ETFGI reports assets invested in ESG (Environmental, Social, and Governance) ETFs and ETPs listed globally reach a new milestone of US$187 billion at end of 2020

LONDON — January 22, 2020 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in ESG (Environmental, Social, and Governance) ETFs and ETPs reached a new milestone of US$187 billion at the end of 2020. Assets invested in ESG ETFs and ETPs increased by 206% in 2020. During December ESG ETFs and ETPs gathered net inflows of US$18.46 billion during, bringing 2020 net inflows to US$88.95 billion which significantly greater than the US$27.79 billion gathered in 2019, according to ETFGI’s December 2020 ETF and ETP ESG industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in ESG ETFs and ETPs listed globally reached a new milestone of $187 billion.

- Assets invested in ESG ETFs and ETPs increased 206% in 2020.

- 2020 net inflows are a record $88.95 billion which is significantly greater than the $27.79 billion gathered in 2019.

- 53.6% of the assets and 47% of ESG ETFs and ETPs are in Europe.

“The S&P 500® was up 3.8% for December and finished the year at an all-time high, having added 18.4% the year. Developed ex-U.S. gained 5.5% during December, concluding 2020 up 11.1%. The S&P Emerging BMI gained 6.1% during December, finishing 2020 up 15.5%. Emerging BMI gained 6.1% during December, and finished 2020 up 15.5%. “According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

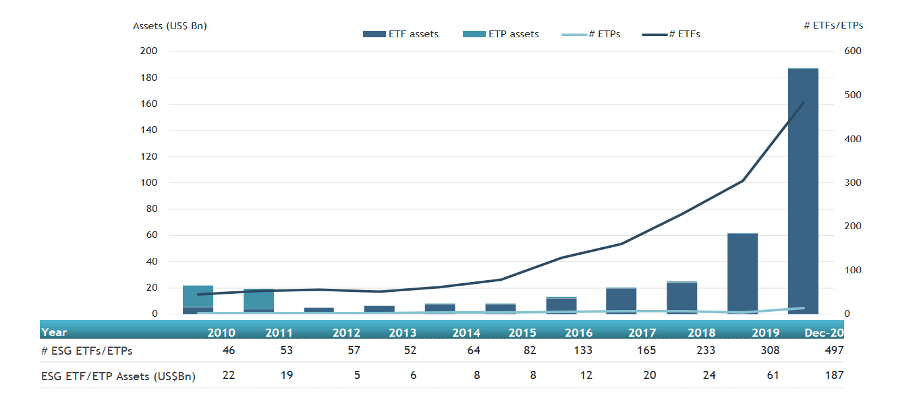

Global ESG ETF and ETP asset growth as at end of December 2020

Since the launch of the first ESG ETF/ETP in 2002, the iShares MSCI USA ESG Select ETF, the number and diversity of products has increased steadily. Globally there were 497 ESG ETFs and ETPs, with 1,452 listings, assets of U$187 Bn, from 113 providers listed on 35 exchanges in 29 countries at the end of 2020.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered $9.30 billion at the end of December. Huatai-PineBridge CSI Photovoltaic Industry ETF (515790 CH) gathered $1.41 billion alone.

Top 20 ESG ETFs/ETPs by net new assets December 2020

|

Name |

Ticker |

Assets (US$ Mn) Dec-20 |

NNA (US$ Mn) YTD-20 |

NNA (US$ Mn) Dec-20 |

|

Huatai-PineBridge CSI Photovoltaic Industry ETF |

515790 CH |

1481.58 |

1411.79 |

1411.79 |

|

iShares Global Clean Energy ETF |

ICLN US |

4699.99 |

2624.25 |

924.22 |

|

iShares Global Clean Energy UCITS ETF |

INRG LN |

5364.98 |

2972.25 |

857.61 |

|

iShares MSCI World ESG Enhanced UCITS ETF - Acc |

EDMW GY |

948.15 |

893.37 |

700.45 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

13424.18 |

9578.87 |

622.54 |

|

iShares JP Morgan ESG USD EM Bond UCITS ETF - Acc - Acc |

EMSA LN |

1125.35 |

611.27 |

452.04 |

|

iShares MSCI USA ESG Enhanced UCITS ETF - Acc |

EDMU GY |

1293.80 |

1147.86 |

446.84 |

|

AMUNDI INDEX MSCI USA SRI - UCITS ETF DR (C) - Acc |

USRI FP |

1767.89 |

1468.26 |

359.43 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

1911.78 |

1139.75 |

358.32 |

|

iShares MSCI EM ESG Enhanced UCITS ETF |

EDM2 GY |

690.76 |

612.14 |

324.42 |

|

AMUNDI S&P 500 ESG UCITS ETF DR - EUR Hdg - Acc |

S500H FP |

327.82 |

319.13 |

312.04 |

|

Invesco WilderHill Clean Energy ETF |

PBW US |

2174.78 |

1010.95 |

308.89 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

1598.18 |

1350.07 |

308.54 |

|

First Trust NASDAQ Clean Edge Green Energy Index Fund |

QCLN US |

1999.28 |

1181.34 |

304.15 |

|

iShares MSCI World SRI UCITS ETF - EUR - Acc |

SUSW LN |

2517.75 |

1463.16 |

299.56 |

|

AMUNDI INDEX MSCI EUROPE SRI - UCITS ETF DR (C) - Acc |

EUSRI FP |

1679.94 |

1184.18 |

289.98 |

|

iShares ESG MSCI EM ETF |

ESGE US |

6133.64 |

4160.04 |

272.68 |

|

iShares MSCI USA SRI UCITS ETF - Acc |

SUAS LN |

4906.74 |

2148.55 |

260.46 |

|

Xtrackers MSCI Japan ESG UCITS ETF - 1C - Acc |

XZMJ LN |

1376.64 |

1009.26 |

244.13 |

|

Vanguard ESG US Stock ETF |

ESGV US |

2981.32 |

1577.96 |

243.69 |

Confusion persists around what constitutes an ESG fund. According to PRI, a UN-supported initiative which seeks to understand the investment implications of ESG issues, 56% of adopters believe there is a lack of clarity in ESG definitions. ETFGI’s classification system attempts to provide greater precision, with ETFs/ETPs listed globally organised into categories, including core ESG products and theme-based groups, such as Clean/Alternative Energies and Gender Diversity. Please contact deborah.fuhr@etfgi.com if you would like to discuss the cost to subscribe to any of ETFGI’s research or consulting services.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter.

ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter.

ETF TV Episode #57 - ETF TV NEWS week commencing 18th January 2021

Registrations are now open for the six ETFGI Global ETFs Insights Summits scheduled for 2021!

ETFGI, a leading independent research, and consultancy firm covering trends in the global ETFs and ETPs ecosystem is excited to announce that registrations are now open for the six ETFGI Global ETFs Insights Summits scheduled for 2021!

2021 Virtual Events Schedule:

ESG and Active ETFs Trends, March 24th & 25th Register Here, Event Website

2nd Annual Latin America, April 14th & 15th Register Here, Event Website

2nd Annual USA, May 19th & 20th Register Here, Event Website

2nd Annual Europe & MEA, September 15th & 16th Register Here, Event Website

2nd Annual Asia Pacific, November 2nd & 3rd Register Here, Event Website

3rd Annual Canada, December 1st & 2nd Register Here, Event Website

The summits are designed as educational events for institutional investors and financial advisors to provide substantive and in-depth discussion on the regulatory, trading, and technological developments impacting the use, selection, trading and development of new ETFs and the impact ETFs have on markets and market structure. Exciting line up of speakers in fireside chats and panel discussions on timely and relevant topics with sponsor booths and virtual networking!

Free registration and CPD educational credits are offered to institutional investors and financial advisors. If you cannot attend, register anyway and we will send you the session recordings.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

We look forward to seeing you at our events!

Debbie and Margareta

Industry Events:

Register now to join Deborah Fuhr of ETFGI at the Women in ETFs 2021 Around the Clock Around the World virtual conference on Jan 26th & 27th at https://bit.ly/3oxsZuM.

This event is free to attend thanks to the generosity of the sponsors of Women in ETFs!

Featuring fireside chats and panel discussions with more than 30 of the industry’s preeminent experts, the event will cover four main themes:

The market outlook for 2021;

The next generation of the ETF industry;

Accelerating the pace of diversity in our industry; and

Changes to the world of work as we emerge from the pandemic.

There will be a virtual opening bell ringing at the London Stock Exchange and a virtual closing bell ringing at the Toronto Stock Exchange to celebrate the event and the 7th Anniversary of Women in ETFs. Register at https://bit.ly/3oxsZuM The full lineup of speakers and moderators can be found here: https://lnkd.in/dy

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()