ETFGI reports a record 1.05 trillion US dollars invested in Smart Beta ETFs and ETPs listed globally at the end of February 2021

LONDON —March 18, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reports Smart Beta ETFs and ETPs listed globally gathered a record US$18.39 billion in net inflows during February bringing year-to-date net inflows to a record US$29.45 billion. Smart Beta Equity ETF/ETP assets have increased by 5.9% from US$994 billion to US$1.05 trillion, with a 5-year CAGR of 22.9%, according to ETFGI’s February 2021 ETF and ETP Smart Beta industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (report looks at equity focused Smart Beta products, All dollar vales in USD unless otherwise noted.)

Highlights

- Assets in Smart Beta ETFs and ETPs listed globally reach a record $1.05 Tn at the end of February.

- Record monthly net inflows of $18.39 Bn in February passing the prior record of $16.76 Bn in November 2020.

- YTD net inflows are a record $29.45 Bn, higher than the $15.60 Bn gathered YTD in 2020 and beating the prior record of $25.86 Bn set in February 2018.

There were 1,344 smart beta equity ETFs/ETPs, with 2,573 listings, assets of $1.05 trillion, from 192 providers on 45 exchanges in 37 countries at the end of February 2021.

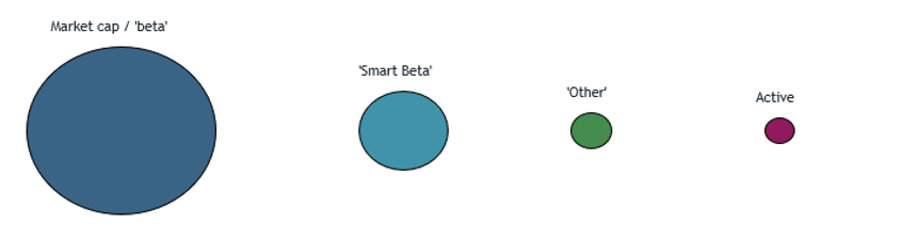

Comparison of assets in market cap, smart beta, other and active equity products

Alternative Weighting ETFs and ETPs attracted the greatest monthly net inflows, gathering $10.05 Bn during February. Quality ETFs and ETPs suffered the greatest net outflows during the month and amounted to $584 Mn.

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $16.6 Bn during February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF (SSPU GY) gathered $5.54 Bn.

Top 20 Smart Beta ETFs/ETPs by net new assets February 2021

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

5,521.04 |

5,537.99 |

5,537.99 |

|

Vanguard Value ETF |

VTV US |

66,511.18 |

2,550.61 |

1,379.20 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,809.16 |

1,300.75 |

926.79 |

|

iShares S&P Mid-Cap 400 Value ETF |

IJJ US |

7,397.75 |

1,215.71 |

815.16 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

ESGU US |

14,140.91 |

480.49 |

796.06 |

|

Invesco S&P 500 Equal Weight ETF |

RSP US |

20,785.96 |

1,636.20 |

757.88 |

|

Schwab US Dividend Equity ETF |

SCHD US |

18,527.63 |

1,351.20 |

725.41 |

|

iShares MSCI EAFE Value ETF |

EFV US |

11,478.10 |

3,956.72 |

683.73 |

|

Invesco Dynamic Leisure and Entertainment ETF |

PEJ US |

1,649.33 |

779.79 |

649.89 |

|

iShares Edge MSCI USA Value Factor ETF |

VLUE US |

11,979.55 |

1,668.07 |

635.96 |

|

iShares Core Dividend Growth ETF |

DGRO US |

15,807.62 |

944.67 |

582.43 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF |

EMUG LN |

519.21 |

523.59 |

488.52 |

|

iShares Edge MSCI USA Momentum Factor ETF |

MTUM US |

14,688.14 |

1,448.46 |

423.59 |

|

3D Printing ETF |

PRNT US |

611.44 |

499.12 |

359.37 |

|

iShares MSCI EAFE Growth ETF |

EFG US |

10,207.01 |

409.64 |

328.60 |

|

Vanguard Growth ETF |

VUG US |

67,615.38 |

(612.55) |

322.33 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

US Global Jets ETF |

JETS US |

3,793.51 |

386.44 |

312.51 |

|

SPDR Portfolio S&P 500 Value ETF |

SPYV US |

8,512.71 |

587.56 |

303.47 |

|

iShares Ageing Population UCITS ETF - Acc |

AGES LN |

678.26 |

292.47 |

274.10 |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

#####

Register now for the ETFGI Global ETFs Insights Summit on ESG and Active ETFs Trends, March 24th & 25th!

This event will provide an overview of the regulatory environment, public policy, investor initiatives and fiduciary obligations to help institutional investors and financial advisors understand how ESG and Active ETFs strategies are being implemented across portfolios.

To see the full agenda and the list of speakers click here.

Free registration and CE credits are offered to buyside investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

Upcoming 2021 ETFGI Global ETFs Insight Summits:

ESG and Active ETFs Trends, March 24th & 25th Register Here

2nd Annual Latin America, April 14th & 15th Register Here

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

Please email relevant Press Releases and related stories to deborah.fuhr@ETFGI.com

For more information on ETF TV deborah.fuhr@ETFGI.com

ETF TV News #65 - Willem Keogh, Head Passive and ETF Investment Analytics, UBS Asset Management Switzerland discusses demand for ESG ETFs and what SFDR means for investors with Dan Barnes and Deborah Fuhr. #PressPlay

ETF TV News #65 - Willem Keogh, Head Passive and ETF Investment Analytics, UBS Asset Management Switzerland discusses demand for ESG ETFs and what SFDR means for investors with Dan Barnes and Deborah Fuhr. #PressPlay

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV