ETFGI reports assets invested in ETFs and ETPs listed globally broke through the $7 trillion milestone at the end of August 2020

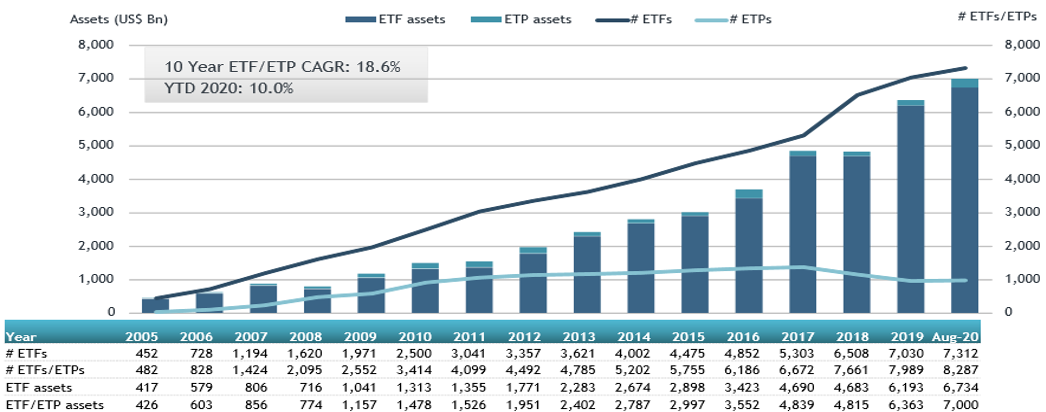

LONDON —September 9, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports today that assets invested in ETFs and ETPs listed globally broke through the $7 trillion milestone at the end of August. During the month ETFs and ETPs listed globally gathered net inflows of US$55.18 billion, bringing year-to-date net inflows to US$428.25 billion which is significantly higher than the US$272.62 billion gathered at this point last year. Assets invested in the global ETFs/ETPs industry have increased by 5.1%, from US$6.66 trillion at the end of July 2020, to US$7 trillion at the end of August, according to ETFGI's August 2020 Global ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed globally broke through the $7 trillion milestone at the end of August

- August marks the 15th month of net inflows

- During August ETFs and ETPs listed globally gathered net inflows of $55.18 billion

- year-to-date net inflows are $428.25 billion which is significantly higher than the US$272.62

- Equity products attracted $24.82 billion the majority net inflows during August.

“The S&P 500 enjoyed its best August since 1986, gaining 7.2% in the month and up 9.7% year to date. The 24 developed ex-U.S. markets were all up for the month with the index up 5.5% - Norway (up 8.9%) and Japan (up 7.9%) gained most, while Iberian countries Spain (up 1.9%) and Portugal (up 0.2%) gained least. Emerging markets gained 2.7% in August, with the U.S. dollar weakness and virus responses impacting performance.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of August 2020

At the end of August 2020, the Global ETF/ETP industry had 8,287 ETFs/ETPs, with 16,495 listings, assets of $7 trillion, from 474 providers listed on 73 exchanges in 59 countries.

During August 2020, ETFs/ETPs gathered net inflows of $55.19 billion. Equity ETFs/ETPs listed globally reported net inflows of $24.82 billion during August, bringing net inflows for 2020 to $137.74 billion, significantly more than the

$87.63 billion in net inflows equity products had attracted YTD in 2019. Fixed income ETFs/ETPs listed globally gathered net inflows of $19.99 billion at the end of month, bringing net inflows for 2020 to $160.61 billion, higher than the $147.99 billion in net inflows fixed income products had attracted YTD in 2019. Active ETFs/ETPs reported $7.82 billion in net inflows bringing net inflows for 2020 to $43.24 billion, which is much greater than the $24.62 billion in net inflows reported through August 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $25.56 billion at the end of August, the iShares Core MSCI EAFE ETF (IEFA US) gathered $2.18 billion alone.

Top 20 ETFs by net new inflows August 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

72,029.90 |

2,484.19 |

2,178.90 |

|

Vanguard Total Bond Market ETF |

|

BND US |

60,517.97 |

9,261.02 |

2,164.41 |

|

Invesco QQQ Trust |

|

QQQ US |

140,246.24 |

14,662.32 |

2,086.58 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

164,828.02 |

14,188.55 |

2,000.53 |

|

Vanguard Short-Term Corporate Bond ETF |

|

VCSH US |

31,746.54 |

5,153.75 |

1,702.25 |

|

TOPIX Exchange Traded Fund |

|

1306 JP |

117,712.11 |

19,264.30 |

1,577.86 |

|

iShares TIPS Bond ETF |

|

TIP US |

23,648.50 |

1,274.46 |

1,309.64 |

|

iShares Russell 2000 ETF |

|

IWM US |

41,699.75 |

(4,210.72) |

1,201.11 |

|

ARK Innovation ETF - Acc |

|

ARKK US |

8,485.16 |

3,533.69 |

1,135.17 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

38,741.18 |

11,109.93 |

1,079.20 |

|

Xtrackers USD High Yield Corporate Bond ETF |

|

HYLB US |

6,258.76 |

2,225.55 |

1,025.56 |

|

Kamnd |

|

KMND1 |

1,969.92 |

1,926.75 |

984.96 |

|

iShares Edge MSCI USA Value Factor ETF |

|

VLUE US |

6,807.54 |

2,675.73 |

973.72 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

18,566.12 |

(1,783.19) |

966.70 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

24,658.10 |

6,167.06 |

962.31 |

|

Listed Index Fund TOPIX |

|

1308 JP |

54,280.59 |

10,222.77 |

899.20 |

|

Goldman Sachs ActiveBeta U.S. Large Cap Equity ETF - Acc |

|

GSLC US |

10,425.69 |

2,056.04 |

879.68 |

|

Vanguard Short-Term Bond ETF |

|

BSV US |

26,634.63 |

3,177.60 |

838.61 |

|

Utilities Select Sector SPDR Fund |

|

XLU US |

12,132.08 |

2,567.62 |

810.52 |

|

Industrial Select Sector SPDR Fund |

|

XLI US |

11,524.30 |

1,690.71 |

788.78 |

The top 10 ETPs by net new assets collectively gathered $3.40 billion in August. The iShares Gold Trust - Acc (IAU US) gathered $897.02 million alone.

Top 10 ETPs by net new inflows August 2020: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Gold Trust - Acc |

IAU US |

31798.01 |

8263.88 |

897.02 |

|

SPDR Gold Shares - Acc |

GLD US |

77588.80 |

20047.81 |

662.09 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13730.64 |

3967.50 |

314.30 |

|

SPDR Gold MiniShares Trust - Acc |

GLDM US |

3519.32 |

1841.26 |

296.42 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

1387.46 |

404.84 |

262.70 |

|

Xtrackers Physical Silver ETC (EUR) - Acc |

XAD6 GY |

1201.55 |

439.18 |

214.36 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN - Acc |

VXX US |

1039.23 |

(709.28) |

199.35 |

|

Aberdeen Physical Swiss Gold Shares - Acc |

SGOL US |

2793.50 |

1129.72 |

197.34 |

|

Invesco DB Agriculture Fund - Acc |

DBA US |

608.27 |

287.18 |

182.71 |

|

iShares Silver Trust - Acc |

SLV US |

15693.91 |

3801.93 |

169.74 |

Investors have tended to invest in Equity ETFs/ETPs during August.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

###

The ETFGI Global ETFs Insights Summits are designed to facilitate substantive and in-depth discussions around the impact that market structure and regulations have on ETF product development, due diligence, suitability, the use and trading, and technological developments have on ETFs and mutual funds in the respective jurisdictions.

Attendees will have the opportunity to see and hear speakers via live video and audio of the keynote and panel discussions with audience Q&A, visit virtual event booths where you can meet and speak with our sponsors, attend virtual happy hours, virtual networking sessions and receive physical promotional items from our sponsors for qualified buy side investors.

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors.

ETFGI has announced the dates for the upcoming events:

- Latin America - Oct 19 - Register now

- Asia Pacific - Oct 28-29

- Europe - Nov 17-18

- Canada - Nov 30 - Dec 1

- ESG & Active - TBC

- Visit our website www.etfgi.com to register to receive our press releases

Upcoming Industry Events:

22nd September 2020 - Join us for our virtual event with leading women in finance: «How will current factors impact the future of investing?» The virtual event will be hosted by ETF pioneer Deborah Fuhr, Managing Partner & Founder of ETFGI. She will give her views on trends in the industry. This will be followed by an expert panel with Karin Russell-Wiederkehr, Institutional Sales and Trading at Jane Street, Anna Paglia, Global Head of ETFs & Indexed Strategies at Invesco and Maria Lombardo, Head of ESG Client Strategy EMEA at Invesco.

NEW ETF TV Episode 38 - Jim Ross tackles some of the ETF industry’s biggest issues

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com