd.

- Deborah Fuhr, Managing Partner and Founder, ETFGI

- Dan McCabe, Chief Executive Officer, Precidian Investments

To see the full list of confirmed speakers - click here and visit the website to see further updates.

Panel discussions and fireside chats offer an opportunity for substantive and in-depth discussions on topics including:

- ETFs and Their Impact on the Markets, Trading and Market Structure

- Regulatory Impact on Investor Choice – ETF Rule, Non-Transparent Active, Derivatives Rule, Best Interest Rule

- How to Trade ETFs – Fixed Income ETFs, ICE ETF Hub, Trading Platforms, Liquidity

- Portfolio Construction – Outlook for the Markets, How and When to Use ETFs, Mutual Funds, Shares and/or Futures

- Non-Transparent Active, How Will They Work, What Types of Products Are Likely to Be Offered

- Trends in ESG and Thematic Investing

- The Future Trends Impacting the Use and Development of ETFs in the Next 5 – 10 Years

Workshops give attendees the opportunity to separate into small groups to engage with peers on a number of topics of importance relating to the use, implementation and trading of ETFs, as well as raise any questions with and obtain guidance from ETF thought leaders.

Spaces are limited so register now to ensure your attendance. Free registration and CPD educational credits are offered to buyside investors and financial advisors.

If you are interested in sponsoring or speaking at the event please contact deborah.fuhr@etfgi.com.

ETFGI sends our best wishes to those countries and individuals impacted by the Coronavirus. Guest health and safety is the utmost priority for ETFGI. We are closely monitoring the situation for our many upcoming events and ask that all attendees check our website for any updates.

In the meantime, we look forward to welcoming everyone to ETFGI Global ETFs Insights Summits in:

New York, Fall 2020- Register here

London, Fall 2020 - Register here

Toronto, September 2020

Hong Kong, November 2020

Other ETFGI Summits

See Highlights Reel from our successful Toronto Summit, December 2019.

Best regards,

Deborah Fuhr

Managing Partner, Founder

ETFGI

125 Old Broad Street

London EC2N 1AR United Kingdom

Phone +44 777 5823 111

deborah.fuhr@etfgi.com

ETFGI SERVICES

ETFGI currently offers the following subscription services:

- ETFGI Basic Global ETFs and ETPs research service – Global Industry insight Landscape reports and database and factsheet for all ETFs/ETPs listed globally

- ETFGI Global ESG ETFs and ETPs Landscape report

- ETFGI Global Active ETF ETFs and ETPs Landscape report

- ETFGI Global Smart Beta Equity ETF ETFs and ETPs Landscape report

- ETFGI Global Currency Hedged ETFs and ETPs Landscape report

- ETFGI Global Leverage and Inverse ETFs and ETPs Landscape report

- ETFGI Global EM and FM ETFs and ETPs Landscape report

- ETFGI China ETFs and ETPs Landscape report

- ETFGI Global Institutional Users of ETFs and ETPs Landscape report

- ETFGI Trends in ETF Adoption by fund platforms in the UK report

- Custom reports and analysis

- ETFGI Weekly Newsletter – Premium

- ETFGI Weekly Newsletter (free subscription - register at www.etfgi.com

- ETFGI Global ETFs Insights Summits 2020

• New York, Fall 2020 – register now

• London, Fall 2020 – register now

• Toronto – September 2020

• Hong Kong – November 2020

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs.

ETF TV is a new show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs.

Go to www.ETFtv.net to watch episodes 1 - 12

Episode 1 ETF TV views from industry leaders in Europe

Episode 2 ETF TV Tara O'Reilly on the regulatory environment for ETFs

Episode 3 ETF TV Dan Draper of Invesco picks out the key future trends to watch in the ETF market

Episode 4 ETF TV Dr Xiaolin Chen of KraneShares explains ETF use in institutional investment and for access to China

Episode 5 ETF TV ETF market structure and trading protocols are evolving approaches to investment Tom Digby, Head of EMEA ETF Client Trading at Invesco

Episode 6 ETF TV Ciarán Fitzpatrick, Managing Director, Head of ETF Servicing Europe at State Street discuss generating alpha with ETFs

Episode 7 of ETF TV features Eric M. Pollackov Global Head of ETF Capital Markets at Invesco sharing his views on active and passive investing being a collaboration of capabilities, the need for education and innovations developing in non-transparent active and Crypto ETPs

Episode 8 of ETF TV features Shaun Baskett, Director Index Sales at Cboe Europe sharing his views on the role of regulation, trade transparency and liquidity for ETFs

Episode 9 of ETF TV features Sergey Dolomanov, Partner at WILLIAM FRY sharing his views on the value of ETFs being the delivery of better value and choice for investors and the development of active and ESG strategies with Hamish McArthur of ETF TV and Deborah Fuhr of ETFGI

Episode 10 of ETF TV features Jim Goldie, head of ETF Capital Markets (EMEA) at Invesco, sharing his views on the growth in the use of fixed income ETFs, how they can have tighter spreads than the index and provide cost efficient execution, with Hamish McArthur of ETF TV

Episode 11 of ETF TV features Elena Philipova, Global head of ESG proposition at Refinitiv, sharing her views on the changing landscape of ESG application within the investment industry

Episode 12 of ETF TV features Elena Philipova, Global head of ESG proposition at Refinitiv,sharing her views on the regional differences in approach to supporting investment based on environmental, social and governance factors

Episode 13 of ETF TV features Tom Stephens, head of international ETF Capital Markets at JP Morgan Asset Management, Active ETFs will be the next level. The use of fixed income exchange-traded funds for long term investment as well as for shorter term liquidity management and portfolio transitions

Episode 14 of ETF TV episode features Manuela Sperandeo, EMEA head of smart beta, sustainable and thematic ETFs at BlackRock explains how to define the category, assess it in the context of investment strategy, and to implement it in practicality.

Episode 15 of ETF TV features Ivan Gilmore, head of exchange-traded products and global product development at the London Stock Exchange sees innovation in trading protocols and ESG products are transforming the ETF landscape, plus his thoughts on active vs passive and governance.

Episode 16 of ETF TV features Deborah Fuhr and Dan Barnes - The ETF Rule in the US will lead to many new issues in the market across 2020; the ‘non-transparent active’ ETFs – in reality as transparent as mutual funds, and better described as periodically-disclosed ETFs, will increase in number. New smart-beta strategies and launches of funds based on existing smart-beta strategies will also grow.

Episode 17 of ETF TV features Highlights from ETFGI Global ETFs Insights Summit Toronto.

Episode 18 of ETF TV features Deborah Fuhr and Dan Barnes - Buy-side trading skills make bond ETFs and mutual funds safer for investors

Please contact us if you are interested in sponsoring a mini segment or a full episode.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

About Deborah Fuhr

Previously Deborah Fuhr served as global head of ETF research and implementation strategy and as a managing director at BlackRock/Barclays Global Investors from 2008 – 2011. She also worked as a managing director and head of the investment strategy team at Morgan Stanley in London from 1997 – 2008, and as an associate at Greenwich Associates.

She has been working with investors, ETF, ETP providers, index providers, exchanges, MMs and APs, regulators, trade associations, custodians, law firms, accounting firms around the world since 1997.

ETFGI is honored to count as our research and consulting clients some of the leading firms in the ETF Ecosystem around the world as well as some new entrants and firms that are considering entering the ETF, ETP industry.

Ms Fuhr was made a Fellow of CFA UK in January 2020, was the recipient of the ETF.com 2018 lifetime achievement award, 100 Women in Finance’s 2017 European Industry Leadership Award, the 2014 William F. Sharpe Lifetime Achievement Award for outstanding and lasting contributions to the field of index investing, the Nate Most Greatest Contributor to the ETF industry award at the 11th annual ExchangeTradedFunds.com awards dinner in 2015, the ETF.com Lifetime achievement award in 2015. She has been named as one of the “100 Most Influential Women in Finance” by Financial News over several years, most recently in 2016, and as one of the “10 to Watch in 2014” by Rep. magazine and wealthmanagement.com. Ms Fuhr won the award for the Greatest Overall Contribution to the development of the Global ETF industry in the ExchangeTradedFunds.com survey in 2011 and 2008 and received an award for her contribution to the ETF sector at the annual closed end funds and ETF event in New York and was featured in the Investors Chronicle’s list of “150 people that can make you money” in 2010.

Deborah Fuhr is a founder and board member of Women in ETFs “WE” the first women’s group for the ETF industry. Founded in January 2014, WE is a non-profit organization that brings together over 5,600 members, including women and men, in chapters in major financial centers around the world to CONNECT, SUPPORT and INSPIRE. WE achieves this by organizing events at our chapters globally that support our goals of education, networking, philanthropy, and idea sharing across the industry and beyond. For more information, visit: www.womeninetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]() www.ETFtv.net

www.ETFtv.net

Women in ETFs ![]()

![]()