ETFGI reports assets invested in ETFs and ETPs listed in Canada reached US$ 171.62 billion a new record at the end of July 2020

LONDON —August 28, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that assets invested in ETFs and ETPs listed in Canada reached US$ 171.62 billion a new record at the end of July. ETFs and ETPs listed in Canada gathered net inflows of US$4.58 billion during June, bringing year-to-date net inflows to US$21.40 billion which is significantly more than US$9.00 billion in net inflows gathered at this point in 2019 and nearly as much as the US$20.93 billion gathered in all of 2019. At the end of the month, Canadian ETF assets increased by 7.5%, from US$159.58 billion at the end of June to US$171.62 billion according to ETFGI's July 2020 Canadian ETF and ETP industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights:

- Assets invested in ETFs/ETPs listed in Canada reached a new record of $171.62 BN at the end of July.

- ETFs and ETPs listed in Canada gathered net inflows of $4.58 Bn during July the second highest monthly net inflow on record. February 2020 was the largest monthly net inflow with $6.28 Bn.

- YTD net inflows are $21.40 Bn which is significantly more than $9.00 Bn in net inflows gathered at this point in 2019 and nearly as much as the $20.93 Bn gathered in all of 2019.

“The S&P 500 gained 5.6% in July, aided by the U.S. Federal Reserve stimulus and strong earnings. International markets also gained, with Developed Ex-U.S. and Emerging up 3.0% and 8.5%, respectively. In the developed markets Scandinavian countries benefited most, led by Norway (up 10.8%) and Sweden (up 10.1%); while Japan (down 2.0%) was the sole negative performer among developed countries. Dollar weakness contributed toward the positive momentum in Emerging markets where 19 of 25 countries gained, led by Brazil (up 14.4%) and Pakistan (up 13.4%), while Taiwan (up 12.1%) neared an all-time high.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of July 2020, the Canadian ETF industry had 812 ETFs, with 984 listings, assets of US$172 Bn, from 36 providers listed on 2 exchanges.

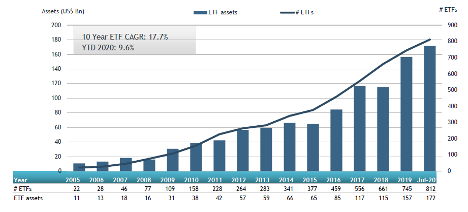

Growth in Canadian ETF and ETP assets as of the end of July 2020

ETFs and ETPs listed in Canada gathered net inflows of $4.58 Bn in July. Year to date, net inflows stand at $21.40 Bn. At this point last year there were net inflows of $9.00 Bn. Equity ETFs/ETPs gathered net inflows of $1.37 Bn over July, bringing net inflows for the year to $10.93 Bn, much higher than the $1.01 Bn in net inflows Equity products had attracted for the year to July 2019. Active ETFs/ETPs attracted net inflows of $2.18 Bn over the month, gathering net inflows YTD of $6.89 Bn, greater than the $4.98 Bn in net inflows Active products had reported for the year to July 2019. Fixed Income ETFs/ETPs had net inflows of $889 Mn during July, bringing net inflows for the year to July 2020 to $2.79 Bn, slightly higher than the $2.77 Bn in net inflows Fixed Income products had attracted by the end of July 2019. Commodity ETFs/ETPs accumulated net inflows of $85 Mn in July. Year to date, net inflows are at $406 Mn, compared to net inflows of $44 Mn over the same period last year.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $3.74 Bn during July. NBI Unconstrained Fixed Income ETF (NUBF CN) gathered $1.21 Bn alone.

Top 20 ETFs by net new assets July 2020: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

NUBF CN |

1,215.61 |

1,218.25 |

1,214.37 |

|

|

iShares S&P/TSX 60 Index Fund |

XIU CN |

6,834.40 |

450.45 |

441.40 |

|

iShares S&P 500 Index ETF |

XUS CN |

2,287.35 |

683.04 |

437.98 |

|

Manulife Multifactor Developed International Index ETF |

MINT/B CN |

294.20 |

166.17 |

167.82 |

|

BMO Aggregate Bond Index ETF |

ZAG CN |

3,825.15 |

(296.93) |

151.85 |

|

iShares Global Government Bond Index ETF Cad Hedged |

XGGB CN |

205.37 |

162.68 |

147.30 |

|

TD S&P/TSX Capped Composite Index ETF |

TTP CN |

500.19 |

185.25 |

139.88 |

|

Manulife Multifactor Emerging Markets Index Etf |

MEME/B CN |

215.00 |

138.02 |

138.02 |

|

CI First Asset Gold Giants Covered Call ETF |

CGXF CN |

343.86 |

217.47 |

120.97 |

|

TD Canadian Aggregate Bond Index ETF |

TDB CN |

460.97 |

234.26 |

90.99 |

|

High Interest Savings Account Fund |

HISA CN |

253.52 |

195.54 |

87.01 |

|

iShares Core Canadian Universe Bond Index ETF |

XBB CN |

3,567.16 |

409.47 |

82.55 |

|

Mackenzie Canadian Equity Index ETF |

QCN CN |

177.88 |

144.98 |

74.97 |

|

TD Global Technology Leaders Index ETF |

TEC CN |

177.07 |

129.35 |

70.52 |

|

BMO Mid Provincial Bond Index ETF |

ZMP CN |

537.23 |

63.09 |

67.97 |

|

BMO Ultra Short-Term Bond ETF |

ZST CN |

541.25 |

47.82 |

65.16 |

|

Horizons Cash Maximizer ETF - Acc |

HSAV CN |

361.49 |

355.86 |

65.03 |

|

iShares Gold Bullion Fund - CAD Hdg |

CGL CN |

694.75 |

245.85 |

63.22 |

|

BMO Laddered Preferred Share Index ETF |

ZPR CN |

1,468.12 |

36.14 |

61.12 |

|

CI High Interest Savings Fund |

CSAV CN |

1,864.32 |

782.22 |

55.51 |

Investors have tended to invest in Active ETFs during July.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

The ETFGI Global ETFs Insights Summit - Latin America is designed to facilitate a substantive and in-depth discussion on the market structure, regulatory, tax, trading, and technological developments impacting the use of and opportunity for local, US domiciled and European UCITS ETFs by investors in the main countries in Latin America.

Drivers of growth in the use of ETFs include a growing middle class, desire to diversity investments, increase in pension savings, and the use of third-party investment products by pension funds and insurance companies and changing regulatory landscape.

The event is designed for ETF issuers, brokerage firms, and others in the ETF ecosystem globally that are interested in understanding how to tap into the growing interest in ETFs in Latin America.

Panels will discuss the current and future use of ETFs by various types of investors and the regulatory requirements for local ETFs, US domiciled and European UCITS ETFs to be marketed, sold, and bought in Mexico, Brazil, Chile, Columbia, Peru, Uruguay, and Costa Rica.

As for all our virtual events, attendees will have the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, visit virtual event booths where they can meet and speak with our sponsors and attend virtual networking sessions.

CPD educational credits are offered to buy side institutional investors and financial advisors.

ETFGI has announced the dates for the upcoming events:

- Latin America - Oct 19 - Register now

- Asia Pacific - Oct 28-29

- Europe - Nov 17-18

- Canada - Nov 30 - Dec 1

- ESG & Active - TBC

- Visit our website www.etfgi.com to register to receive our press releases

Upcoming Industry Events:

22nd September 2020 - Join us for our virtual event with leading women in finance: «How will current factors impact the future of investing?» The virtual event will be hosted by ETF pioneer Deborah Fuhr, Managing Partner & Founder of ETFGI. She will give her views on trends in the industry. This will be followed by an expert panel with Karin Russell-Wiederkehr, Institutional Sales and Trading at Jane Street, Anna Paglia, Global Head of ETFs & Indexed Strategies at Invesco and Maria Lombardo, Head of ESG Client Strategy EMEA at Invesco.

NEW ETF TV Episode 36 - July continues to see significant inflows into the ETF market

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com