ETFGI reports assets invested in Smart Beta ETFs and ETPs listed globally reached a record 1.12 trillion US dollars at the end of Q1 2021

LONDON —April 30, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that equity-based Smart Beta ETFs and ETPs listed globally gathered net inflows of US$27.92 billion during March, bringing year-to-date net inflows to a record US$57.40 billion which is higher than the US$8.97 billion gathered at this point last year. Year-to-date through the end of March 2021, Smart Beta Equity ETF/ETP assets have increased by 12.5% from US$1 trillion to US$1.12 trillion, with a 5-year CAGR of 22.8%, according to ETFGI’s March 2021 ETFs and ETPs Smart Beta industry landscape insights report, the monthly report which is part of an annual paid-for research subscription service. (All dollar vales in USD unless otherwise noted.)

Highlights

- Assets invested in Smart Beta ETFs and ETPs listed globally reach a record $1.12 Tn a the end of Q1 2021.

- Smart Beta ETFs and ETPs listed globally gathered net inflows of $27.92 billion during March

- Year-to-date Q1 net inflows are a record $57.40 billion which is higher than the $8.97 billion gathered in Q1 2020.

“The S&P 500® gained 4.4% in March and 6.2% in Q1, supported by the increasing pace of COVID-19 vaccinations and continued monetary and fiscal support. Global equities gained 2.5% in March and 5.2% in Q1, as measured by the S&P Global BMI. 38 of the 50 countries advanced during the month and 35 were positive at the end of Q1. Developed markets ex-U.S. gained 2.3% in USD terms in March and 4.0% in Q1. Emerging markets were down 1.6% in USD terms in March and up 2.8% in Q1, as measured by the S&P Emerging BMI.” According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

At the end of March 2021, there were 1,357 smart beta equity ETFs and ETPs, with 2,597 listings, assets of $1.12 Tn, from 195 providers listed on 45 exchanges in 37 countries.

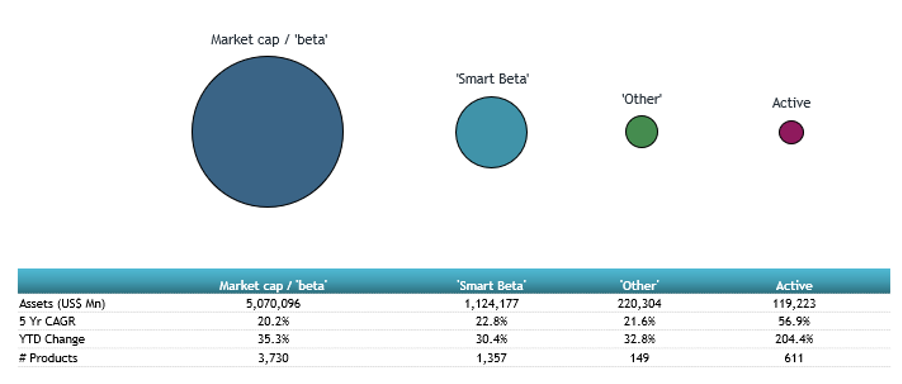

Comparison of assets in market cap, smart beta, other and active equity products

Substantial inflows can be attributed to the top 20 Smart Beta ETFs/ETPs by net new assets, which collectively gathered $21.38 Bn during March. Invesco S&P 500 Equal Weight ETF (RSP US) gathered $2.68 Bn the largest net inflows.

Top 20 Smart Beta ETFs/ETPs by net new assets March 2021

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Invesco S&P 500 Equal Weight ETF |

|

RSP US |

24,622.43 |

4,320.88 |

2,684.68 |

|

Vanguard Value ETF |

|

VTV US |

72,757.19 |

4,693.20 |

2,142.59 |

|

iShares Edge MSCI USA Value Factor UCITS ETF - Acc |

|

IUVL LN |

4,907.41 |

2,300.66 |

1,735.41 |

|

Xtrackers S&P 500 Equal Weight UCITS ETF (DR) - 1C - Acc |

|

XDEW GY |

5,441.54 |

2,673.49 |

1,372.74 |

|

iShares Edge MSCI USA Value Factor ETF |

|

VLUE US |

14,095.58 |

2,918.10 |

1,250.03 |

|

SPDR Portfolio S&P 500 Value ETF |

|

SPYV US |

10,298.23 |

1,832.88 |

1,245.32 |

|

Schwab US Dividend Equity ETF |

|

SCHD US |

21,258.92 |

2,590.98 |

1,239.77 |

|

iShares Edge MSCI World Value Factor UCITS ETF - Acc |

|

IWVL LN |

5,167.70 |

1,465.94 |

1,176.64 |

|

iShares Edge MSCI USA Minimum Volatility ESG UCITS ETF - Acc |

|

MVEA NA |

1,443.69 |

1,059.64 |

1,050.66 |

|

iShares Edge MSCI USA Momentum Factor UCITS ETF - Acc |

|

IUMO LN |

1,904.12 |

1,122.42 |

1,031.25 |

|

iShares S&P 500 Value ETF |

|

IVE US |

21,535.37 |

905.16 |

881.11 |

|

iShares Trust iShares ESG Aware MSCI USA ETF |

|

ESGU US |

15,401.86 |

1,315.71 |

835.22 |

|

Invesco S&P 500 High Beta ETF |

|

SPHB US |

1,662.31 |

979.26 |

668.57 |

|

WisdomTree Emerging Markets ex-State-Owned Enterprises Fund |

|

XSOE US |

4,719.90 |

1,284.72 |

654.87 |

|

Vanguard Small-Cap Value ETF |

|

VBR US |

22,745.60 |

1,956.46 |

643.85 |

|

iShares Core Dividend Growth ETF |

|

DGRO US |

17,476.14 |

1,556.93 |

612.26 |

|

First Trust Rising Dividend Achievers ETF |

|

RDVY US |

3,149.46 |

968.92 |

564.62 |

|

iShares S&P Small-Cap 600 Value ETF |

|

IJS US |

8,835.34 |

868.04 |

538.71 |

|

iShares Edge MSCI Europe Value Factor UCITS ETF |

|

IEFV LN |

2,856.92 |

758.54 |

532.76 |

|

MicroSectors FANG+ Index 3X Leveraged ETNs due January 8, 2038 |

|

FNGU US |

1,403.47 |

650.96 |

516.63 |

Contact deborah.fuhr@etfgi.com if you have any questions or comments on the press release or ETFGI events, research or consulting services.

####

Register now for the ETFGI Global ETFs Insights Summit - United States, a virtual event on May 19th and 20th.

Exciting line up of speakers, topics, and virtual networking! View the speakers and topics and register here. Free attendance and educational credits for buyside institutional investors and financial advisors. Receive a free copy of the end of Q1 2021 ETFGI directory of ETFs and ETPs.

The event is designed to facilitate substantive and in-depth discussion on the regulatory, product and trading developments impacting the use of and trading of ETFs in the United States.

Confirmed speakers:

- Rochelle Shelly Antoniewicz, Senior Director, Industry and Financial Analysis, Investment Company Institute, ICI

- Jeffrey B. Baccash, Global Head of ETF Solutions, BNP Paribas

- Vincent Deluard, Director - Global Macro Strategy, StoneX

- Dan Draper, CEO, S&P Dow Jones Indices

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Stacy Fuller, Partner, K&L Gates

- Jennifer Grancio, Chief Executive Officer, Engine No. 1

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- David LaValle, CEO, Alerian

- Matt Lewis, VP, Head of ETF Implementation and Capital Markets, American Century Investments

- Dan Madden, Head of Capital Markets, FlexShares Exchange Traded Funds

- Kevin D. Mahn, President & Chief Investment Officer, Hennion & Walsh Asset Management

- Kathleen Moriarty, Partner, Chapman and Cutler LLP

- Barry Pershkow, Partner, Chapman and Cutler LLP

- Eric Pollackov, Global Head of ETF Capital Markets, Invesco

- Fred Pye, Chairman & CEO, 3iQ Corp.

- Amanda Rebello, Head of Passive Sales, US Onshore, DWS

- Rick Redding, CEO, Index Industry Association

- Edward Rosenberg, Senior Vice President, Head of ETFs, American Century Investments

- Kimberly Russell, Vice President, Market Structure Specialist, State Street Global Advisors SPDR

- Adam Stempel, Director, BMO Capital Markets

- Diana van Maasdijk, Co-Founder & Executive Director, Equileap

- Lorraine Wang, Founder & CEO, GAMMA Investing

Topics include:

- Lessons learned in 2020

- An Appraisal of Regulatory Issues Impacting Market Structure and ETF Trading

- Creating Better Trading Systems and Tools for ETFs

- Hot ETFs Regulatory Topics

- Future of Indexing

- Sustainable Finance and ESG regulations in the US and Europe

- Creating ESG Indices

- Investing in Digital Assets

- Examination of the State of Active ETFs

- Global Macro Outlook

- Update on Flows & Trends in the Global ETF Industry

- How Institutions and Financial Advisors Using ETFs and ETNs?

- How are Investors Integrating ESG into their Portfolios

- Future Trends in the ETF Industry

Can't attend on the day? Register anyway, and you'll receive recordings of all the sessions.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

We look forward to seeing you at the event.

Best regards, Deborah and Margareta

Upcoming 2021 ETFGI Global ETFs Insight Summits:

2nd Annual United States, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

2nd Annual ESG and Active, 2022

3rd Annual Latin America, 2022

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com