ETFGI reports assets invested in the global ETFs industry increase the lead over global hedge fund industry to US$4.39 trillion at the end of 2020

LONDON — March 29, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in the global ETFs and ETPs industry extended the lead over the global hedge fund industry to US$4.39 trillion at the end of 2020, an increase of 44.95% since 2019. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in global ETFs and ETPs industry increase the lead over assets in global hedge fund industry to $4.39 trillion at the end of 2020.

- In 2020 the HFRI Fund Weighted Composite Index was up 11.74%, while the S&P 500 Index with dividends was up 18.39%

- Hedge funds gathered net inflows of $3 Bn in Q4 while ETFs/ETPs gathered net inflows of $258.3 Bn.

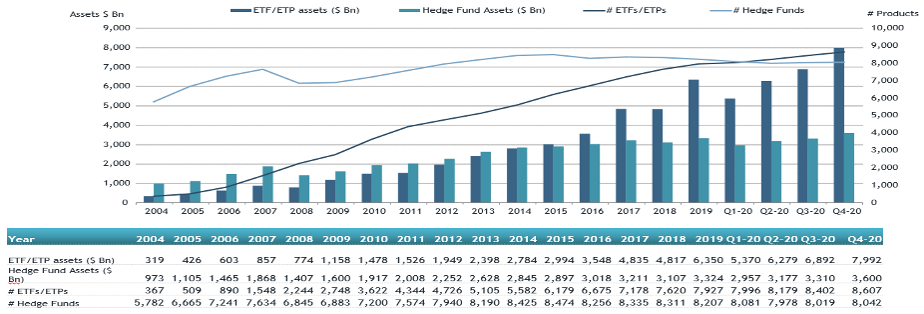

Assets invested in the global ETF/ETP industry first surpassed those invested in the hedge fund industry at the end of Q2 2015, as ETFGI had forecasted. Growth in assets in the ETF/ETP industry has outpaced growth in the hedge fund industry since the financial crisis in 2008. According to ETFGI’s analysis $7.99 trillion were invested in 8,607 ETFs/ETPs listed globally at the of 2020, representing an increase in assets of 15.96% over the quarter. Over the same period assets invested in hedge funds globally increased by 8.76%, to $3.6 trillion in

8,042 hedge funds, according to a report by HFR.

During the fourth quarter of 2020 ETFs/ETPs listed globally gathered $258.3 billion in net inflows, according to ETFGI’s Global ETF and ETP industry insights report. In contrast, HFR reported that hedge fund saw net inflows of $3 billion in Q4 2020.

Growth in global ETF/ETP and global hedge fund assets, as at end of December 2020

In Q4 2020 the performance of the HFRI Fund Weighted Composite Index was up 10.81%, while the S&P 500 Index with dividends increased 12.14%. Year to date, the HFRI Fund Weighted Composite Index was up 11.74%, while the S&P 500 Index with dividends has increased 18.39%.

###

Register to join the discussions at our 2nd annual virtual ETFGI Global ETFs Insights Summit - Latin America.

The summit is designed to facilitate a substantive and in-depth discussion on the market structure, regulatory, trading, and technological developments impacting the use of and opportunity for local, US domiciled and European UCITS ETFs by various types of investors in Latin America.

Panels will discuss the current and future use of ETFs by various types of investors and the regulatory requirements for local ETFs, US domiciled and European UCITS ETFs to be marketed, sold and bought in Mexico, Brazil, Chile, Colombia, Peru, Uruguay and Argentina.

Speakers include:

Click here to see the full list of speakers.

Free registration and CE credits are offered to buyside institutional investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

Upcoming 2021 ETFGI Global ETFs Insight Summits:

2nd Annual Latin America, April 14th & 15th Register Here

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter. Contact Deborah.fuhr@etfgi.com if you are interested in sponsoring ETF tv.

ETF TV is a show which provides insights into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange-traded products ETPs. Go to www.ETFtv.net to view other episodes and signup for the ETF tv newsletter. Contact Deborah.fuhr@etfgi.com if you are interested in sponsoring ETF tv.

ETF TV News #66 Rory Riggs, CEO, Syntax discusses converting funds into ETFs and Stratified Weight indexes with Dan Barnes and Deborah Fuhr #PressPlay http://bit.ly/3f288ye

ETF TV News #66 Rory Riggs, CEO, Syntax discusses converting funds into ETFs and Stratified Weight indexes with Dan Barnes and Deborah Fuhr #PressPlay http://bit.ly/3f288ye

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()