ETFGI reports assets invested in ETFs and ETPs listed globally reached a new record of US$7.62 trillion at the end of November 2020

LONDON — December 14, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in ETFs and ETPs listed globally reached new records of US$7.62 trillion and net inflows reached a new record of US$670.57 billion at the end of November.

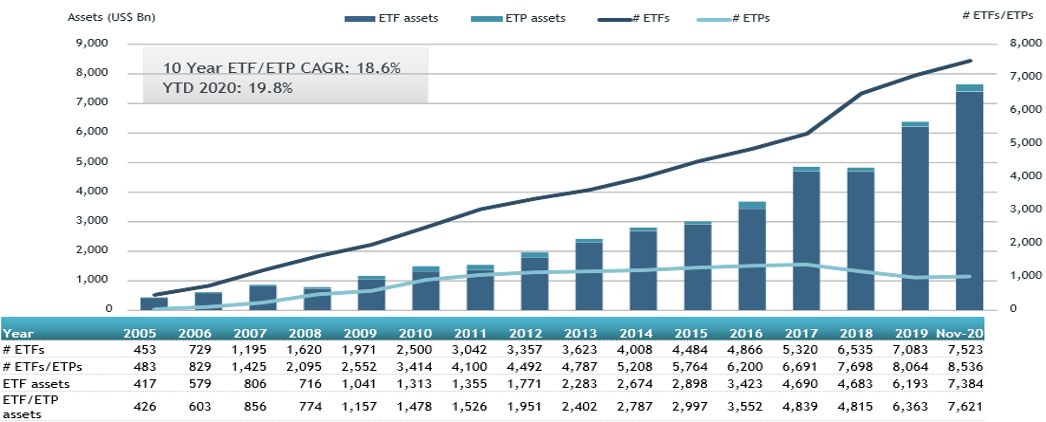

ETFs and ETPs listed globally gathered record net inflows of US$131.99 billion during November, bringing year-to-date net inflows to a record US$670.57 billion which is higher than the US$475.53 billion gathered at this point last year, the full year 2019 NNA of US$571.15 billion as well as the prior full year record for net inflows of US$654 billion set at the end of 2017. Assets invested in the global ETFs/ETPs industry have increased by 11.4% from US$6.84 trillion at the end of October 2020, to US$7.62 trillion at the end of November, according to ETFGI's November 2020 Global ETFs and ETPs industry landscape insights report, the monthly report tht is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in ETFs and ETPs listed globally reach a new record high of $7.62 trillion at the end of November.

- Net inflows reach an all time high of $670.57 Bn beating the prior record of record of $654 billion set at the end of 2017.

- There have been 18 months of positive net inflows into the Global ETFs and ETPs industry.

“During Novemebr the S&P 500 gained 11%, vaccine and US election news boosting optimism which contributed to the best month since April. Developed markets outside the US, had a very strong month up 15.3%, all markets where up over 9%. The S&P Europe 350 had its best month ever. Global equities gained 12.8% in November with all 50 countries up for the month on postive prospects of overcoming Covid. This was the highest monthly return since the turn of the century. Emerging markets gained 8.9% during the month.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of November 2020

The Global ETF/ETP industry had 8,536 ETFs/ETPs, with 16,983 listings, assets of $7.62 Tn, from 501 providers listed on 74 exchanges in 60 countries at the end of November.

During November, ETFs/ETPs gathered net inflows of $131.99 billion. Equity ETFs/ETPs listed globally gathered net inflows of $108.80 billion over November, bringing net inflows for 2020 to $302.83 billion, higher than the $212.61 billion in net inflows equity products had attracted for the corresponding period through November 2019. Fixed Income ETFs/ETPs reported $16.49 billion in net inflows bringing net inflows for 2020 to $210.49 billion, which is greater than the $207.49 billion in net inflows reported through November 2019. Commodity ETFs/ETPs listed globally reported net outflows of $8.02 billion in November, bringing year to date newt inflows to $63.40 billion which is significantly higher thant the net infows of $18.58 billion gathered at this point in 2019.

Active ETFs/ETPs listed globally reported net inflows of $18.55 billion during November, bringing net inflows for 2020 to $77.24 billion, more than the $38.27 billion in net inflows active products had attracted for the corresponding period through November 2019.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $64.84 billion during November, the SPDR S&P 500 ETF Trust (SPY US) gathered $15.11 billion alone.

Top 20 ETFs by net new inflows November 2020: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

SPDR S&P 500 ETF Trust |

|

SPY US |

325,596.51 |

(22,553.46) |

15,111.15 |

|

Magellan Global Fund/Open Class |

|

MGOC AU |

10,002.02 |

10,004.26 |

10,004.26 |

|

Vanguard Total Stock Market ETF |

|

VTI US |

187,201.06 |

26,777.06 |

5,144.81 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

|

511990 CH |

22,088.75 |

5,503.91 |

3,121.13 |

|

iShares iBoxx $ High Yield Corporate Bond ETF |

|

HYG US |

27,274.55 |

7,352.94 |

3,084.28 |

|

iShares Russell 2000 ETF |

|

IWM US |

51,074.79 |

(1,229.55) |

2,654.42 |

|

Vanguard Total International Stock Index Fund ETF |

|

VXUS US |

34,615.87 |

13,703.32 |

2,590.96 |

|

iShares Core S&P 500 ETF |

|

IVV US |

232,832.95 |

11,074.40 |

2,557.87 |

|

Vanguard S&P 500 ETF |

|

VOO US |

177,317.31 |

21,513.13 |

2,304.24 |

|

Financial Select Sector SPDR Fund |

|

XLF US |

22,701.15 |

(106.43) |

2,167.06 |

|

Invesco QQQ Trust |

|

QQQ US |

144,615.27 |

17,647.74 |

2,104.59 |

|

siShares Core S&P Small-Cap ETF |

|

IJR US |

50,954.53 |

1,710.87 |

1,812.82 |

|

Industrial Select Sector SPDR Fund |

|

XLI US |

15,935.54 |

4,364.38 |

1,752.73 |

|

iShares Core MSCI Emerging Markets ETF |

|

IEMG US |

62,701.65 |

(4,011.71) |

1,744.24 |

|

Vanguard Value ETF |

|

VTV US |

58,625.95 |

4,307.58 |

1,599.98 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

41,564.82 |

13,299.62 |

1,566.69 |

|

iShares Russell 1000 Value ETF |

|

IWD US |

41,578.42 |

155.96 |

1,447.77 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

83,522.09 |

10,541.88 |

1,370.79 |

|

Vanguard Total Bond Market ETF |

|

BND US |

65,912.51 |

14,369.83 |

1,362.47 |

|

UBS ETFs plc - MSCI ACWI SF UCITS ETF (hedged to USD) A-acc |

|

ACWIU SW |

2,035.13 |

(179.23) |

1,338.96 |

The top 10 ETPs by net new assets collectively gathered $1.20 billion over November. ProShares Ultra VIX Short-Term Futures (UVXY US) gathered $462 million alone.

Top 10 ETPs by net new inflows November 2020: Global

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

ProShares Ultra VIX Short-Term Futures |

UVXY US |

1,186.59 |

1,032.37 |

461.60 |

|

WisdomTree Physical Swiss Gold - Acc |

SGBS LN |

3,507.34 |

396.87 |

145.09 |

|

United States Natural Gas Fund LP |

UNG US |

379.59 |

110.67 |

97.62 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

VXX US |

916.71 |

(331.87) |

91.70 |

|

ProShares Ultra DJ-UBS Natural Gas |

BOIL US |

137.59 |

109.97 |

83.32 |

|

WisdomTree NASDAQ 100 3x Daily Leveraged - Acc |

QQQ3 LN |

95.54 |

88.65 |

74.65 |

|

ProShares UltraShort DJ-UBS Crude Oil |

SCO US |

117.96 |

(33.36) |

64.71 |

|

WisdomTree Nickel - Acc |

NICK LN |

448.18 |

(29.11) |

64.25 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1,361.93 |

809.17 |

63.01 |

|

ProShares VIX Short-Term Futures ETF |

VIXY US |

266.00 |

(210.46) |

59.07 |

Investors have tended to invest in Equity ETFs/ETPs during November`.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

Equity and commodity ETF options: Trading strategies are building a deep market

ETF TV Episode #51 - Equity and commodity ETF options: Trading strategies are building a deep market

We would like to thank you for attending one of our ETFGI Global ETFs Insights Summits: Canada, Europe MEA, Asia Pacific, Latin America and USA in 2020. We hope that you found the event (s) informative, productive, and enjoyable.

The ETFGI Global ETFs Insights Summits are designed to facilitate substantive and in-depth discussions around the impact that market structure and regulations have on ETF product development, due diligence, suitability, the use and trading, and technological developments have on ETFs and mutual funds in the respective jurisdictions. Free registration and CE credits are offered to buyside investors and financial advisors. There are speaker and sponsorship opportunities available.

Register now to join the discussion with leading ETF issuers, investors, the top brokerage firms, regulators and representatives from stock exchanges, law firms and other firms.

Upcoming ETFGI Global ETFs Insights Summits:

ESG & Active, Feb 24 & 25, Register Here, Event Website

Latin America, April 14 & 15

USA, May 19 & 20

Europe & MEA, September 15 & 16

Asia Pacific, November 2 & 3

Canada, December 1 & 2

If you are interested in speaking or sponsoring one of our events, don't hesitate to contact us at Deborah.fuhr@etfgi.com or Margareta.hricova@etfgi.com

Please contact us if you are interested in sponsoring a mini segment or a full episode.

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com