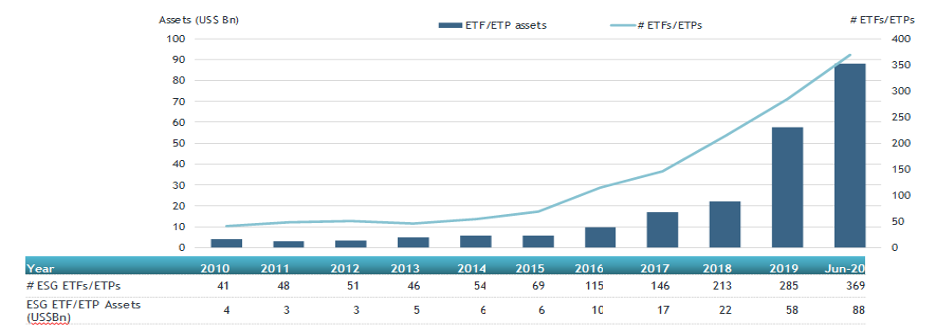

ETFGI reports assets invested in ESG (Environmental, Social, and Governance) ETFs and ETPs listed globally reached a new record of 88 billion US dollars at end of June 2020

LONDON — July 22, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ESG (Environmental, Social, and Governance) ETFs and ETPs listed globally gathered net inflows of US$3.49 billion during June, bringing year-to-date net inflows to US$32.02 billion which is significantly more than the US$9.86 billion gathered at this point last year. Assets invested in ESG ETFs and ETPs increased by 7.3% from US$82 billion at the end of May 2020 to reach US$88 billion a new record at the end of June, according to ETFGI’s June 2020 ETF and ETP ESG industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets invested in ESG ETFs and ETPs listed globally reached a new record of $88 Bn.

- $32.02 Bn of net inflows into ESG ETFs/ETPs listed globally is significantly greater than the $9.86 Bn at this point in 2019

- Products domiciled in Europe account for 50.9% of overall ESG assets followed by those in the US with 40.5% and then Asia Pacific ex Japan with 5.8% of the assets

“The S&P 500 gained 1.99% during June. In Q2, U.S. equities staged a recovery from the Q1’s decline. Although Covid cases in the U.S. are still increasing the stimulus from the Fed and Congress, aided the market rebound. During June developed markets outside the U.S. were up 3.44% and up 16.8% in Q2. In June Hong Kong (up 11.35%), New Zealand (up 10.09%) Netherlands (up 8%) and Germany (up 6.08%) as the top performers. Emerging markets gained 7.6% in June and are up 19.3% in Q2.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products have increased steadily, the Global ESG ETF/ETP industry had 369 ETFs/ETPs, with 1,019 listings, assets of $88 Bn, from 89 providers on 31 exchanges in 25 countries. During June, 21 new ESG ETFs/ETPs were launched.

Global ESG ETF and ETP asset growth as at end of June 2020

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $2.67 Bn at the end of June, CSIF IE MSCI USA ESG Leaders Blue UCITS ETF - Acc (USESG SW) gathered

$321.29 Mn.

Top 20 ESG ETFs/ETPs by net new assets June 2020

|

Name |

Ticker |

Assets (US$ Mn) Jun-20 |

NNA (US$ Mn) YTD-20 |

NNA (US$ Mn) Jun-20 |

|

CSIF IE MSCI USA ESG Leaders Blue UCITS ETF - Acc |

USESG SW |

753.82 |

667.34 |

321.29 |

|

Nuveen ESG Large-Cap Value ETF - Acc |

NULV US |

451.75 |

346.10 |

258.82 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

2776.07 |

938.50 |

247.99 |

|

Ossiam Euro Government Bonds 3-5y Carbon Reduction UCITS ETF |

OG35 GY |

230.76 |

220.50 |

220.50 |

|

iShares ESG MSCI EAFE ETF |

ESGD US |

2443.39 |

1091.31 |

184.12 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc - Acc |

SUSW LN |

1329.79 |

667.64 |

165.55 |

|

CSIF IE FTSE EPRA NAREIT Developed Green Blue UCITS ETF - Acc |

GREIT SW |

104.70 |

104.70 |

104.70 |

|

iShares MSCI Europe SRI UCITS ETF - Acc |

IESG LN |

1845.00 |

784.08 |

104.51 |

|

Amundi MSCI USA ESG Leaders Select UCITS ETF DR - Acc |

SADU GY |

127.18 |

129.07 |

101.67 |

|

iShares MSCI EMU ESG Screened UCITS ETF - Acc - Acc |

SAUM LN |

934.51 |

138.11 |

101.67 |

|

Vanguard ESG US Stock ETF |

ESGV US |

1537.07 |

648.92 |

101.03 |

|

AMUNDI INDEX MSCI EUROPE SRI - UCITS ETF DR (C) - Acc |

EUSRI FP |

925.34 |

657.90 |

99.87 |

|

Xtrackers MSCI World ESG UCITS ETF - 1C - Acc |

XZW0 LN |

495.87 |

357.21 |

97.59 |

|

Xtrackers II ESG EUR Corporate Bond UCITS ETF DR |

XB4F GY |

653.25 |

205.41 |

97.27 |

|

UBS ETF (LU) MSCI World Socially Responsible UCITS ETF (USD) A-dis |

UIMM GY |

1988.80 |

573.75 |

87.80 |

|

UBS ETF (LU) MSCI Pacific Socially Responsible UCITS ETF (USD) A-dis |

UIMT GY |

569.44 |

91.97 |

79.02 |

|

UBS ETF (LU) - MSCI EMU Socially Responsible UCITS ETF (EUR) A-dis |

UIMR GY |

927.30 |

48.16 |

75.55 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

923.61 |

559.86 |

75.22 |

|

iShares MSCI USA Small-Cap ESG Optimized ETF |

ESML US |

275.07 |

172.85 |

75.14 |

|

UBS (Irl) ETF plc - MSCI ACWI Socially Responsible UCITS ETF EUR ACC - EUR Hdg |

AWSRIE SW |

390.57 |

92.39 |

74.37 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity.

Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

##

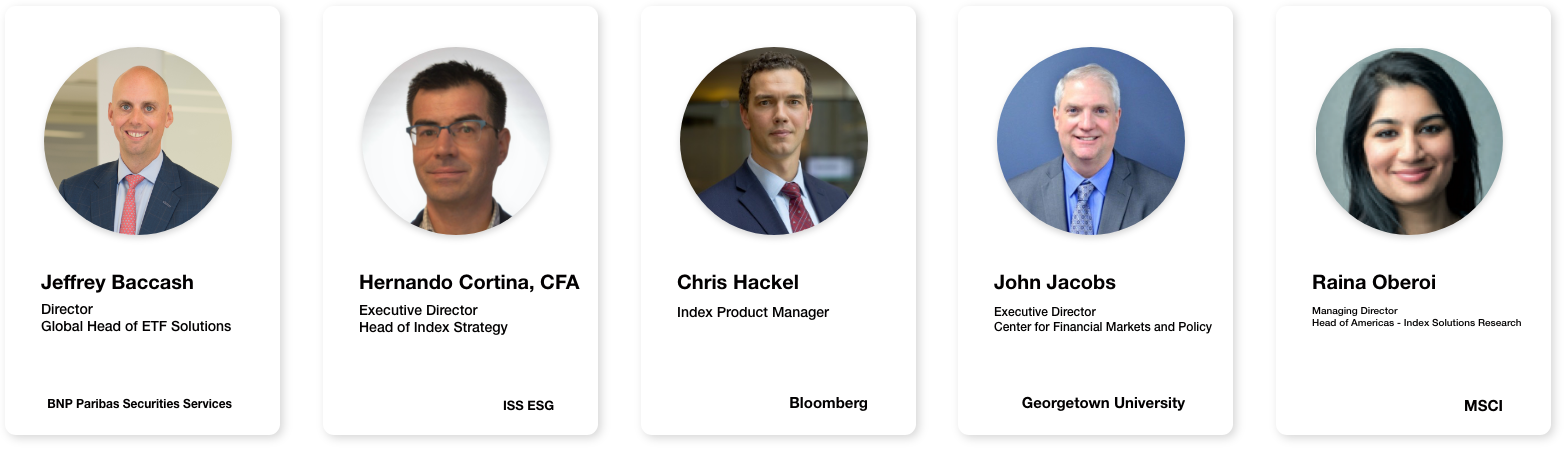

ETFGI Global ETFs Insights Summit is happening virtually on July 28, 29, 30th from 2:00 - 5:30 pm EDT!

Register now to join the discussions at our Global ETFs Insights Summit virtual event from 2:00 - 5:30 pm EDT on the afternoons of July 28, 29, and 30th. The event is designed to facilitate a substantive and in-depth discussion on the impact that ETFs have on markets and market structure, and the regulatory, trading, and technological developments impacting the use of ETFs.

The event will provide the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, virtual event booths where you can meet and speak with our sponsors, virtual networking, attend virtual happy hours, and receive physical promotional items from our sponsors for qualified buy side investors.

Register now to join us! Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors.

We are very excited about this year's event. To learn more about the Trends in ESG and Sustainable investing register to attend our event and join the panel discussion on Wed July 30th.

Trends in ESG and Sustainable Investing

- What is ESG, sustainable and impact investing?

- How are regulations impacting ETFs, indices and investment product development?

- Which investors are using ESG products and how are they being used?

Keynotes with: Alex Matturri, Anna Paglia, Rick Redding, and Jim Ross

Register now to join us!

Stay tuned for details on future events planned for London on October 21-22, Hong Kong/Asia on November 3-4 and Toronto on December 2-3.

###

New Episode 32 of ETF TV - Deborah Fuhr, ETFGI discusses global ETF flows in June and H1 2020

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com