ETFGI reports year to date net inflows of US$333.23 billion US into ETFs and ETPs listed in United States as of the end of October are greater than full year 2019 inflows

LONDON — November 25, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in US gained net inflows of US$33.36 billion during October, bringing year-to-date net inflows to US$333.23 billion which is higher than the US$223.14 billion net inflows gathered at this point last year as well as greater than the US$330.24 billion gathered in all of 2019. Assets invested in the US ETFs/ETPs industry have decreased by 0.8%, from US$4.73 trillion at the end of September, to US$4.69 trillion, according to ETFGI's October 2020 US ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Year-to-date net inflows of $333.23 billion are much higher than the $223.14 billion had gathered by end of October 2019 as well as the $330.24 billion gathered in all of 2019.

- During October 2020, ETFs/ETPs listed in US attracted $33.36 billion in net inflows with Fixed Income products being the most attractive among all asset classes.

- Assets of $4.69 trillion invested in ETFs/ETPs listed in US at the end of October are the 3rd highest on record.

“During October, the S&P 500 decreased by 2.66% due to the uncertainty of US election while the pandemic still rising around the world. Regarding US companies, the negative movement of oil prices leaded the energy stocks down, although the four tech giants remain in positive sign. Developed markets outside the U.S. fell 3.56% during October, with Japan (24.7%), UK (11.2%) and Canada (8.5%) were the leaders. However, Emerging markets reported positive return of 2.04% through October.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

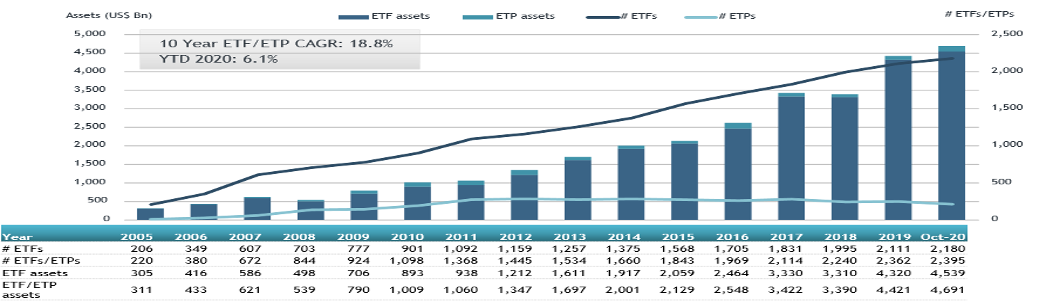

Growth in US ETF and ETP assets as of the end of October 2020

The US ETF/ETP industry had 2,395 ETFs/ETPs, assets of $4.69 Tn, from 167 providers on 3 exchanges at the end of October 2020.

During October 2020, ETFs/ETPs gathered net inflows of $33.36 billion. Fixed income ETFs/ETPs listed in US reported net inflows of $16.55 billion during October, bringing YTD net inflows for 2020 to $146.94 billion, which is greater than the $108.82 billion in net inflows in the corresponding period through October 2019. Equity ETFs/ETPs listed in US reported net inflows of $12.03 billion over October, bringing YTD net inflows for 2020 to $88.40 billion, more than the $84.36 billion in net inflows Equity products had attracted for the corresponding period through October 2019. Commodity ETFs/ETPs saw net outflows of $291 million in October. Year to date, net inflows are at $44.27 Billion, significantly more than the net inflows of $9.71 billion over the same period last year.

Active ETFs/ETPs gathered net inflows of $5.47 billion, bringing the YTD net inflows to $41.61 billion for 2020, which is higher than the $20.84 billion in net inflows for the corresponding period to October 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $28.35 billion during October. The Vanguard Total Stock Market ETF (VTI US) gathered 3.69 billion alone.

Top 20 ETFs by net new assets October 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

VTI US |

162,034.90 |

21,632.25 |

3,690.77 |

|

Vanguard Total International Stock Index Fund ETF |

VXUS US |

28,229.33 |

11,112.36 |

2,653.88 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

10,534.51 |

8,391.80 |

2,028.21 |

|

Vanguard Total Bond Market ETF |

BND US |

63,881.41 |

13,007.36 |

1,784.12 |

|

iShares MBS ETF |

MBB US |

23,941.96 |

2,393.84 |

1,598.18 |

|

Vanguard Total International Bond ETF |

BNDX US |

33,940.00 |

8,607.87 |

1,456.74 |

|

iShares Russell 2000 ETF |

IWM US |

40,808.28 |

(3,883.97) |

1,444.25 |

|

Vanguard Short-Term Corporate Bond ETF |

VCSH US |

34,135.88 |

7,574.76 |

1,367.39 |

|

Vanguard S&P 500 ETF |

VOO US |

157,452.07 |

19,208.89 |

1,274.52 |

|

iShares Core S&P 500 ETF |

IVV US |

207,569.59 |

8,516.53 |

1,257.53 |

|

iShares S&P 500 Growth ETF |

IVW US |

28,660.68 |

1,169.28 |

1,205.91 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

EMB US |

17,208.79 |

2,016.07 |

1,125.32 |

|

iShares Core U.S. Aggregate Bond ETF |

AGG US |

81,476.11 |

9,171.09 |

1,084.24 |

|

iShares iBoxx $ Investment Grade Corporate Bond ETF |

LQD US |

56,045.44 |

17,128.19 |

1,083.75 |

|

JPMorgan BetaBuilders US Mid Cap Equity ETF |

BBMC US |

988.14 |

1,025.60 |

1,019.27 |

|

ARK Innovation ETF |

ARKK US |

9,643.17 |

5,208.46 |

1,000.46 |

|

iShares ESG MSCI EM ETF |

ESGE US |

4,658.70 |

3,483.04 |

924.22 |

|

iShares 20+ Year Treasury Bond ETF |

TLT US |

19,355.26 |

(747.82) |

885.67 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

13,603.55 |

(1,309.20) |

782.37 |

|

Vanguard Real Estate ETF |

VNQ US |

27,476.85 |

(2,508.77) |

682.08 |

The top 10 ETPs by net new assets collectively gathered $1.46 billion during October. The iShares Gold Trust

(IAU US) gathered $556.56 million alone.

Top 10 ETPs by net new assets October 2020: US

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

iShares Gold Trust |

IAU US |

31,889.65 |

9,629.85 |

556.56 |

|

iShares Silver Trust |

SLV US |

13,219.68 |

3,427.15 |

262.88 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

1,358.98 |

(423.57) |

220.30 |

|

SPDR Gold MiniShares Trust |

GLDM US |

3,703.00 |

2,163.09 |

152.44 |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

1,589.92 |

570.77 |

133.33 |

|

ProShares Ultra DJ-UBS Crude Oil |

UCO US |

1,010.98 |

1,532.20 |

45.33 |

|

ETRACS Alerian Midstream Energy Total Return Index ETN |

AMTR US |

28.65 |

29.66 |

29.66 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

326.11 |

(269.53) |

25.03 |

|

iPath S&P 500 Dynamic VIX ETN |

XVZ US |

32.60 |

19.82 |

21.11 |

|

ProShares UltraShort DJ-UBS Natural Gas |

KOLD US |

50.29 |

61.55 |

19.81 |

Investors have tended to invest in Fixed Income ETFs/ETPs during October.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETF TV News #47 Dimensional Fund Advisors entered the ETF industry last week launching its first ETFs

This is significant news for retail investors as the firms mutual funds have exclusively been available only to trained advisors. The firm listed 2 ETFs last week, plans to list another ETF in December and is working to convert 6 mutual funds with approx. $20 billion in assets into ETFs in 2021. Dan Barnes ETFtv and Deborah Fuhr ETFGI discuss the trends seen in the 23 new ETFs which were listed globally during the week of November 16, 2020

#PressPlay to hear more https://bit.ly/33aPygu

ETFGI Weekly Newsletter November 23, 2020 https://bit.ly/39gjufg

###

Free registration for buy side institutional investors and financial advisors at the ETFGI Global ETFs Insights Summit - Canada, a virtual event on November 30 & December 1 from 12:30 to 17:30 EST! Register now

The event is designed to facilitate a substantive and in-depth discussion on the regulatory, trading, and technological developments impacting the use, selection, trading, and development of new ETFs and the impact ETFs have on markets and market structure.

Free registration and CPD educational credits are offered to buy side institutional investors and financial advisors. Register Here Cannot attend, register anyway so we can send you the session recordings.

![]()

Attendees will have the opportunity to see and hear speakers the keynote and panel discussions with audience Q&A and visit virtual event booths and network.

Exciting line up of speakers, topics, and virtual networking! View the full agenda and see all of the speakers on the event website

Speakers will include:

- Rochelle “Shelly” Antoniewicz, PhD, Senior Director of Industry and Financial Analysis, Investment Company Institute

- Elmer Atagu, Director, ETF Trading, CIBC Capital Markets

- Kathleen Bock, Principal and Head of the Americas Region, Vanguard

- Georgia Bullitt, Partner, Willkie Farr & Gallagher LLP

- Raymond Chan, Director, Investment Funds, Structured Products, Ontario Securities Commission

- Prerna Chandak, VP, ETF Product & Strategy, Mackenzie Investments

- Roger Chandhok, Director, Global Equity Derivatives, ETF Sales & Trading, National Bank Financial

- Pat Chiefalo, Managing Director, Head of iShares Canada, BlackRock

- Michael Cooke, SVP, Head of Exchange Traded Funds, Mackenzie Investments

- Michael Craig, Managing Director Head of Asset Allocation & Derivatives, TD Asset Management

- Jaclyn Daitchman, Vice President, ESG Client Coverage, MSCI Inc.

- Carol E. Derk, Partner, Borden Ladner Gervais LLP

- Todd Evans, Managing Director, Investment Industry Association of Canada

- Linda French, Assistant Chief Counsel, ICI Global

- Deborah Fuhr, Founder, Managing Director, ETFGI

- Yann Furic, CFA, Senior Portfolio Manager, Asset Allocation & Alternative Strategies, Financière des Professionnels

- Kevin Gopaul, President, Exchange Traded Funds, BMO Global Asset Management

- Michael Greenberg, VP, Portfolio Manager, Franklin Templeton Investment Solutions

- Katie Gouinlock, Head of Canada ETF Capital Markets, Vanguard Canada

- Margaret Gunawan, Managing Director, General Counsel & Chief Compliance Officer, BlackRock

- Mary Hagerman M.Sc.,FCSI,CIM,Pl.Fin., Portfolio Manager, Investment Advisor, Groupe Mary Hagerman de Raymond James

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- Tara Kennedy, VP, Trading, Wealthsimple

- Dan Kessous, CEO, Nasdaq Canada

- Ronald Landry, Head of Product and Canadian ETF Services, CIBC Mellon

- Kevin Law, ETF Trader, Virtu Financial, Canada

- Alfred Lee, Director, Portfolio Manager, Investment Strategist, BMO Global Asset Management

- Jin Li, Vice President, ETF & Quantitative Research Analyst, BMO Capital Markets

- Graham Mackenzie, Head, Exchange Traded Products, TMX Group

- Christian Medeiros, Associate - Asset Allocation, TD Asset Management

- Joseph Micallef, FCPA, FCA, Partner, Tax – National Tax Leader Financial Services & Asset Management Industry, KPMG

- Mona Naqvi, Head of ESG Index Strategy, North America, S&P Dow Jones Indices

- Jonathan Needham, Vice President, ETF Distribution, TD Asset Management

- Alex Perel, Head of ETF Services, Scotiabank Global Banking & Markets

- Rick Redding, CEO, Index Industry Association

- Andres Rincon, CMT Director, Head of ETF Sales & Strategy, TD Securities Inc.

- Erik Sloane, Chief Revenue Officer, NEO Exchange

- Fred Wang, Associate Portfolio Manager, Portfolio Solutions, Mackenzie Investments

Panel discussions will cover the following topics:

- Introduction to ETF Landscape in Canada

- Fireside Chat – Regulatory Initiatives Impacting ETFs

- An Appraisal of Market Structure and ETF Trading

- ETF Trading and Implementation

- Impact of Regulations on Investor Choice

- Update on Regulatory Trends in the US ETF Industry

- Trends in the Use of Fixed Income ETFs

- Macro Investment Outlook

- Fireside Chat – Regulatory Trends in ESG and Sustainable Investing

- How Investors Are Implementing ESG Into Their Portfolios

- ETF Due Diligence

- How Are Institutions and Financial Advisors Using ETFs?

- What Are the Future Trends That Will Impact Investor and ETFs?

For speaker updates and the full agenda, please visit the event website. Register Here

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at a future event.

We look forward to seeing you at the event!

Debbie and Margareta

Deborah Fuhr

Managing Partner, Founder, Owner

ETFGI

London EC2N 1AR United Kingdom

deborah.fuhr@etfgi.com

Upcoming ETFGI Global ETFs Insights Summits:

2020

Canada, Nov 30 - Dec 1, Register Here, Event Website

2021

ESG & Active, Feb 24 & 25 Register Here, Event Website

USA, May 19 & 20

Europe & MEA, September 15 & 16

Asia Pacific, November 2 & 3

Canada, December 1 & 2