ETFGI reports assets invested in Active ETFs and ETPs reached a new record high of US$228.41 billion at the end of Q3 2020

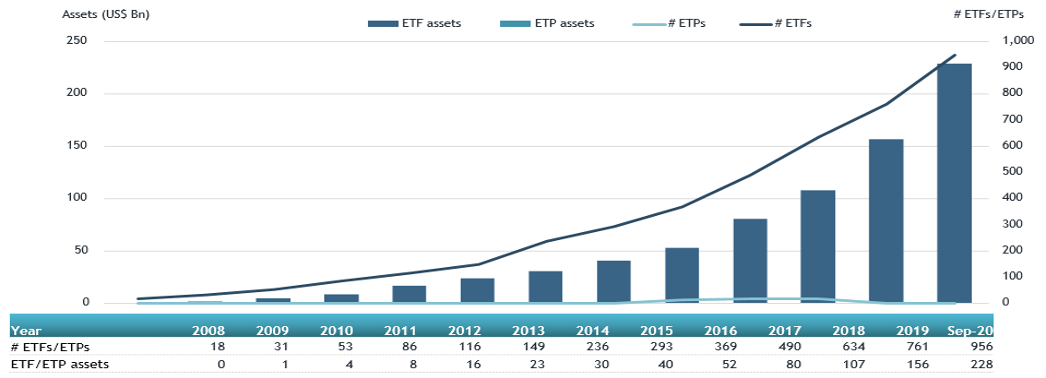

LONDON — October 27, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF and ETP ecosystem, reported today that active ETFs and ETPs gathered net inflows of US$8.24 billion during September, bringing year-to-date net inflows to a record US$51.48 billion which is significantly more than the US$29.41 billion gathered through Q3 2019 as well as the US$42.10 billion gathered in all of 2019. Assets invested in Active ETFs and ETPs increased 10.5% during September, reaching a new record of US$228.41 billion, according to ETFGI's September 2020 Active ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Active ETFs and ETPs reached a new record high of $228.41 billion at the end of Q3

- YTD net inflows are at a record $51.48 billion which is significantly more than the $29.41 billion gathered through Q3 2019 as well as the US$42.10 billion gathered in all of 2019

“The S&P 500 declined 3.8% in September, with concerns over back-to-school (and resulting COVID cases), U.S. elections and stimulus talks. Strong prior month gains boosted the index higher to close up 8.9% for Q3. Global equities declined 3.1% in September, as measured by the S&P Global BMI. Despite the monthly decline, the global benchmark managed to finish Q3 up 8.1% Q3 and up 0.7% YTD. Emerging markets, declined 2.2% in September but closed up 9.0% for Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of Q3, the Global active ETF/ETP industry had 956 ETFs/ETPs, with 1,199 listings, assets of $228 Bn, from 181 providers listed on 25 exchanges in 18 countries.

Growth in actively managed ETF and ETP assets as of the end of September 2020

In September, Active ETFs and ETPs gathered net inflows of $8.24 Bn. YTD through end of Q3, ETFs/ETPs saw net inflows of $51.47 Bn. Fixed Income focused Active ETFs/ETPs listed globally gathered net inflows of $5.25 billion during September, bringing net inflows through Q3 to $30.81 billion, more than the $22.74 billion in net inflows Fixed Income products had attracted through Q3 2019. Equity focused Active ETFs/ETPs listed globally attracted net inflows of $1.73 billion during September, bringing net inflows for the year through Q3 2020 to $16.39 billion, greater than the $5.89 billion in net inflows equity products had attracted for the year to Q3 2019.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $6.83 billion during September. Hwabao WP Cash Tianyi Listed Money Market Fund (511990 CH) gathered $2.27 billion alone.

Top 20 actively managed ETFs/ETPs by net new assets September 2020

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

511990 CH |

18,193.60 |

2,272.86 |

2,272.86 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

14,599.47 |

4,310.91 |

710.83 |

|

ARK Innovation ETF |

ARKK US |

8,871.34 |

4,208.00 |

674.31 |

|

Cabana Target Drawdown 10 ETF |

TDSC US |

473.59 |

476.65 |

476.65 |

|

iShares Liquidity Income ETF |

ICSH US |

4,713.79 |

2,069.44 |

338.70 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

3,950.56 |

2,569.31 |

317.16 |

|

Cabana Target Drawdown 7 ETF |

TDSB US |

310.81 |

312.65 |

312.65 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

6,158.46 |

2,190.63 |

286.67 |

|

Janus Short Duration Income ETF |

VNLA US |

2,442.56 |

1,296.57 |

209.06 |

|

Cabana Target Drawdown 13 ETF |

TDSD US |

162.43 |

162.94 |

162.94 |

|

Innovator S&P 500 Power Buffer ETF |

PSEP US |

221.77 |

201.98 |

159.81 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

2,308.55 |

1,119.33 |

134.22 |

|

Invesco Ultra Short Duration ETF |

GSY US |

2,980.92 |

166.64 |

116.24 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

693.40 |

544.15 |

109.59 |

|

USAA Core Short-Term Bond ETF |

USTB US |

214.58 |

118.62 |

108.57 |

|

ARK Fintech Innovation ETF |

ARKF US |

674.06 |

479.89 |

103.15 |

|

PIMCO Total Return Active Exchange-Traded Fund |

BOND US |

3,724.38 |

696.56 |

101.22 |

|

Cambria Tail Risk ETF |

TAIL US |

407.21 |

331.12 |

80.49 |

|

Quadratic Interest Rate Volatility and Inflation ETF |

IVOL US |

570.15 |

474.22 |

76.62 |

|

Cabana Target Drawdown 16 ETF |

TDSE US |

75.52 |

75.72 |

75.72 |

Investors have tended to invest in Fixed Income actively managed ETFs/ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Last chance, Register now to attend the ETFGI Global ETFs Insights Summit - Asia Pacific, a virtual event on October 28 & 29 from 2:00pm to 5:30pm HKT!

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. Register Here

Attendees will have the opportunity to see and hear speakers via video and audio of the keynote and panel discussions with audience Q&A and visit virtual event booths where you can meet and speak with our sponsors.

Exciting line up of speakers, topics, and virtual networking!

Speakers will include:

- Eva Chan, Partner, Simmons & Simmons

- Grace Chong, Of Counsel, Simmons & Simmons JWS

- Sean Cunningham, Asia Head of ETFs, JP Morgan Asset Management

- Tom Digby, Head of ETF Capital Markets, Asia Pacific, Invesco

- Lida Eslami, Head of Business Development, ETP & IOB, London Stock Exchange

- Christopher Friese, Head of Lyxor Hong Kong & Head of Lyxor ETF Asia Pacific, SG Securities (HK) Ltd

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Ivan Gilmore, Head of Exchange Traded Products & Global Product Development, London Stock Exchange

- Kevin Gopaul, Global Head, Exchange Traded Funds, BMO Global Asset Management

- Chang Hwan Sung, Portfolio Manager, Invesco Investment Solutions

- Paul Jackson, Global Head of Asset Allocation Research, Invesco

- Ethan W. Johnson, Partner, Morgan, Lewis & Bockius LLP

- Trevor Lee, Senior Director, Investment Products, Securities and Futures Commission

- Jessie Meng, Head Quantitative Strategist, Huatai PineBridge Fund Management Ltd

- Jean-François Mesnard-Sense, ETF Capital Markets Specialist, Asia Pacific, State Street Global Advisors

- Aik Kai Ng, Managing Associate, Simmons & Simmons JWS

- Jack O’Brien, Partner, Morgan, Lewis & Bockius LLP

- Tara O'Reilly, Partner, Arthur Cox

- Viktor Ostebo, Head of Institutional Trading APAC, Flow Traders

- Antoine De Saint Vaulry, Regional Head of ETF Sales and Business Development, APAC, Citi

- Cindy Shek, Partner, King & Wood Mallesons

- Melody Yang, Funds and Corporate Partner, Simmons & Simmons

Panel discussions will cover the following topics:

- Introduction to the ETF Landscape in Asia Pacific

- Update on Hong Kong ETF Market

- Best Practices When Trading US, European and Asia Listed ETFs from Asia

- Update on Singapore ETF Market

- Update on Trends in the US ETF Industry - Impact of Regulations on Investor Choice

- Update on the Mainland China ETF Market

- Update on Trends in the European ETF Industry

- How Regulators View ESG, Crypto and Digital Assets

- Global Macro Outlook

- Best Practices When Using ETFs in Portfolio Construction

For more updates and the full agenda, please visit the event website.

The event is designed to provide the opportunity for family offices, private bankers, financial advisors, pension funds, insurance companies and other investment professionals to hear updates from industry leaders on ETF market structure and regulatory issues, and obtain a better understanding of how to trade and use US listed ETFs, European listed ETFs and locally listed ETFs in Hong Kong, Singapore and Asia and the impact that ETFs have on the markets and market structure.

We look forward to seeing you at the event! Register Here

Upcoming ETFGI Global ETFs Insights Summits:

2020

Europe & MEA, Nov 17 - 18, Register Here, Event Website

Canada, Nov 30 - Dec 1, Register Here, Event Website

2021

ESG & Active, February 2021

USA

Latin America

Asia Pacific

Europe & MEA

Canada

###

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

NEW ETF TV Episode 41 - ETF managers could reduce FX hedging risk through this execution model

NEW ETF TV Episode 41 - ETF managers could reduce FX hedging risk through this execution model

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()