ETFGI reports assets invested in Leverage and Inverse ETFs and ETPs listed globally reached a record US$89.64 billion at the end of July 2020

LONDON — August 28, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported that assets invested in Leverage and Inverse ETFs and ETPs listed globally reached a record US$89.64 billion at the end of July. Leveraged and Inverse ETFs and ETPs gathered net inflows of US$203 million during July and YTD gathered net inflows of US$20.56 billion which is significantly more than the YTD net outflows of US$3.4 billion during 2019 and the full year 2019 net outflows of US$4.13 billion, according to ETFGI’s July 2020 Leveraged and Inverse ETF and ETP industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Leverage and Inverse ETFs and ETPs listed globally reach a record $89.64 Bn at end of July.

- YTD Leverage and Inverse ETFs and ETPs listed globally gathered net inflows of $20.56 Bn which is significantly more than the YTD net outflows of US$3.4 Bn during 2019 and the full year 2019 net outflows of US$4.13 Bn.

“The S&P 500 gained 5.5% during July. Totally the market is 1.25% up during the first month of Q3 which overcome the historical collapse of pandemic. During July the tech giants achieved again a great month. Developed markets outside the U.S. were up 3.04%. In July, the three Scandinavian countries Norway (up 10.78), Sweden (up 10.11) and Finland (up 9.18) were the leaders. Emerging markets gained 8.47% in July and are up 19.86% in Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

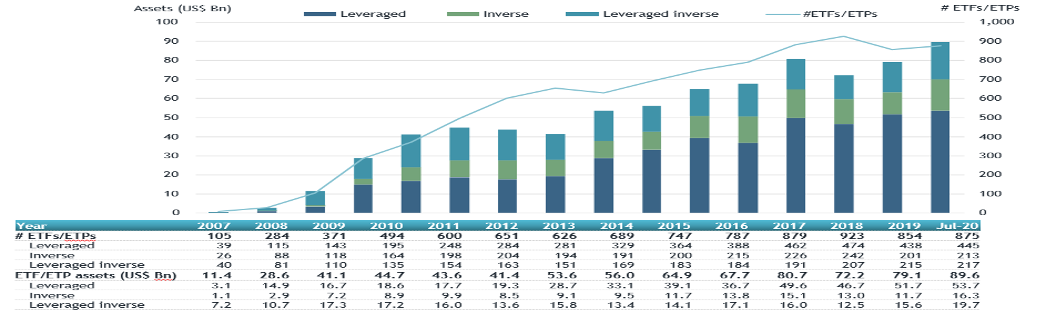

At the end of July 2020, the Global leveraged/inverse ETF/ETP industry had 875 ETFs/ETPs. Of these 875 ETFs/ETPs, 445 were leveraged products, while 213 were inverse listings, and 217 were Leveraged/Inverse.

Global leveraged/inverse ETF and ETP asset growth as at the of end of July 2020

The majority of assets were invested in Leveraged ETFs/ETPs with $53.7 billion, followed by Leveraged/Inverse products with assets of $19.7 billion and Inverse with $16.3 billion.

The largest market for leveraged and inverse ETFs/ETPs is the United States, which, at the end of July 2020, had assets of $54 Bn invested in 243 ETFs/ETPs.

The Samsung KODEX 200 Futures Inverse 2X ETF – Acc gathered $2.22 Bn alone, the largest net inflow year-to-date to July.

Top 20 ETFs/ETPs by YTD net new assets July 2020: Leveraged and Inverse

|

Name |

Country Listed |

Ticker |

Assets |

ADV |

NNA |

Leverage |

|

Samsung KODEX 200 Futures Inverse 2X ETF - Acc |

South Korea |

252670 KS |

2,178.32 |

680.69 |

2,223.14 |

Leveraged Inverse |

|

ProShares Short S&P500 |

US |

SH US |

3,045.25 |

252.50 |

1,995.46 |

Inverse |

|

ProShares Ultra DJ-UBS Crude Oil |

US |

UCO US |

1,431.82 |

208.68 |

1,686.90 |

Leveraged |

|

ProShares UltraPro Short QQQ |

US |

SQQQ US |

1,257.48 |

704.28 |

1,625.64 |

Leveraged Inverse |

|

ProShares UltraPro Short S&P 500 |

US |

SPXU US |

1,050.88 |

340.53 |

1,488.12 |

Leveraged Inverse |

|

YUANTA Daily Taiwan Top 50 -1X Bear ETF |

Taiwan |

00632R TT |

3,014.89 |

57.44 |

1,398.81 |

Inverse |

|

Direxion Daily S&P 500 Bear 3X Shares |

US |

SPXS US |

903.72 |

259.79 |

1,288.58 |

Leveraged Inverse |

|

NEXT NOTES Nikkei JPX Leveraged Crude Oil ETN - Acc |

Japan |

2038 JP |

1,541.82 |

22.80 |

1,282.41 |

Leveraged |

|

VelocityShares 3x Long Crude Oil ETN - Acc |

US |

UWT US |

0.00 |

0.00 |

1,201.97 |

Leveraged |

|

Yuanta S&P GSCI Crude Oil 2X Leveraged ER Futures ETF - Acc |

Taiwan |

00672L TT |

114.57 |

1.63 |

1,104.03 |

Leveraged |

|

ProShares UltraPro Short Dow30 |

US |

SDOW US |

669.60 |

286.54 |

872.43 |

Leveraged Inverse |

|

NEXT FUNDS Nikkei 225 Double Inverse Index Exchange Traded Fund - Acc |

Japan |

1357 JP |

3,427.19 |

413.67 |

848.08 |

Leveraged Inverse |

|

ProShares UltraShort S&P500 |

US |

SDS US |

1,270.59 |

255.49 |

831.38 |

Leveraged Inverse |

|

Direxion Daily Financial Bull 3x Shares |

US |

FAS US |

1,537.70 |

133.16 |

828.34 |

Leveraged |

|

Direxion Daily Small Cap Bear 3x Shares |

US |

TZA US |

664.08 |

589.61 |

737.05 |

Leveraged Inverse |

|

Samsung KODEX Inverse ETF |

South Korea |

114800 KS |

971.60 |

176.99 |

663.61 |

Inverse |

|

Direxion Daily S&P Oil & Gas Exp. & Prod. Bull 2X Shares |

US |

GUSH US |

456.83 |

117.17 |

593.98 |

Leveraged |

|

Direxion Daily MSCI Brazil Bull 2x Shares |

US |

BRZU US |

202.00 |

32.32 |

475.82 |

Leveraged |

|

NEXT FUNDS Nikkei 225 Inverse Index ETF |

Japan |

1571 JP |

739.89 |

14.53 |

459.07 |

Inverse |

|

NEXT FUNDS Nikkei 225 Leveraged Index ETF |

Japan |

1570 JP |

2,003.72 |

1,130.75 |

447.18 |

Leveraged |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

The ETFGI Global ETFs Insights Summit - Latin America is designed to facilitate a substantive and in-depth discussion on the market structure, regulatory, tax, trading, and technological developments impacting the use of and opportunity for local, US domiciled and European UCITS ETFs by investors in the main countries in Latin America.

Drivers of growth in the use of ETFs include a growing middle class, desire to diversity investments, increase in pension savings, and the use of third-party investment products by pension funds and insurance companies and changing regulatory landscape.

The event is designed for ETF issuers, brokerage firms, and others in the ETF ecosystem globally that are interested in understanding how to tap into the growing interest in ETFs in Latin America.

Panels will discuss the current and future use of ETFs by various types of investors and the regulatory requirements for local ETFs, US domiciled and European UCITS ETFs to be marketed, sold, and bought in Mexico, Brazil, Chile, Columbia, Peru, Uruguay, and Costa Rica.

As for all our virtual events, attendees will have the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, visit virtual event booths where they can meet and speak with our sponsors and attend virtual networking sessions.

CPD educational credits are offered to buy side institutional investors and financial advisors.

ETFGI has announced the dates for the upcoming events:

- Latin America - Oct 19 - Register now

- Asia Pacific - Oct 28-29

- Europe - Nov 17-18

- Canada - Nov 30 - Dec 1

- ESG & Active - TBC

- Visit our website www.etfgi.com to register to receive our press releases

Upcoming Industry Events:

22nd September 2020 - Join us for our virtual event with leading women in finance: «How will current factors impact the future of investing?» The virtual event will be hosted by ETF pioneer Deborah Fuhr, Managing Partner & Founder of ETFGI. She will give her views on trends in the industry. This will be followed by an expert panel with Karin Russell-Wiederkehr, Institutional Sales and Trading at Jane Street, Anna Paglia, Global Head of ETFs & Indexed Strategies at Invesco and Maria Lombardo, Head of ESG Client Strategy EMEA at Invesco.

NEW ETF TV Episode 36 - July continues to see significant inflows into the ETF market

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com