Happy 20th anniversary to the ETF industry in Europe

LONDON —April 28, 2020 —April 2020 marks the 20thanniversary of the listing of the first ETFs to be listed in Europe. The LDRS DJ STOXX 50 and LDRS DJ EUROSTOXX 50 sponsored by Merrill Lynch were listed on 11 April 2000 on the Deutsche Borse, closely followed by the listing of the iShares FTSE 100 ETF on the London Stock Exchange on April 28, 2000. The LDRS ‘leaders’ were acquired by Barclays Global Investors from Merrill Lynch in September 2003 and their names were changed to iShares DJ STOXX 50 and iShares DJ EUROSTOXX 50.

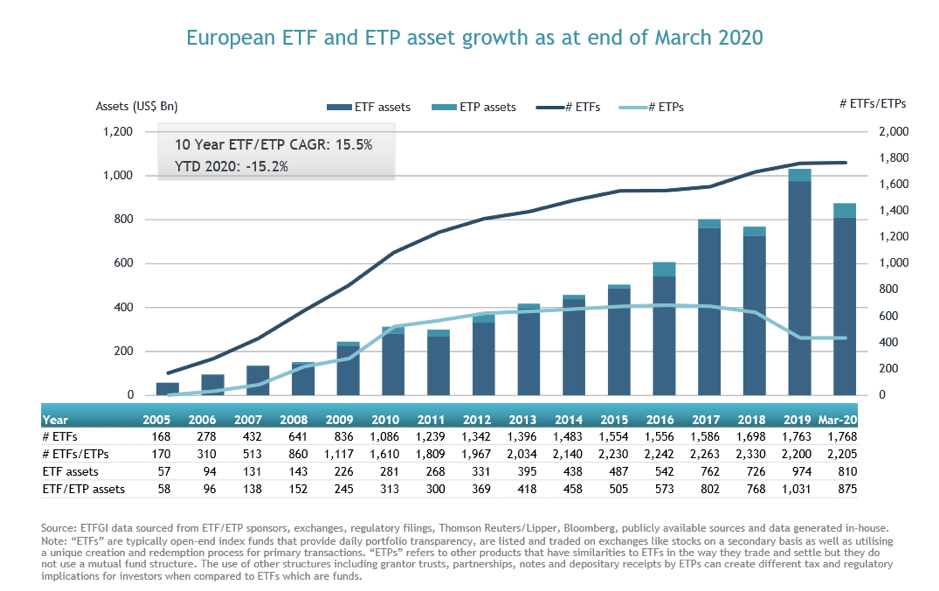

Assets invested in ETFs and ETPs listed in Europe broke through the $1 trillion milestone at the end 2019. The European ETFs/ETPs industry had 2,198 ETFs/ETPs, with 8,401 listings, assets of US$1.027 trillion, from 70 providers listed on 27 exchanges at the end of 2019.

ETFs and ETPs listed in Europe reported net outflows of US$22.83 billion at the end of March, bringing year-to-date net outflows to US$1.63 billion. Assets invested in the European ETFs/ETPs industry have decreased from US$1.027 at the end 2019, to US$874.87 billion, according to ETFGI's March 2020 European ETFs and ETPs industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

The ETF product evolution has shaped the profile of ETFs and ETPs users, initially appealing to equity-focused investors and evolving over time to multi-asset class and fixed income and commodity specialists. Today, slightly more than half of all ETFs and ETPs in Europe provide exposure to equity indices and account for 60% of all assets. Fixed Income products now account for 28% of assets, 10% of assets are in products providing exposure to commodities while 1% of the asset are in Active strategies.

ETFs are uniquely the only democratic investment product being used by institutional investors, financial advisors and retail investors.

Top ten benefits of ETFs:

- ETFs are UCITS funds

- Transparency– a key defining feature; all holdings are published daily

- Cost effective– ETFs do not have sales loads and most have lower fees than other products offering similar exposure

- Flexibility– ETFs trade and settle like stock, have intraday pricing and trading, allow stop and limit orders, can be bought in increments of one share and can be used to go long or short

- Diversification– instant, low cost exposure to entire benchmarks in a single trade

- Liquidity– there are two sources: secondary, which is volume on an exchange; and primary, which is due to the creation/redemption process. Generally, an ETF is as liquid as its underlying components; however, the spreads of larger funds may be tighter than those of their individual holdings in the secondary market

- Investment objectives– ETFs suit a variety of uses and can be tools for long-term strategic core positions, short-term tactical allocations, and over- and underweighting holdings

- Cash management– including cash equitisation, manager transitions, tax loss harvesting

- Risk management – employing ETFs to hedge positions, avoid stock- and market-specific risks

- Derivatives alternative– for institutional investors unable to include derivatives in their portfolios, ETFs are an attractive alternative.

The use of ETFs will continue to grow across Europe and around the world. Many investors view ETFs as a tool or a solution to assist them in managing their investment management ad asset allocation work. New ETFs are being developed to address investor needs for exposure to ESG, thematic, disruptive trends, and fixed income.

Drivers of growth

- Product features: easy to use; liquid; transparent; cost efficient access.

- Growth in indexing.

- Access to markets and asset classes that were otherwise not easily available.

- Growth in new products: new asset classes; new market segments; new benchmarks; and actively managed ETFs.

- Growth in users: institutional; financial advisors, retail, ETF strategists and robo-advisors.

- Expansion to new markets with local products, registrations and cross-listings.

- UCITS ETFs are increasingly being used by investors across Europe, in Asia and Latin America.

By Deborah Fuhr

Managing Partner, Founder

ETFGI

This commentary is published by, and remains the copyright of, ETFGI LLP ("ETFGI"). This commentary June only be used by the permitted recipients and shall not be provided to any third parties. ETFGI makes no warranties or representations regarding the accuracy or completeness of the information contained in this commentary.

ETFGI does not offer investment advice or make recommendations regarding investments and nothing in this commentary shall be deemed to constitute financial or investment advice in any way and shall not constitute a regulated activity for the purposes of the Financial Services and Markets Act 2000. Further, nothing in this commentary shall constitute or be deemed to constitute an invitation or inducement to any person to engage in investment activity. Should you undertake any such activity based on information contained in this commentary, you do so entirely at your own risk and ETFGI shall have no liability whatsoever for any loss, damage, costs or expenses incurred or suffered by you as a result.