ETFGI reports that the assets invested in and net new inflows for ETFs listed in Canada have reached all-time records at the end of November 2020

LONDON — December 15, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs listed in Canada gathered net inflows of US$2.27 billion during November, bringing year-to-date net inflows to a record level US$28.25 billion beating the prior record of US$20.93 Bn set at the end of 2019. Canadian ETF assets increased by 10.4%, from US$174.12 billion at the end of October to US$192.30 billion at the end of November, according to ETFGI's November 2020 Global ETFs and ETPs industry landscape insights report, the monthly report that is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed in Canada reached a new record of $192.30 Bn at the end of November.

- Year to date net inflows of $28.25 Bn are a new record beating the prior record of $20.93 Bn for all of 2019.

“During November the S&P 500 gained 11%, vaccine and US election news boosting optimism which contributed to the best month since April. Developed markets outside the US, had a very strong month up 15.3%, all markets where up over 9%. The S&P Europe 350 had its best month ever. Global equities gained 12.8% in November with all 50 countries up for the month on positive prospects of overcoming Covid. This was the highest monthly return since the turn of the century. Emerging markets gained 8.9% during the month.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

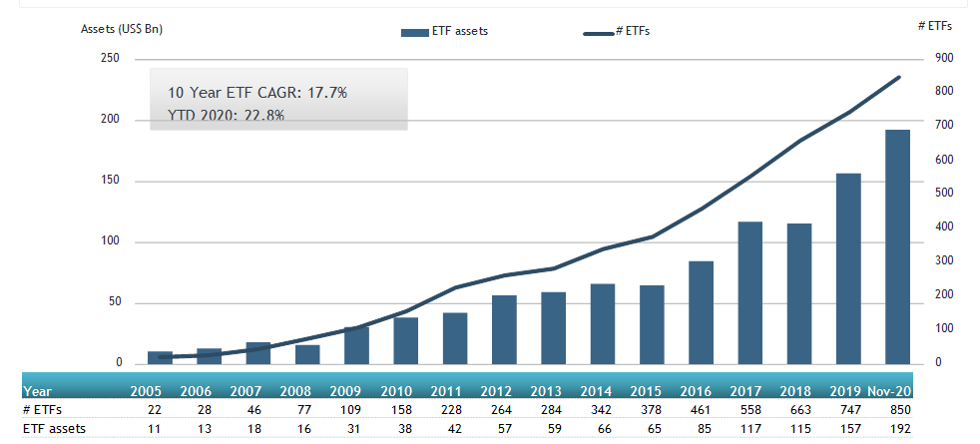

Growth in Canadian ETF and ETP assets as of the end of November 2020

The Canadian ETF industry had 850 ETFs, with 1,032 listings, assets of $192.30 Bn, from 39 providers listed on 2 exchanges at the end of November 2020.

Equity ETFs/ETPs gathered net inflows of $1.21 billion over November, bringing net inflows for the year to November 2020 to $13.67 billion, much higher than the $4.37 billion in net inflows equity products had attracted for the year to October 2019. Active ETFs/ETPs attracted net inflows of $489 million over the month, gathering net inflows for the year in Canada of $8.85 billion, lower than the $7.94 billion in net inflows active products had reported for the year to November 2019. Fixed income ETFs/ETPs had net inflows of $397 million during November, bringing net inflows for the year to November 2020 to $4.47 billion, lower than the $4.55 billion in net inflows fixed income products had attracted by the end of November 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $1.78 billion during November. BMO Aggregate Bond Index ETF (ZAG CN) gathered $266.23 million alone.

Top 20 ETFs by net new assets November 2020: Canada

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ZAG CN |

4250.59 |

62.54 |

266.23 |

|

|

TD S&P 500 Index ETF |

TPU CN |

728.86 |

420.77 |

136.97 |

|

iShares Core S&P/TSX Capped Composite Index ETF |

XIC CN |

5357.68 |

351.46 |

135.96 |

|

BMO Europe High Dividend Covered Call ETF |

ZWP CN |

799.03 |

113.44 |

108.67 |

|

iShares Core S&P 500 Index ETF (CAD-Hedged) |

XSP CN |

4874.00 |

259.11 |

107.78 |

|

iShares MSCI EAFE IMI Index Fund |

XEF CN |

3144.81 |

297.96 |

93.11 |

|

iShares S&P 500 Index ETF |

XUS CN |

2563.96 |

707.98 |

88.70 |

|

Invesco ESG Canadian Core Plus Bond ETF |

BESG CN |

183.47 |

82.51 |

86.75 |

|

iShares S&P/TSX Capped Financials Index Fund |

XFN CN |

837.21 |

21.69 |

76.81 |

|

TD Global Technology Leaders Index ETF |

TEC CN |

420.09 |

322.20 |

73.55 |

|

CI First Asset Energy Giants Covered Call ETF (unhedged) |

NXF/B CN |

79.15 |

71.42 |

72.75 |

|

BMO S&P 500 Index ETF |

ZSP CN |

7138.56 |

786.90 |

71.19 |

|

iShares S&P/TSX Capped Energy Index ETF |

XEG CN |

567.03 |

188.74 |

60.19 |

|

BMO Mid-Term US IG Corporate Bond Index ETF |

ZIC CN |

1370.08 |

205.11 |

58.98 |

|

iShares S&P/TSX Composite High Dividend Index ETF |

XEI CN |

610.04 |

128.29 |

58.07 |

|

Vanguard S&P 500 Index ETF |

VFV CN |

2753.50 |

384.03 |

56.99 |

|

CI First Asset Global Financial Sector ETF |

FSF CN |

383.22 |

153.79 |

56.90 |

|

Vanguard Canadian Aggregate Bond Index ETF |

VAB CN |

2431.18 |

251.69 |

56.07 |

|

CIBC Active Investment Grade Corporate Bond ETF |

CACB CN |

518.04 |

314.41 |

55.33 |

|

Mackenzie US Investment Grade Corporate Bond Index ETF CAD-Hedged |

QUIG CN |

505.83 |

249.59 |

55.27 |

Investors have tended to invest in Equity ETFs during November.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETF TV Episode #51 - Equity and commodity ETF options: Trading strategies are building a deep market

We would like to thank you for attending one of our ETFGI Global ETFs Insights Summits: Canada, Europe MEA, Asia Pacific, Latin America and USA in 2020. We hope that you found the event (s) informative, productive, and enjoyable.

The ETFGI Global ETFs Insights Summits are designed to facilitate substantive and in-depth discussions around the impact that market structure and regulations have on ETF product development, due diligence, suitability, the use and trading, and technological developments have on ETFs and mutual funds in the respective jurisdictions. Free registration and CE credits are offered to buyside investors and financial advisors. There are speaker and sponsorship opportunities available.

Register now to join the discussion with leading ETF issuers, investors, the top brokerage firms, regulators and representatives from stock exchanges, law firms and other firms.

Upcoming ETFGI Global ETFs Insights Summits:

ESG & Active, Feb 24 & 25, Register Here, Event Website

Latin America, April 14 & 15 Register Here

USA, May 19 & 20 Register Here

Europe & MEA, September 15 & 16 Register Here

Asia Pacific, November 2 & 3 Register Here

Canada, December 1 & 2 Register Here

If you are interested in speaking or sponsoring one of our events, don't hesitate to contact us at Deborah.fuhr@etfgi.com or Margareta.hricova@etfgi.com

Please contact us if you are interested in sponsoring a mini segment or a full episode.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()