ETFGI reports assets invested in Thematic ETFs and ETPs listed globally reached a record US$394 billion at the end of February 2021

LONDON — March 23, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that assets invested in Thematic ETFs and ETPs listed globally reached a record US$394 billion at the end of February 2021. These products gathered net inflows of US$17.67 billion during February, bringing year-to-date net inflows to a record US$42.63 billion which is much higher than the US$13.33 billion gathered at this point last year, according to ETFGI’s February 2021 ETF and ETP Thematic industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in Thematic ETFs and ETPs listed globally reached a record $393.67 Bn at the end of February

- During February Thematic ETFs and ETPs gathered net inflows of $17.67 Bn the second highest monthly net inflows on record, the record was $24.96 Bn gathered in January 2021.

YTD net inflows of $42.63 Bn are a record, surpassing the prior record of $13.33 Bn gathered at this point last year.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

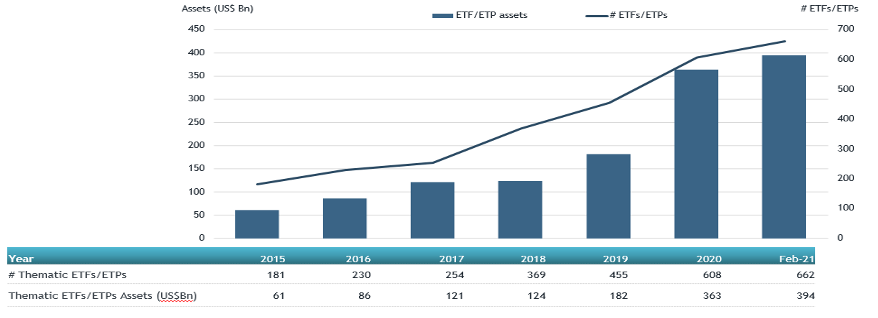

Global Thematic ETF and ETP asset growth as at end of February 2021

There were 662 thematic ETFs and ETPs listed globally, with 1,258 listings, assets of US$394 Bn, from 183 providers on listed on 48 exchanges in 40 countries at the end of February 2021. During February, 53 new Thematic ETFs/ETPs were launched.

Substantial inflows can be attributed to the top 20 ETFs/ETPs by net new assets, which collectively gathered

$13.15 Bn at the end of February. ARK Innovation ETF (ARKK US) gathered $2.37 Bn.

Top 20 Thematic ETFs/ETPs by net new assets February 2021

|

Name |

Ticker |

Assets (US$ Mn) Feb-21 |

NNA (US$ Mn) YTD-21 |

NNA (US$ Mn) Feb-21 |

|

ARK Innovation ETF |

ARKK US |

23,431.99 |

5,465.72 |

2,368.57 |

|

ARK Fintech Innovation ETF |

ARKF US |

4,412.96 |

2,355.98 |

1689.80 |

|

ARK Web x.O ETF |

ARKW US |

8,075.87 |

2,412.75 |

1583.86 |

|

ARK Autonomous Technology & Robotics ETF |

ARKQ US |

3,609.34 |

1,794.19 |

877.96 |

|

ARK Genomic Revolution Multi-Sector ETF |

ARKG US |

10,486.05 |

3,293.29 |

858.24 |

|

Invesco Dynamic Leisure and Entertainment ETF |

PEJ US |

1,649.33 |

779.79 |

649.89 |

|

Global X Cybersecurity ETF |

BUG US |

838.47 |

695.41 |

620.42 |

|

ChinaAMC CSI Science and Technology Innovation Board 50 ETF |

588000 CH |

2,518.23 |

711.55 |

515.75 |

|

FlexShares Morningstar Global Upstream Natural Resources Index Fund |

GUNR US |

4,264.49 |

465.27 |

480.74 |

|

Amplify Transformational Data Sharing ETF |

BLOK US |

1,091.22 |

543.51 |

409.32 |

|

AdvisorShares Pure US Cannabis ETF |

MSOS US |

1,019.40 |

708.03 |

375.75 |

|

China Southern CSI New Energy ETF |

516160 CH |

348.04 |

375.26 |

375.26 |

|

3D Printing ETF |

PRNT US |

611.44 |

499.12 |

359.37 |

|

Invesco Elwood Global Blockchain UCITS ETF - Acc |

BCHN LN |

1,016.37 |

434.15 |

316.32 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

Global X U.S. Infrastructure Development ETF |

PAVE US |

1,510.39 |

658.38 |

304.59 |

|

Global X Lithium & Battery Tech ETF |

LIT US |

2,805.97 |

960.52 |

274.98 |

|

iShares Ageing Population UCITS ETF - Acc |

AGES LN |

678.26 |

292.47 |

274.10 |

|

ChinaAMC CSI 5G Communications Theme ETF |

515050 CH |

3,110.98 |

21.96 |

252.83 |

|

First Trust NASDAQ Clean Edge Green Energy Index Fund |

QCLN US |

2,947.16 |

982.21 |

251.22 |

Please contact deborah.fuhr@etfgi.com if you have any questions on this press release.

#####

Last chance to register to join us at the ETFGI Global ETFs Insights Summit on ESG and Active ETFs Trends, March 24th & 25th!

This event will provide an overview of the regulatory environment, public policy, investor initiatives and fiduciary obligations to help institutional investors and financial advisors understand how ESG and Active ETFs strategies are being implemented across portfolios.

To see the full agenda and the list of speakers click here.

Free registration and CE credits are offered to buyside institutional investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

Upcoming 2021 ETFGI Global ETFs Insight Summits:

ESG and Active ETFs Trends, March 24th & 25th Register Here

2nd Annual Latin America, April 14th & 15th Register Here

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

Please email relevant Press Releases and related stories to deborah.fuhr@ETFGI.com

For more information on ETF TV deborah.fuhr@ETFGI.com

ETF TV News #66 Rory Riggs, CEO, Syntax discusses converting funds into ETFs and Stratified Weight indexes with Dan Barnes and Deborah Fuhr #PressPlay http://bit.ly/3f288ye

ETF TV News #66 Rory Riggs, CEO, Syntax discusses converting funds into ETFs and Stratified Weight indexes with Dan Barnes and Deborah Fuhr #PressPlay http://bit.ly/3f288ye

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV