ETFGI reports ETFs and ETPs listed in Europe gathered net inflows of US$8.93 billion during September 2020

LONDON —October 28, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed in Europe gathered net inflows of US$8.93 billion during September, bringing year-to-date net inflows to US$69.50 billion which is less than the US$75.37 billion gathered through Q3 in 2019. Assets invested in the European ETFs and ETPs industry have decreased by 2.5%, from US$1.14 billion at the end of August, to US$1.11 trillion, according to ETFGI's September 2020 European ETFs and ETPs industry landscape insights report, the monthly report which is part of annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- ETFs and ETPs listed in Europe gathered net inflows of $8.93 Bn during September, bringing YTD net inflows to $69.50 Bn which is less than the $75.37 Bn gathered through Q3 in 2019.

- Assets invested in ETFs and ETPs listed in Europe are $1.11 trillion at the end of Q3 which is the second highest on record.

- Commodity ETFs/ETPs gathered year-to-date net inflows of $17.83 billion, much higher than the $7.21 billion had attracted by this time last year.

- $8.15 billion or most of the net inflows went into equity ETFs and ETPs in September.

“The S&P 500 declined 3.8% in September, with concerns over back-to-school (and resulting COVID cases), U.S. elections and stimulus talks. Strong prior month gains boosted the index higher to close up 8.9% for Q3. Global equities declined 3.1% in September, as measured by the S&P Global BMI. Despite the monthly decline, the global benchmark managed to finish Q3 up 8.1% Q3 and up 0.7% YTD. Emerging markets, declined 2.2% in September but closed up 9.0% for Q3.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

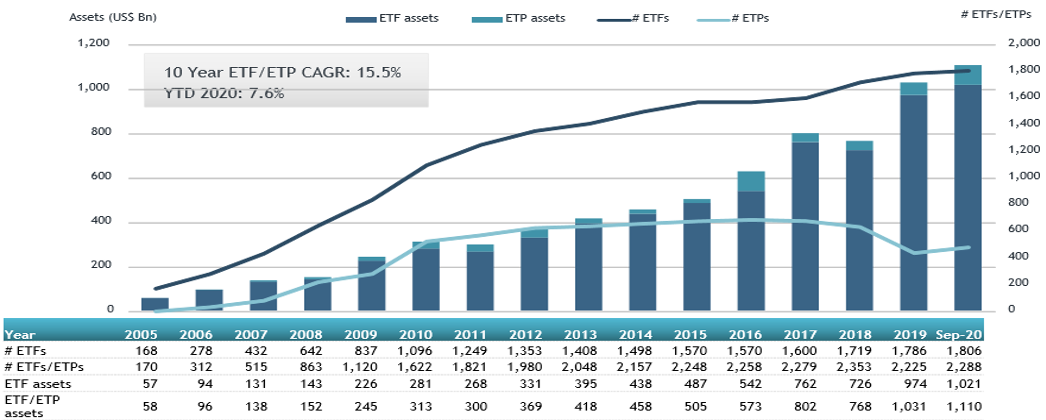

Europe ETFs and ETPs asset growth as at the end of September 2020

At the end of Q3 2020, the European ETF/ETP industry had 2,288 ETFs, with 8,615 listings, assets of $1.11 trillion, from 73 providers listed on 28 exchanges in 23 countries.

Equity ETFs/ETPs listed in Europe reported net inflows of $8.15 billion during September, bringing net inflows for the year 2020 to $20.85 billion, higher than the $16.81 billion in net inflows equity products had attracted at this point in 2019. Commodity ETFs/ETPs listed in Europe had net inflows of $875 million during September, taking net inflows for the year to $17.83 billion, much higher than the $7.21 billion in net inflows commodity products had reported at this point in 2019. Fixed Income ETFs/ETPs reported $219 million in net outflows bringing net inflows to $30.55 billion for 2020, which is much lower than the $47.80 billion in net inflows gathered year to date at this point in 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $7.57 billion during September. iShares China CNY Bond UCITS ETF (CNYB NA) gathered $976 million alone.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $7.57 billion during September. iShares China CNY Bond UCITS ETF (CNYB NA) gathered $976 million alone.

Top 20 ETFs by net inflows in September 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

2,246.21 |

2,082.79 |

975.87 |

|

Lyxor UCITS ETF NASDAQ-100 - D-EUR - Dist |

NADQ GY |

704.79 |

679.82 |

679.82 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQQQ IM |

4,487.76 |

1,211.59 |

549.66 |

|

L&G US Equity Responsible Exclusions UCITS ETF - Acc |

RIUS LN |

1,192.28 |

611.80 |

516.64 |

|

Lyxor S&P 500 UCITS ETF - Daily Hedged - GBP -Acc |

SP5G LN |

548.27 |

541.97 |

508.02 |

|

CSIF IE MSCI USA Blue UCITS ETF - Acc |

CMXUS SW |

2,266.14 |

2,008.81 |

480.08 |

|

UBS ETF (IE) MSCI USA UCITS ETF (USD) A-dis |

UBU3 GY |

644.94 |

400.08 |

448.16 |

|

AMUNDI INDEX MSCI EMERGING MARKETS UCITS ETF DR (C) - Acc |

AEME FP |

1,993.22 |

(1,163.94) |

371.14 |

|

Invesco S&P 500 ETF - Acc |

SPXS LN |

8,718.57 |

1,021.65 |

329.99 |

|

iShares $ Treasury Bond 20+yr UCITS ETF - Acc |

DTLA LN |

747.76 |

481.94 |

302.87 |

|

Lyxor Core EURO STOXX 50 (DR) - UCITS ETF Dist |

MTDB GY |

269.91 |

278.81 |

278.81 |

|

iShares J.P. Morgan EM Local Govt Bond UCITS ETF |

SEML LN |

5,987.79 |

(2,780.86) |

278.06 |

|

Xtrackers S&P 500 Swap UCITS ETF - Acc |

D5BM GY |

6,509.78 |

(1,191.22) |

276.01 |

|

UBS ETF (LU) MSCI Canada UCITS ETF (CAD) A-dis |

CANCDA SW |

1,113.16 |

158.62 |

269.40 |

|

iShares J.P. Morgan $ EM Bond UCITS ETF - GBP Hdg |

EMHG LN |

463.76 |

335.90 |

265.26 |

|

iShares Global Corp Bond EUR Hedged UCITS ETF (Dist) |

CRPH SW |

1,787.37 |

230.83 |

220.52 |

|

iShares Digital Security UCITS ETF - Acc |

LOCK LN |

910.50 |

573.89 |

219.77 |

|

iShares MSCI Europe UCITS ETF EUR (Acc) - Acc |

IMEA LN |

2,855.98 |

916.33 |

208.58 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

2,079.52 |

1,163.22 |

198.70 |

|

Invesco EQQQ Nasdaq-100 UCITS ETF |

EQAC SW |

524.40 |

421.19 |

197.65 |

The top 10 ETPs by net new assets collectively gathered $2.70 billion during September. SPDR Physical Gold ETC – Acc (SGLN LN) gathered $983.69 million alone.

Top 10 ETPs by net inflows in September 2020: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Physical Gold ETC - Acc |

SGLN LN |

15,283.65 |

5,903.86 |

983.69 |

|

Invesco Physical Gold ETC - Acc |

SGLD LN |

13,981.77 |

4,735.13 |

767.63 |

|

Invesco Physical Gold ETC - EUR Hdg Acc |

SGLE IM |

185.91 |

178.13 |

176.60 |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

XGDU LN |

182.09 |

180.34 |

153.69 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

GOLD FP |

3,872.09 |

2,269.88 |

149.95 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,516.47 |

176.84 |

148.78 |

|

WisdomTree Precious Metals - EUR Daily Hedged - Acc |

00XQ GY |

114.75 |

(13.01) |

111.94 |

|

WisdomTree Physical Swiss Gold - Acc |

SGBS LN |

3,472.36 |

145.45 |

90.45 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

XGDE GY |

115.97 |

112.06 |

69.02 |

|

Invesco Physical Silver ETC - Acc |

SSLV LN |

161.69 |

66.12 |

46.12 |

Investors have tended to invest in Equity ETFs and ETPs during September.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Register to attend Day 2 of the ETFGI Global ETFs Insights Summit - Asia Pacific, a virtual event on October 28 & 29 from 2:00pm to 5:30pm HKT!

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. Register Here

Attendees will have the opportunity to see and hear speakers via video and audio of the keynote and panel discussions with audience Q&A and visit virtual event booths where you can meet and speak with our sponsors.

Exciting line up of speakers, topics, and virtual networking!

Thursday, 29 October

2:00-2:30 PM HKT

Registration, Exhibit Hall & Networking

2:30-2:50 PM

Update on the Mainland China ETF Market

Moderator: Deborah Fuhr, Managing Partner, Founder, ETFGI

Jessie Meng, Head Quantitative Strategist, Huatai PineBridge Fund Management Ltd

Melody Yang, Partner, Simmons & Simmons

2:50-3:10 PM

European ETF Industry Outlook

Moderator: Deborah Fuhr, Managing Partner, Founder, ETFGI

Lida Eslami, Head of Business Development, ETP & IOB, London Stock Exchange

Tara O'Reilly, Partner, Arthur Cox

3:10-3:30 PM

How Regulators View ESG, Crypto and Digital Assets

Moderator: Deborah Fuhr, Managing Partner, Founder, ETFGI

Grace Chong, Of Counsel, Simmons & Simmons JWS

3:30-3:50 PM

Fireside Chat

Kevin Gopaul, Global Head, Exchange Traded Funds, BMO Global Asset Management

4:05-4:25 PM

Global Macro Outlook

Moderator: Deborah Fuhr, Managing Partner, Founder, ETFGI

Paul Jackson, Global Head of Asset Allocation Research, Invesco

4:25-4:55 PM

Best Practices When Using ETFs in Portfolio Construction

Moderator: Deborah Fuhr, Managing Partner, Founder, ETFGI

Sean Cunningham, Asia Head of ETFs, JP Morgan Asset Management

Aleksey Mironenko, Global Head of Investment Solutions, The Capital Company

Chang Hwan Sung, Portfolio Manager, Invesco Investment Solutions

4:55-5:00 PM

Closing Remarks

Deborah Fuhr, Managing Partner, Founder, ETFGI

5:00-5:30 PM

Exhibit Hall & Networking Open Discussion

For more updates and the full agenda, please visit the event website.

The event is designed to provide the opportunity for family offices, private bankers, financial advisors, pension funds, insurance companies and other investment professionals to hear updates from industry leaders on ETF market structure and regulatory issues, and obtain a better understanding of how to trade and use US listed ETFs, European listed ETFs and locally listed ETFs in Hong Kong, Singapore and Asia and the impact that ETFs have on the markets and market structure.

We look forward to seeing you at the event! Register Here

Upcoming ETFGI Global ETFs Insights Summits:

2020

Europe & MEA, Nov 17 - 18, Register Here, Event Website

Canada, Nov 30 - Dec 1, Register Here, Event Website

2021

ESG & Active, February 2021

USA

Latin America

Asia Pacific

Europe & MEA

Canada

###

![]() ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

ETF TV is a new show for institutional investors and financial advisors which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to watch the latest episodes and contact us if you are interested in sponsoring a mini segment or a full episode.

NEW ETF TV Episode 41 - ETF managers could reduce FX hedging risk through this execution model

NEW ETF TV Episode 41 - ETF managers could reduce FX hedging risk through this execution model

Attribution Policy

The information contained here is proprietary. The media is welcome to use our information and ideas, provided that the following sourcing is included: ETFGI is a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, based in London, England. Deborah Fuhr, Managing Partner, Founder, ETFGI website www.etfgi.com.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

![]()

ABOUT ETFGI

ABOUT THE FOUNDER

ETFGI SERVICES

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()