ETFGI reports assets invested in ETFs and ETPs listed globally reached US$8.95 trillion at the end of April 2021

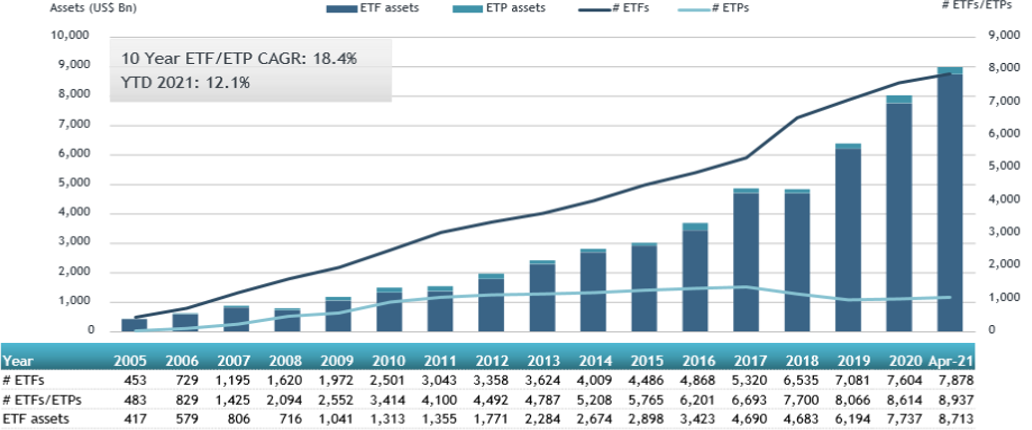

LONDON —May 12, 2021 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETFs and ETPs ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$105.37 billion during April, bringing year-to-date net inflows to a record US$465.41 billion which is higher than the prior record US$184.04 billion which was gathered at this point last year. Assets invested in the global ETFs and ETPs industry have increased by 4.6% from US$8.56 trillion at the end of March 2021, to US$8.96 trillion at the end of April, according to ETFGI's April 2021 Global ETFs and ETPs industry landscape insights report, a monthly report which is part of an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- A record $8.95 trillion invested in ETFs and ETPs listed globally at the end of April

- Net inflows of $105.37 billion gathered in April

- Record YTD net inflows of $465.41 Bn beating the prior record $184.04 billion gathered YTD in 2020

- 23rd month of consective net inflows

The S&P 500 gained 5.34% in April and 11.84% YTD as positive corporate earnings and US stimulis measures helped push U.S. equities higher. Developed markets ex-U.S. gained 3.35% in April. Denmark 7.07% and Finland 7.05% were the leaders of the month while Japan lost 1.60% and was the only country to be down for the month. Emerging markets were up 2.93% at the end of April. Poland (up 9.9%) and Greece were the leaders (up 9.20%), whilst Chile (down 8.1%), Peru (down 7.1%), and Colombia (down 6.5%) were down the most. “ According to Deborah Fuhr, managing partner, founder and owner of ETFGI.

Global ETF and ETP assets as of the end of April 2021

The Global ETFs and ETPs industry had 8,937 products, with 17,894 listings, assets of $8.95 trillion, from 545 providers listed on 77 exchanges in 62 countries as the end of April 2021.

During April, ETFs/ETPs gathered net inflows of $105.37 Bn. Equity ETFs/ETPs listed globally gathered net inflows of $62.81 Bn in April, bringing YTD net inflows to $336.85 Bn, greater than the $75.33 Bn in net inflows equity products had attracted YTD in 2020. Fixed Income ETFs/ETPs listed globally reported net inflows of $31.99 Bn during April, bringing YTD net inflows to $65.03 Bn, much higher than the $34.97 Bn in net inflows fixed income products had attracted YTD in 2020. Commodity ETFs/ETPs listed globally suffered net outflows of $940 Mn, bringing net outflows for 2021 to $7.41 Bn, significantly lower than the $38.86 Bn in net inflows commodity products had attracted YTD in 2020. Active ETFs/ETPs reported $13.95 Bn in net inflows, bringing net inflows for 2021 to $61.97 Bn, higher than the $12.45 Bn in net inflows active products had attracted YTD in 2020.

Substantial inflows can be attributed to the top 20 ETFs by net new assets, which collectively gathered $41.14 Bn during April. Vanguard Total Stock Market ETF (VTI US) gathered $4.30 Bn the largest net inflows for a product.

Top 20 ETFs by net new inflows April 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Vanguard Total Stock Market ETF |

|

VTI US |

238,048.62 |

14,150.32 |

4,301.38 |

|

Vanguard S&P 500 ETF |

|

VOO US |

220,351.89 |

20,602.64 |

3,974.76 |

|

Hwabao WP Cash Tianyi Listed Money Market Fund |

|

511990 CH |

29,218.42 |

8,285.01 |

3,013.44 |

|

iShares Core S&P 500 ETF |

|

IVV US |

275,373.12 |

11,733.23 |

2,597.04 |

|

Vanguard Total Bond Market ETF |

|

BND US |

73,997.99 |

8,298.23 |

2,551.91 |

|

Vanguard Short-Term Treasury ETF |

|

VGSH US |

12,572.53 |

2,798.24 |

2,450.48 |

|

iShares Core U.S. Aggregate Bond ETF |

|

AGG US |

87,226.14 |

4,639.77 |

2,320.10 |

|

Vanguard Value ETF |

|

VTV US |

77,535.95 |

6,962.07 |

2,268.88 |

|

Vanguard Intermediate-Term Corporate Bond ETF |

|

VCIT US |

44,770.51 |

3,876.01 |

1,902.05 |

|

iShares US Treasury Bond ETF |

|

GOVT US |

16,299.19 |

2,278.32 |

1,872.61 |

|

Schwab US Dividend Equity ETF |

|

SCHD US |

23,595.06 |

4,446.92 |

1,855.94 |

|

iShares Core MSCI EAFE ETF |

|

IEFA US |

91,743.13 |

1,722.14 |

1,722.14 |

|

JPMorgan BetaBuilders Europe ETF |

|

BBEU US |

6,226.33 |

2,486.57 |

1,655.74 |

|

iShares U.S. Real Estate ETF |

|

IYR US |

6,476.45 |

353.61 |

1,327.97 |

|

Blackrock US Carbon Transition Readiness ETF |

|

LCTU US |

1,342.40 |

1,314.12 |

1,314.12 |

|

iShares Core MSCI World UCITS ETF - Acc |

|

IWDA LN |

35,062.05 |

3,144.85 |

1,295.19 |

|

Vanguard Short-Term Corporate Bond ETF |

|

VCSH US |

39,294.12 |

3,321.37 |

1,288.51 |

|

Vanguard Total International Bond ETF |

|

BNDX US |

40,915.06 |

4,854.51 |

1,258.91 |

|

NEXT FUNDS Nikkei 225 Exchange Traded Fund |

|

1321 JP |

75,024.70 |

396.52 |

1,085.28 |

|

iShares J.P. Morgan USD Emerging Markets Bond ETF |

|

EMB US |

19,162.43 |

701.49 |

1,084.61 |

The top 10 ETPs by net new assets collectively gathered $2.92 Bn during April. Xtrackers IE Physical Gold ETC Securities - Acc (XGDU LN) gathered $1.07 Bn the largest net inflows into a product.

Top 10 ETPs by net new inflows April 2021: Global

|

Name |

|

Ticker |

Assets |

NNA |

NNA |

|

Xtrackers IE Physical Gold ETC Securities - Acc |

|

XGDU LN |

1,435.97 |

1,191.74 |

1,065.85 |

|

Xtrackers IE Physical Gold ETC Securities - EUR Hdg Acc |

|

XGDE GY |

497.55 |

358.14 |

376.59 |

|

iPath Series B S&P 500 VIX Short-Term Futures ETN |

|

VXX US |

1,341.75 |

1,012.36 |

324.52 |

|

Xetra Gold EUR – Acc |

|

4GLD GY |

12,844.74 |

537.23 |

261.74 |

|

AMUNDI PHYSICAL GOLD ETC (C) - Acc |

|

GOLD FP |

3,293.67 |

254.26 |

217.08 |

|

Invesco DB Commodity Index Tracking Fund |

|

DBC US |

2,241.94 |

570.38 |

190.07 |

|

WisdomTree Copper – Acc |

|

COPA LN |

777.72 |

325.64 |

163.81 |

|

iShares Physical Gold ETC – Acc |

|

SGLN LN |

12,894.33 |

(391.68) |

124.10 |

|

Smart ESG 30 Net Return ETN |

|

2071 JP |

97.62 |

100.91 |

100.91 |

|

Market Share Leaders Net Return ETN |

|

2072 JP |

96.80 |

99.13 |

99.13 |

Investors have tended to invest in Equity ETFs/ETPs during April.

##

Register for the ETFGI Global ETFs Insights Summit - United States, a virtual event on May 19th and 20th.

Don't miss your chance to receive a free copy of the end of Q1 2021 ETFGI directory of ETFs and educational credits.

The event is designed to facilitate substantive and in-depth discussion on the regulatory, product and trading developments impacting the use of and trading of ETFs in the United States.

Exciting line up of speakers, topics, and virtual networking! View the full agenda and register here. Free attendance and educational credits for buyside institutional investors and financial advisors.

Confirmed speakers:

- Shelly Antoniewicz, Senior Director, Industry and Financial Analysis, Investment Company Institute, ICI

- Jeffrey B. Baccash, Global Head of ETF Solutions, BNP Paribas

- Eric Biegeleisen, CFA, Deputy Chief Investment Officer & Portfolio Manager, 3EDGE Asset Management

- Annette Capretta, Associate General Counsel, Investment Company Institute

- Bill Davis, Managing Director, Stance Capital

- Vincent Deluard, Director - Global Macro Strategy, StoneX

- Dan Draper, CEO, S&P Dow Jones Indices

- Deborah Fuhr, Managing Partner, Founder, ETFGI

- Stacy Fuller, Partner, K&L Gates

- Jennifer Grancio, Chief Executive Officer, Engine No. 1

- John Jacobs, Executive Director, Center for Financial Markets and Policy, McDonough School of Business, Georgetown University

- David LaValle, CEO, Alerian

- Matt Lewis, VP, Head of ETF Implementation and Capital Markets, American Century Investments

- Dan Madden, Head of Capital Markets, FlexShares Exchange Traded Funds

- Kevin D. Mahn, President & Chief Investment Officer, Hennion & Walsh Asset Management

- Rob Marrocco, Senior Director, Listings, Cboe Global Markets

- Kathleen Moriarty, Partner, Chapman and Cutler LLP

- Andrew B. Peake, CFA, Managing Director, UBS Financial Services, New York

- Barry Pershkow, Partner, Chapman and Cutler LLP

- Christine Podolak, Senior Director, Exchange Traded Products Surveillance & Investigations, FINRA

- Eric Pollackov, Global Head of ETF Capital Markets, Invesco

- Fred Pye, Chairman & CEO, 3iQ Corp.

- Prof. Amin Rajan, CEO, CREATE-Research

- Amanda Rebello, Head of Passive Sales, US Onshore, DWS

- Rick Redding, CEO, Index Industry Association

- Edward Rosenberg, Senior Vice President, Head of ETFs, American Century Investments

- Kimberly Russell, Vice President, Market Structure Specialist, State Street Global Advisors SPDR

- Jim Toes, President & CEO, STA

- Perth Tolle, Founder, Life + Liberty Indexes

- Richard Tseng, CFA, Managing Director, Senior Portfolio Manager, Investment Solutions Group, CIO Portfolio Management, Bank of America, N.A.

- Diana van Maasdijk, Co-Founder & Executive Director, Equileap

- Lorraine Wang, Founder & CEO, GAMMA Investing

- Darek Wojnar, Executive Vice President, Head of Funds and Managed Accounts, Northern Trust Asset Management

Topics include:

- Lessons learned in 2020

- An Appraisal of Regulatory Issues Impacting Market Structure and ETF Trading

- Creating Better Trading Systems and Tools for ETFs

- Hot ETFs Regulatory Topics

- Future of Indexing

- Sustainable Finance and ESG regulations in the US and Europe

- Creating ESG Indices

- Investing in Digital Assets

- Examination of the State of Active ETFs

- Global Macro Outlook

- Update on Flows & Trends in the Global ETF Industry

- How Are Institutions and Financial Advisors Using ETFs?

- How are Investors Integrating ESG into their Portfolios

- The Growth in the Use of Model Portfolios

- Direct Indexing

- ETF Selection and Due Diligence

- Future Trends in the ETF Industry

Can't attend on the day? Register anyway, and you'll receive recordings of all the sessions.

Please contact Deborah Fuhr deborah.fuhr@etfgi.com and Margareta Hricova margareta.hricova@etfgi.com if you have any questions or are interested in sponsoring or speaking at any of the upcoming events.

We look forward to seeing you at the event.

Best regards, Deborah and Margareta

Upcoming 2021 ETFGI Global ETFs Insight Summits:

2nd Annual USA, May 19th & 20th Register Here

2nd Annual Europe & MEA, September 15th & 16th Register Here

2nd Annual Asia Pacific, November 2nd & 3rd Register Here

3rd Annual Canada, December 1st & 2nd Register Here

Upcoming 2022 ETFGI Global ETFs Insight Summits:

2nd Annual ESG and Active

3rd Annual Latin America

3rd Annual United States

3rd Annual Europe & MEA

3rd Annual Asia Pacific

4th Annual Canada

ETF TV News #73 Miranda Seath of The IA and Howie Li of LGIM discuss the inclusion of ETFs in the IA sectors with Dan Barnes and Deborah Fuhr #PressPlay https://bit.ly/3y3iWDd

ETF TV News #73 Miranda Seath of The IA and Howie Li of LGIM discuss the inclusion of ETFs in the IA sectors with Dan Barnes and Deborah Fuhr #PressPlay https://bit.ly/3y3iWDd

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes. Please email relevant Press Releases and related stories to press@ETFtv.net For more information on ETF TV Oliver@ETFtv.net, Deborah.Fuhr@ETFtv.net

ETF TV News is a weekly new show which provides insights for investors into the use, trading, regulatory and product development trends for exchange traded funds ETFs and exchange traded products ETPs. Go to www.ETFtv.net to view prior episodes. Please email relevant Press Releases and related stories to press@ETFtv.net For more information on ETF TV Oliver@ETFtv.net, Deborah.Fuhr@ETFtv.net

![]() ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

ETFGI is supporting Jobs in ETFs, the first website for careers and recruitment in the ETF industry. www.jobsinetfs.com

Contact:

Deborah Fuhr

Managing Partner, Founder

ETFGI

Mobile: +44 777 5823 111

Email: deborah.fuhr@etfgi.com

Web: www.etfgi.com

Connect on:

Deborah Fuhr ![]()

![]()

ETFGI ![]()

![]()

![]()

ETF Network ![]()

ETF TV ![]()

![]()

![]()

Women in ETFs ![]()

![]()

![]()