ETFGI reports Active ETFs and ETPs listed globally gather a record US$58.69 billion in YTD net inflows and assets reached a record high of US$234.86 billion at the end of October 2020

LONDON — November 25, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that actively managed ETFs and ETPs saw net inflows of US$7.28 billion during October, bringing year-to-date net inflows to a record level US$58.69 billion which is significantly more than the US$34.85 billion in net inflows gathered at this point in 2019 as well as significantly more than the US$42.10 billion gathered in all of 2019. Assets invested in actively managed ETFs/ETPs finished the month up to 2.8%, from US$228.41 billion at the end of September to reach a new record high of US$234.86 billion, according to ETFGI's October 2020 Active ETF and ETP industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in actively managed ETFs/ETPs reached a new record high of $234.86 billion at the end of October.

- Year-to-date net inflows are a record level of $58.69 billion

- Fixed Income based actively managed ETFs/ETPs gathered net inflows of $3.99 billion during October.

“During October, the S&P 500 decreased by 2.66% due to the uncertainty of US elections and rise in virus infections. Developed markets outside the US fell 3.56% during October, 21 of 24 countries lost ground as a large portion of Europe announced new lockdown plans. Emerging markets reported positive a return of 2.04% in October.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

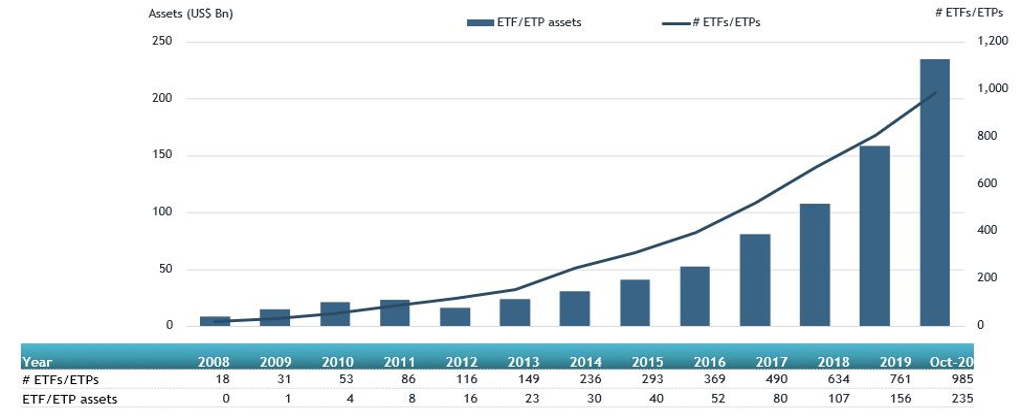

Growth in actively managed ETF and ETP assets as of the end of October 2020

Fixed Income focused actively managed ETFs/ETPs listed globally gathered net inflows of $3.99 billion during October, bringing net inflows year to date to $34.73 billion, which is more than the $26.47 billion in net inflows Fixed Income products had attracted for the year in 2019. Equity focused actively managed ETFs/ETPs listed globally attracted net inflows of $3.18 billion during October, bringing net inflows for the year to $19.57 billion, which is significantly more than the $7.33 billion in net inflows equity products had attracted YTD in 2019.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $5.46 billion during October. ARK Innovation ETF (ARKK US) gathered $1 billion alone.

Top 20 actively managed ETFs/ETPs by net new assets October 2020

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ARK Innovation ETF |

ARKK US |

9,643.17 |

5,208.46 |

1,000.46 |

|

iShares Interest Rate Hedged 10+ Year Credit Bond ETF |

IGBH US |

557.65 |

507.34 |

525.45 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

2,782.24 |

1,557.51 |

438.18 |

|

ARK Web x.O ETF |

ARKW US |

2,825.46 |

1,561.72 |

339.90 |

|

JPMorgan Ultra-Short Income ETF |

JPST US |

14,931.73 |

4,643.29 |

332.39 |

|

First Trust TCW Opportunistic Fixed Income ETF |

FIXD US |

4,219.26 |

2,860.56 |

291.25 |

|

Janus Short Duration Income ETF |

VNLA US |

2,726.53 |

1,578.75 |

282.17 |

|

First Trust Low Duration Mortgage Opportunities ETF |

LMBS US |

6,390.09 |

2,440.54 |

249.91 |

|

TD Q Canadian Dividend ETF |

TQCD CN |

209.98 |

221.04 |

213.71 |

|

iShares Liquidity Income ETF |

ICSH US |

4,922.60 |

2,279.16 |

209.72 |

|

ARK Fintech Innovation ETF |

ARKF US |

893.61 |

683.81 |

203.91 |

|

iShares Interest Rate Hedged Corporate Bond ETF |

LQDH US |

450.02 |

335.30 |

202.29 |

|

PIMCO Euro Short Maturity Source UCITS ETF - Acc |

PJSR GY |

1,430.28 |

986.75 |

177.20 |

|

PIMCO Enhanced Short Maturity Strategy Fund |

MINT US |

14,450.31 |

736.80 |

164.15 |

|

PIMCO Total Return Active Exchange-Traded Fund |

BOND US |

3,851.20 |

847.50 |

150.93 |

|

JPMorgan Ultra-Short Municipal Income ETF |

JMST US |

840.92 |

691.94 |

147.79 |

|

Amin Yekom |

FAYF1 |

242.93 |

(1,321.61) |

145.76 |

|

SPDR Blackstone/GSO Senior Loan ETF |

SRLN US |

1,689.01 |

(756.40) |

135.90 |

|

JPMorgan EUR Ultra-Short Income UCITS ETF |

JSET LN |

766.59 |

98.02 |

123.36 |

|

Kian - Acc |

FKNF1 |

184.05 |

122.49 |

122.70 |

Investors have tended to invest in Fixed Income actively managed ETFs/ETPs during October.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETF TV News #47 Dimensional Fund Advisors entered the ETF industry last week launching its first ETFs

This is significant news for retail investors as the firms mutual funds have exclusively been available only to trained advisors. The firm listed 2 ETFs last week, plans to list another ETF in December and is working to convert 6 mutual funds with approx. $20 billion in assets into ETFs in 2021. Dan Barnes ETFtv and Deborah Fuhr ETFGI discuss the trends seen in the 23 new ETFs which were listed globally during the week of November 16, 2020

#PressPlay to hear more https://bit.ly/33aPygu

ETFGI Weekly Newsletter November 23, 2020 https://bit.ly/39gjufg

|