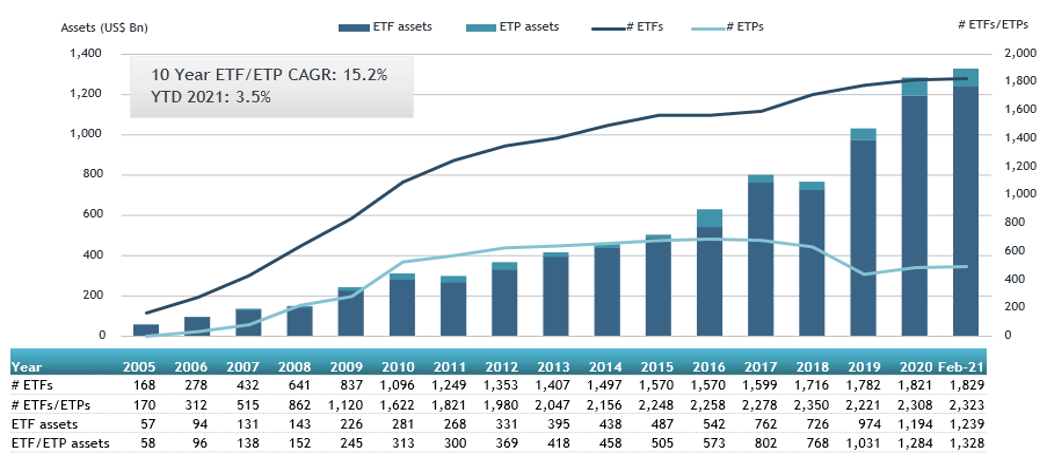

ETFGI reports record assets of US$1.33 trillion invested in ETFs and ETPs listed in Europe at the end of February 2021

LONDON —March 19, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs/ETPs ecosystem, reported today that ETFs and ETPs listed in Europe reported net inflows of US$22.15 billion during February, bringing year-to-date net inflows to a record US$42.66 billion. Assets invested in the European ETFs/ETPs industry have increased by 2.3%, from US$1.30 trillion at the end of January, to US$1.33 trillion, according to ETFGI's February 2021 European ETFs and ETPs industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

- Assets invested in European ETFs and ETPs industry reach a record $1.33 trillion at the end of February.

- Net inflows gathered in February were $22.15Bn, are the second highest behind the $27.17 Bn gathered in December 2020.

- 11 consecutive month net inflows.

- YTD net inflows of $42.66 are a record, beating the prior YTD record of $25.86 Bn in February 2018 and much higher than the $21.23Bn gathered at this point in 2020.

- Equity ETFs/ETPs listed in Europe attracted $35.22 Bn accounting for the majority of net inflows in February.

“Despite a sell-off in the last week of the month, the S&P 500 gained of 2.76% in February, driven by optimism on COVID-19 vaccines, as well as continued monetary and fiscal stimulus. Developed markets ex- the U.S. ended the month up 2.50% while Emerging markets were up by 1.50% for the month. The leaders of the developed market in February were Hong Kong (6.03%), Canada (5.66%) and Spain (5.32%).“ according to Deborah Fuhr, managing partner, founder, and owner of ETFGI.

Europe ETFs and ETPs asset growth as at the end of February 2021

The European ETF/ETP industry had 2,323 ETFs and ETPs, with 8,961 listings, assets of $1.33 Tn, from 81 providers listed on 29 exchanges in 24 countries at the end of February.

Equity ETFs/ETPs listed in Europe reported net inflows of $19.29 Bn during February, bringing net inflows for the year 2021 to $35.22 Bn, much higher than the $9.16 Bn in net inflows gathered YTD in 2020. Fixed income ETFs/ETPs listed in Europe had net inflows of $1.61 Bn during February, taking net inflows for the year to $3.71 Bn, which is lower than the $7.49 Bn in net inflows gathered at this point in 2020. Commodity ETFs/ETPs reported $505 Mn in net inflows bringing net inflows to $2.87 Bn for 2021, which is lower than the $4.30 Bn gathered at this point in 2020.

Actively managed products saw net inflows of $109 Mn in February, bringing year to date net outflows to $25 Mn, which is less than the net inflows of $41 Mn over the same period last year.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $14.87 Bn during February. SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc (SPPU GY) gathered $5.54 Bn.

Top 20 ETFs by net inflows in February 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

SPDR Bloomberg SASB U.S. Corporate ESG UCITS ETF - Acc |

SPPU GY |

5,521.04 |

5,537.99 |

5,537.99 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

XDEW GY |

3,809.16 |

1,300.75 |

926.79 |

|

Invesco US Municipal Bond UCITS ETF |

MUNS LN |

7.09 |

725.16 |

725.16 |

|

iShares China CNY Bond UCITS ETF |

CNYB NA |

5,065.43 |

1,130.58 |

698.35 |

|

iShares MSCI USA ESG Screened UCITS ETF - Acc - Acc |

SASU LN |

2,989.48 |

1,065.60 |

671.76 |

|

iShares MSCI EMU UCITS ETF - Acc |

CSEMU SW |

3,067.04 |

678.29 |

656.63 |

|

CSIF (IE) MSCI World ESG Leaders Blue UCITS ETF B USD - Acc |

WDESG SW |

714.96 |

602.85 |

647.01 |

|

L&G ESG Emerging Markets Corporate Bond USD UCITS ETF |

EMUG LN |

519.21 |

523.59 |

488.52 |

|

iShares Core MSCI World UCITS ETF - Acc |

IWDA LN |

30,539.71 |

1,163.47 |

488.36 |

|

iShares China CNY Bond UCITS ETF - Acc |

CYBA NA |

3,213.53 |

1,134.73 |

476.67 |

|

L&G LONG DATED ALL COMMOD - Acc |

COMF LN |

1,173.18 |

524.80 |

417.57 |

|

Vanguard FTSE All-World UCITS ETF - Acc |

VWRA LN |

2,303.81 |

492.14 |

401.55 |

|

SPDR Bloomberg Barclays Euro Government Bond UCITS ETF - Acc |

GOVA NA |

556.68 |

397.41 |

394.66 |

|

Lyxor UCITS ETF FTSE MIB |

ETFMIB IM |

794.81 |

354.15 |

380.20 |

|

iShares EUR Corp Bond 0-3yr ESG UCITS ETF |

SUSS LN |

1,676.93 |

467.06 |

368.44 |

|

iShares S&P US Banks UCITS ETF - Acc |

BNKS LN |

690.13 |

434.77 |

344.96 |

|

Xtrackers MSCI USA ESG UCITS ETF - 1C - Acc |

XZMU GY |

2,004.44 |

371.20 |

317.25 |

|

Invesco Elwood Global Blockchain UCITS ETF - Acc |

BCHN LN |

1,016.37 |

434.15 |

316.32 |

|

Lyxor S&P Eurozone Paris-Aligned Climate (EU PAB) (DR) UCITS ETF - Acc |

EPAB FP |

673.42 |

327.14 |

313.96 |

|

iShares Core MSCI World UCITS ETF-D - GBP Hdg |

IWDG LN |

974.59 |

288.36 |

294.17 |

The top 10 ETPs by net new assets collectively gathered $779 million during February. BTCetc - Bitcoin ETP - Acc (BTCE GY) gathered $421 million alone.

Top 10 ETPs by net inflows in February 2021: Europe

|

Name |

Ticker |

Assets |

NNA |

NNA |

|

BTCetc - Bitcoin ETP - Acc |

BTCE GY |

846.45 |

310.13 |

290.57 |

|

Xetra Gold EUR - Acc |

4GLD GY |

12,213.12 |

229.34 |

160.45 |

|

WisdomTree Physical Silver - Acc |

PHAG LN |

2,609.95 |

153.92 |

67.21 |

|

CoinShares Physical Ethereum - Acc |

ETHE SW |

61.25 |

61.70 |

61.70 |

|

WisdomTree Industrial Metals - Acc |

AIGI LN |

317.55 |

99.63 |

47.74 |

|

WisdomTree Bitcoin - Acc |

BTCW SW |

276.34 |

9.21 |

35.12 |

|

WisdomTree Physical Gold - GBP Daily Hedged - Acc |

GBSP LN |

1,536.12 |

109.04 |

33.89 |

|

Xtrackers Physical Gold Euro Hedged ETC - Acc |

XAD1 GY |

3,378.85 |

182.60 |

31.92 |

|

Invesco Palladium ETC - Acc |

SPAL LN |

60.91 |

26.08 |

26.08 |

|

Ether Tracker Euro - Acc |

COINETH SS |

346.49 |

30.69 |

23.98 |

Investors have tended to invest in Equity ETFs and ETPs during February.

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

##

#####

Register now for the ETFGI Global ETFs Insights Summit on ESG and Active ETFs Trends, March 24th & 25th!

This event will provide an overview of the regulatory environment, public policy, investor initiatives and fiduciary obligations to help institutional investors and financial advisors understand how ESG and Active ETFs strategies are being implemented across portfolios.

To see the full agenda and the list of speakers click here.

Free registration and CE credits are offered to buyside investors and financial advisors. If you cannot attend on the day, register and you will receive the links to the session recordings.

Upcoming 2021 ETFGI Global ETFs Insight Summits:

ESG and Active ETFs Trends, March 24th & 25th Register Here

2nd Annual Latin America, April 14th & 15th Register Here

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes.

Please email relevant Press Releases and related stories to deborah.fuhr@ETFGI.com

For more information on ETF TV deborah.fuhr@ETFGI.com

ETF TV News #65 - Willem Keogh, Head Passive and ETF Investment Analytics, UBS Asset Management Switzerland discusses demand for ESG ETFs and what SFDR means for investors with Dan Barnes and Deborah Fuhr. #PressPlay

ETF TV News #65 - Willem Keogh, Head Passive and ETF Investment Analytics, UBS Asset Management Switzerland discusses demand for ESG ETFs and what SFDR means for investors with Dan Barnes and Deborah Fuhr. #PressPlay

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI supports Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr

ETFGI

ETF Network

ETF TV