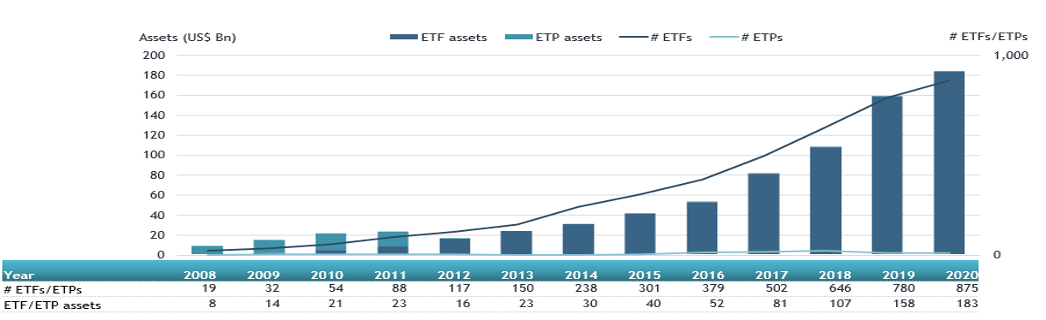

ETFGI reports that assets invested in actively managed ETFs and ETPs reached a new record high of US$182.72 billion at the end of June 2020

LONDON — July 24, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs and ETPs saw net inflows of US$7.04 billion during June, bringing year-to-date net inflows to US$26.69 billion which is significantly more than the US$16.41 billion gathered at this point in 2019. Assets invested in actively managed ETFs/ETPs finished the month up to 8.1%, from US$168.98 billion at the end of May to US$182.72 billion a new record, according to ETFGI's June 2020 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets in actively managed ETFs/ETPs reached a new record high of $182.72 Bn at the end of June.

- YTD net inflows of $26.69 Bn are significantly more than the $16.41 Bn gathered at this point in 2019

- Actively managed fixed Income ETFs/ETPs account for 67.4% of overall assets followed by 27.1% in equity products.

“The S&P 500 gained 1.99% during June. In Q2, U.S. equities staged a recovery from the Q1’s decline. Although Covid cases in the U.S. are still increasing the stimulus from the Fed and Congress, aided the market rebound. During June developed markets outside the U.S. were up 3.44% and up 16.8% in Q2. In June Hong Kong (up 11.35%), New Zealand (up 10.09%) Netherlands (up 8%) and Germany (up 6.08%) as the top performers. Emerging markets gained 7.6% in June and are up 19.3% in Q2.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Growth in actively managed ETF and ETP assets as of the end of June 2020

Fixed Income focused actively managed ETFs/ETPs listed globally gathered net inflows of $4.82 BN during June, bringing net inflows for the year to June to $14.38 BN, more than the $12.88 Bn in net inflows Fixed Income products attracted for the year to June 2019. Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $1.89 Bn during June, bringing net inflows for the year to June 2020 to $10.35 Bn, greater than the $3.25 Bn in net inflows equity products had attracted for the year to June 2019.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$6.41 billion during June. JPMorgan Ultra-Short Income ETF gathered $1.36 billion alone.

Top 20 actively managed ETFs/ETPs by net new assets June 2020

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

12,782.38 |

2,508.79 |

1,364.38 |

|

iShares Liquidity Income ETF |

ICSH US |

3874.66 |

1,230.48 |

828.42 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

13,877.35 |

209.12 |

610.25 |

|

ARK Innovation ETF - Acc |

ARKK US |

4,766.14 |

1,694.89 |

583.61 |

|

HSBC Multi Factor Worldwide Equity UCITS ETF |

HWWA LN |

770.52 |

422.41 |

408.76 |

|

PIMCO US Dollar Short Maturity ETF |

MINT LN |

3,865.51 |

23.78 |

390.16 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

2,762.35 |

1,409.03 |

272.36 |

|

Franklin Liberty US Treasury Bond ETF |

FLGV US |

245.39 |

243.64 |

243.64 |

|

Janus Short Duration Income ETF - Acc |

VNLA US |

1,782.25 |

712.60 |

212.92 |

|

Franklin Liberty Investment Grade Corporate ETF - Acc |

FLCO US |

905.00 |

302.72 |

210.65 |

|

ARK Web x.O ETF - Acc |

ARKW US |

1,280.27 |

503.74 |

192.16 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

5,593.03 |

1,661.14 |

178.27 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

469.72 |

17.34 |

159.28 |

|

Invesco Ultra Short Duration ETF |

GSY US |

2,535.92 |

201.95 |

146.13 |

|

ARK Genomic Revolution Multi-Sector ETF - Acc |

ARKG US |

1,318.73 |

473.11 |

124.23 |

|

Hartford Core Bond ETF |

HCRB US |

136.01 |

134.95 |

114.85 |

|

American Century Focused Dynamic Growth ETF |

FDG US |

130.75 |

124.95 |

109.51 |

|

BetaShares Australian Strong Bear Hedge Fund |

BBOZ AU |

310.98 |

292.92 |

97.46 |

|

Fidelity Limited Term Bond ETF |

FLTB US |

232.09 |

91.40 |

85.92 |

|

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF |

PDBC US |

2,108.63 |

802.48 |

78.92 |

Investors have tended to invest in Fixed Income actively managed ETFs/ETPs during June.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

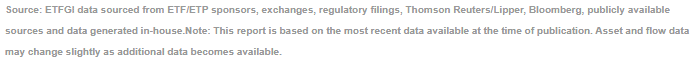

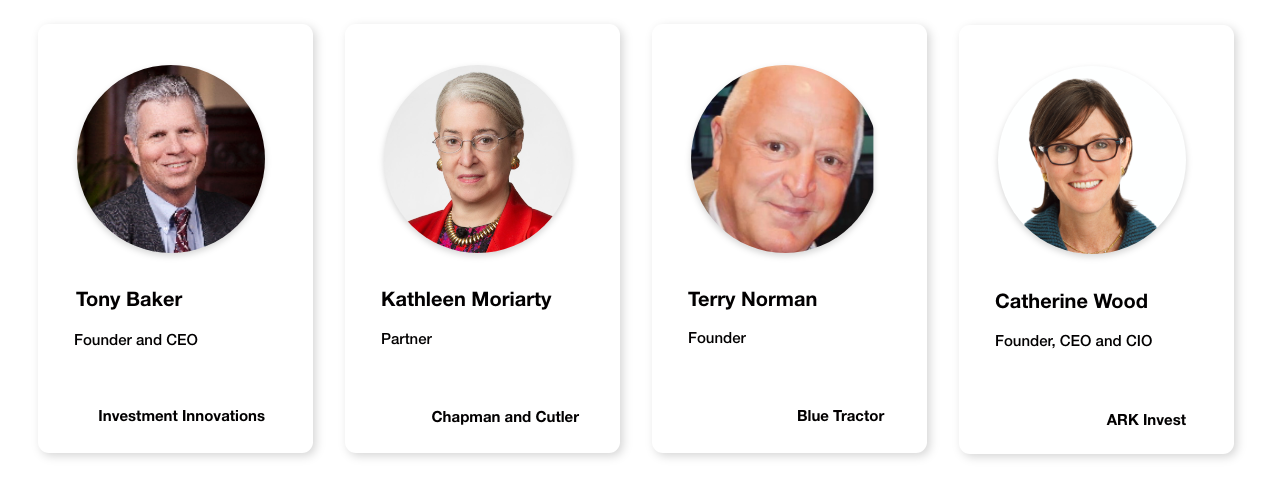

ETFGI Global ETFs Insights Summit is happening virtually on July 28, 29, 30th from 2:00 - 5:30 pm EDT!

Register now to join the discussions at our Global ETFs Insights Summit virtual event from 2:00 - 5:30 pm EDT on the afternoons of July 28, 29, and 30th. The event is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the use of ETFs.

The event will provide the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, virtual event booths where you can meet and speak with our sponsors, virtual networking, attend virtual happy hours, and receive physical promotional items from our sponsors for qualified buy side investors.

Register now to join us! Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors.

We are very excited about this year's event. To learn more about the An Investigation of Semi- Non-transparent Active ETFs register to attend our event and join the panel discussion on Tue July 28th.

An Investigation of Semi-Non-transparent Active ETFs

- Discussing and comparing the existing / proposed models

- What types of products are likely to be launched?

- Will we see conversions of existing mutual funds?

Keynotes with: Alex Matturri, Anna Paglia, Rick Redding, and Jim Ross

Register now to join us!

Stay tuned for details on future events planned for London on October 21-22, Hong Kong/Asia on November 3-4 and Toronto on December 2-3.

###

New Episode 33 of ETF TV - Investors’ confidence in fixed income ETFs is significant

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com